How to Buy: Breaking Down BRRRR

How to Buy: Breaking Down BRRRR

So, you’ve heard about the BRRRR method. You know it stands for Buy, Rehab, Rent, Refinance, and Repeat.

But do you know what each of these steps in the BRRRR method really mean? More importantly, do you know how to set each one up?

Because if you don’t, your success will be limited. Because you won’t be able to make as much money as you could by doing things right. Your monthly cash flow will be lower, your down payments will be higher…a lot higher…And your ability to repeat the process will much…much… slower.

So, let’s break things down, starting with the B in BRRRR.

As mentioned, the B in BRRRR stands for Buy.

But wait! Before you run out and buy the first property you find for sale, you need to know a few important—er, VERY important things. Because the B in BRRRR is one of the most crucial steps in the entire process. If you don’t buy strategically, then you might set yourself up for failure.

First you need to find under market properties that you can add value to.

Under market properties are not found on the MLS. They’re usually found through wholesalers and investor-friendly realtors. And they come at a nice, discounted price.

Just taking this step will do wonders for your wallet.

But it’s not the only thing.

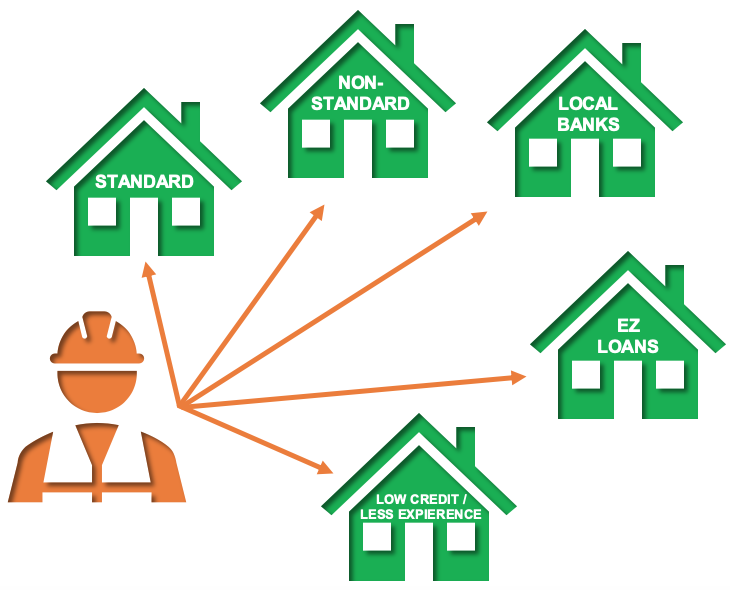

You also need to work with the right lenders.

With BRRRR, there are two lenders involved. The first is for purchasing and renovating the property. The second is for refinancing into a cheaper, long-term loan.

For now, let’s focus on the first lender, for when you BUY the property.

