What Is the Best Real Estate Loan For Investing?

10 things to look for to find the best real estate loan for your investing.

You can get confused fast with real estate funding.

What’s the difference between hard money and private money? Institutional lenders and bank lenders? And what even is OPM?

Most importantly – how do you know which lending option is best for you?

Our goal is to make sure you use the correct leverage for your real estate project:

- What will fit your project?

- What will be the most profitable for you?

Realistically, you need a little bit of everything.

Let’s go through the nuances of each leverage type, so you know the best real estate loan for your investments. Here are 10 qualities of real estate leverage to consider.

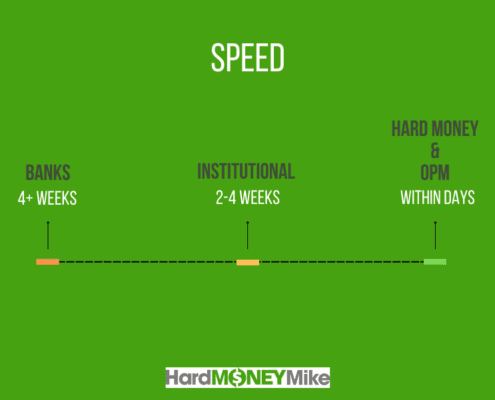

1. Speed

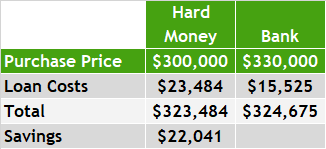

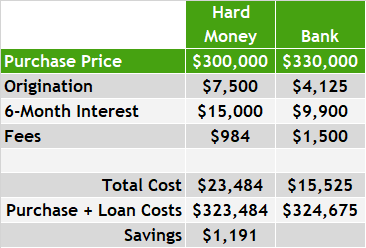

In real estate investing, most of your deals come down to speed. If you can close faster than another bidder, you can get the property – even if the other person offered more money.

Typically, the fastest lending options will be hard money and real OPM.

OPM is using real people’s money, from family, friends, or anyone with money to lend. If you build a relationship with the right OPM lenders, this can be your fastest funding option. OPM can be one phone call and bank transfer away.

Although more expensive, hard money lenders can save you money in the long run with the savings you get from closing quickly on wholesale properties. Hard money lenders can potentially get you money within days (sometimes quicker).

Institutional lenders are fairly quick, typically taking two or three weeks, sometimes four.

Banks are usually the slowest at four or more weeks (unless you already have a line of credit set up, like a HELOC).

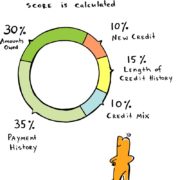

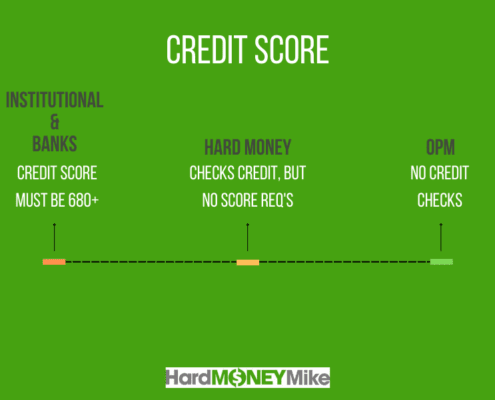

2. Credit Score

Credit is a major factor in the loan process. Requirements for credit scores have gone up over the last few months as money tightens.

Institutions and banks have strict credit score requirements. The target for acceptable credit is constantly moving. Currently, you’ll have a tough time finding any loans with a score lower than 680. The best loans are available to people with a 740 and above.

Hard money lenders will check credit to make sure you’re not defaulting. But your actual score doesn’t have much bearing on your ability to get a loan.

OPM lenders aren’t as concerned with your actual credit score. OPM requirements will vary from person to person. But as long as you’re responsible in protecting their money, you can get an OPM loan.

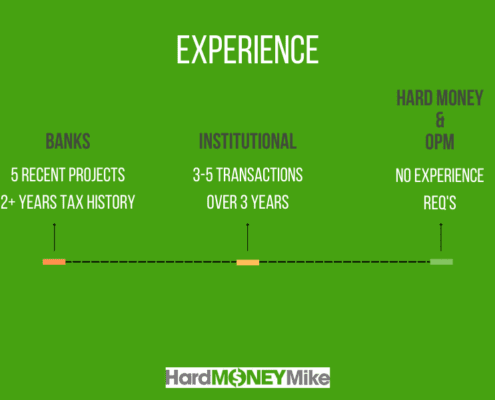

3. Experience

Have you been in business for 2 years? Have you done enough transactions?

The toughest on experience are banks and institutional lenders.

Institutional lenders typically require three to five transactions over a three-year period. They’ll still consider you if you have less experience than that, but they’ll need a higher down payment.

Banks are the strictest. They usually want you to have five completed projects in recent years, plus at least two years of tax history on investment properties.

Hard money and OPM are the easiest on experience.

Hard money lenders care that you have a profitable deal. OPM lenders care that they get a return on their money. Neither lender will be overly concerned with your experience level. They’re more understanding that “you gotta start somewhere.”

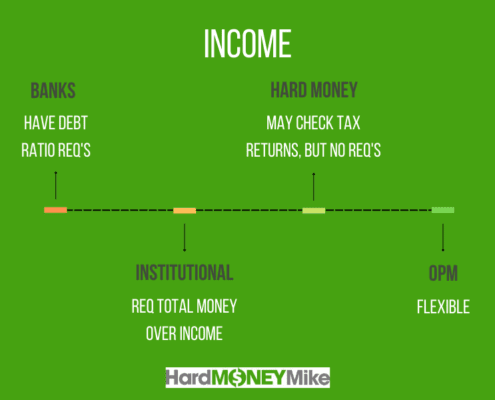

4. Income

What lenders are concerned with your debt ratio?

Banks are the only lenders that are always concerned with your income.

Institutions look at the money you have in the bank, but not necessarily what you have coming in as income.

Hard money might look at your tax returns, but it won’t make or break your loan.

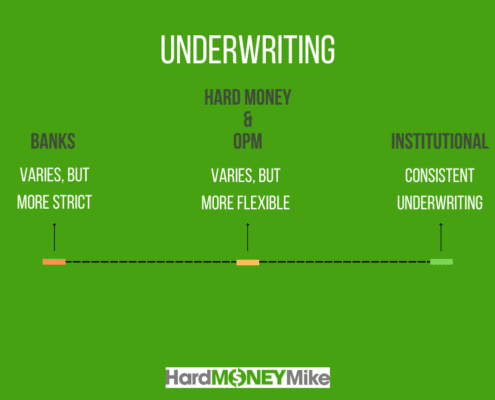

5. Underwriting

How does each lender look at your whole file? What is their criteria, and is it similar from lender-to-lender?

Institutional lenders have fairly consistent underwriting. They all basically require experience, 10 – 20% down, etc.

The other three types of lenders vary drastically.

Banks will always have some sort of requirements. But it’s different between large banks and small banks. Local banks will always be more interested in lending to investors.

Hard money and OPM both vary, too. You have to get to know the lenders in your area to get a feel for their requirements.

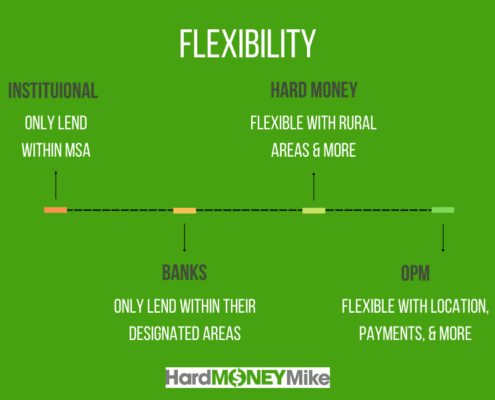

6. Flexibility

What if you need a loan for a rural property? Or what if some other unique situation pops up? Which lenders can be flexible with that.