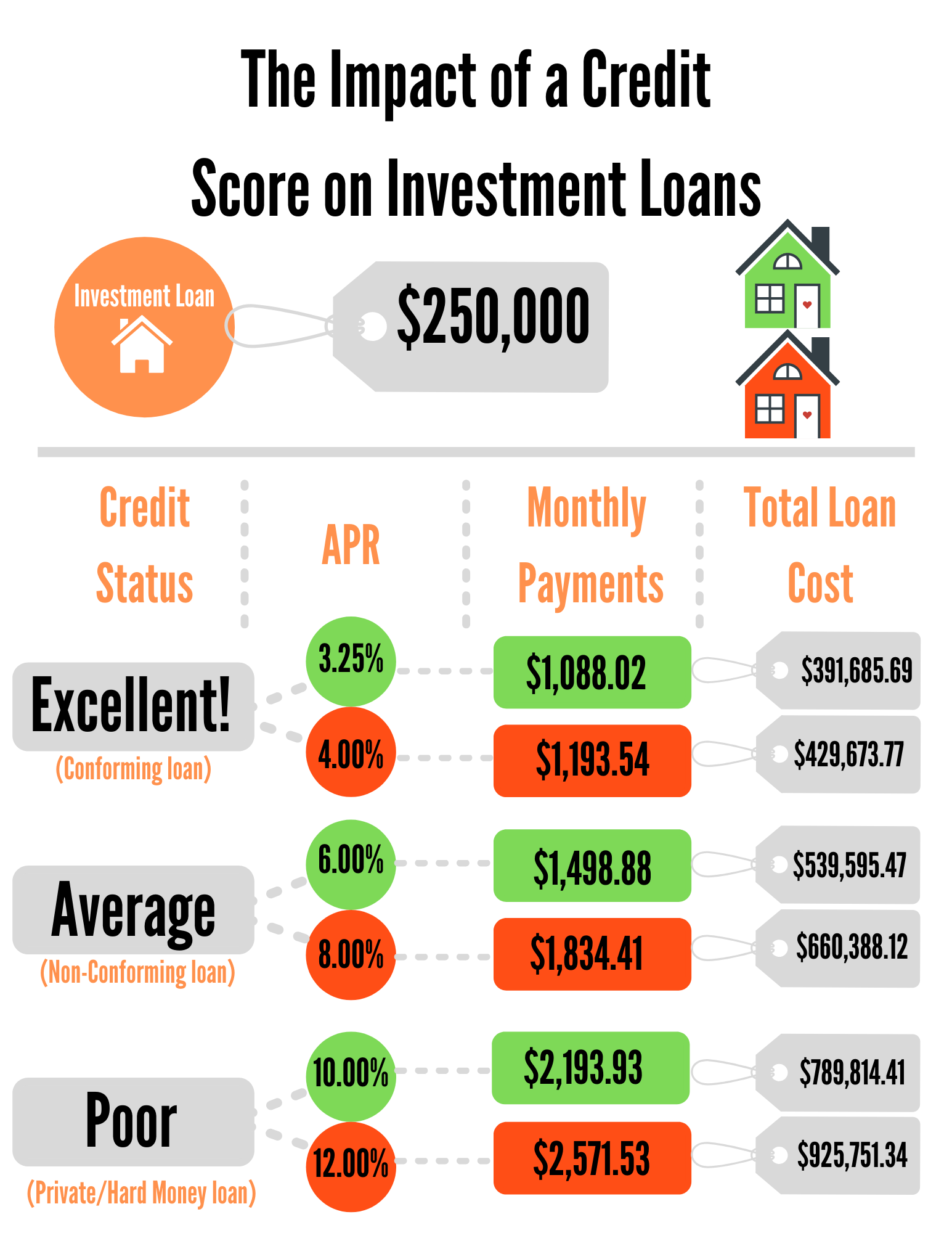

Typically, this is a hard money or private lender. It’s not a bank or another traditional lender. Because those lenders usually require 10, 15, or even 20% down when you go to close. And, if you want the most bang for your buck, you should aim to put 0% down at closing. Because once you put money into a deal, it’s difficult to get it back out.

Hard money and private lenders can help you achieve this.

How? Because they let you maximize your LTV (loan-to-value) by lending up to 75% of the ARV (after repair value).

Ok, deep breath! We get it. This is starting to sound too complicated and confusing.

But trust us, it’s not. Just stick with it. You got this!

The right lender will give you a loan that is 75% of your ARV.

That means they will try to cover the full purchase price, plus part or all the rehab, closing, and holding costs. Basically, they will cover as much as the 75% allows so you don’t have to spend your own money.

And the less money you personally have to put into each deal, the faster you can repeat the BRRRR method. Because you’re not forced to wait until your bank account recovers to make another big down payment on another property.

Aiming for 75% of the ARV will also make a big impact on your refinance (the third R in the BRRRR method). But we’ll get to that later. Let’s stay focused on the B in BRRRR.

If you’re interested in trying the BRRRR Method, then it’s crucial you understand this first part of the process. If you buy an under-market property AND find a lender who can cover 75% of the ARV, then your success rate will be much, much higher. And your bank account will be a whole lot happier.

Happy investing!