Institutions and banks are the most fixed in what they offer. Institutional lenders loan only within MSAs. If a property is outside of city limits, they won’t offer any loans. Similarly, banks typically only lend within their footprint. You’ll have to talk to banks near you to learn those service areas.

Of course, hard money and OPM are more flexible with locations, funding plans, and more.

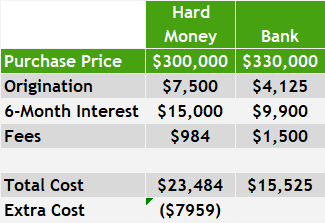

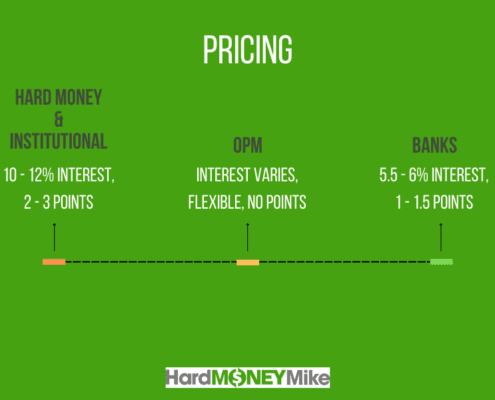

7. Pricing

Every loan has a cost.

Bank loans have a lot of limitations, but this is where they shine. Interest rates and origination fees will almost always be lowest at banks. Interest rates average around 5.5 – 6%, and fees are around 1 – 1.5 points.

OPM is also pretty cheap, and more flexible than banks. Your interest rate will depend on your lender, but there are usually little to no points with real OPM.

Institutional and hard money lenders will be the most expensive, with interest rates around 10 – 12% and fees at 2 – 3 points.

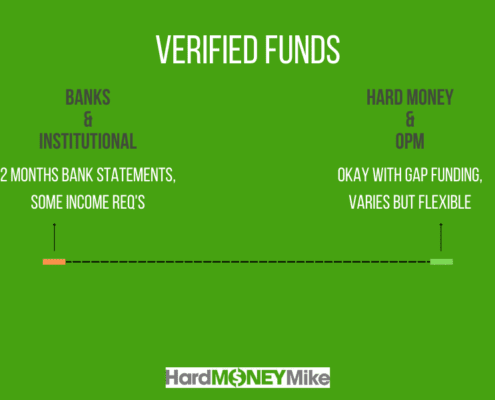

8. Verified Funds

It makes sense that lenders want to know that you’ll have enough money to pay them back. But lenders go about verifying funds differently.

Institutions and banks typically require two months of bank statements. They want to prove you have the money for the down payment, rehab costs, and any carry costs. These lenders emphasize how much money you have and where it came from. They often don’t allow gap funding.

Hard money and OPM lenders, however, are fine with gap funding. These lenders’ requirements vary, but generally, funds are not a major consideration.

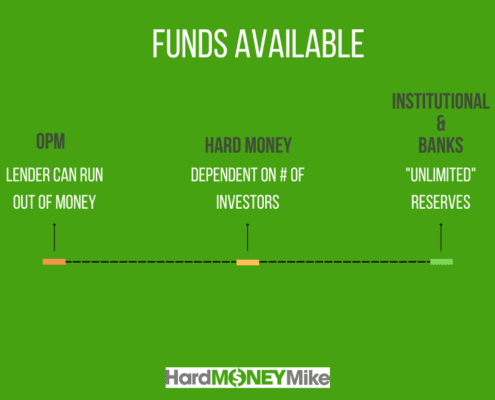

9. Funds Available

How much money does the lender have to offer? Do they ever run out of money, or tell you you’ll have to wait a couple weeks before they have funds?

Typically, the places that have “unlimited” money are institutions and banks. Institutions are backed by Wall Street funds, and banks can always borrow from the Fed.

Hard money and OPM are a bit more limited. Hard money fund availability is based on how many investors they have. Real OPM is limited by the bank account of your lender. A downside of hard money and OPM is that money may run dry; there’s no guaranteed constant flow.

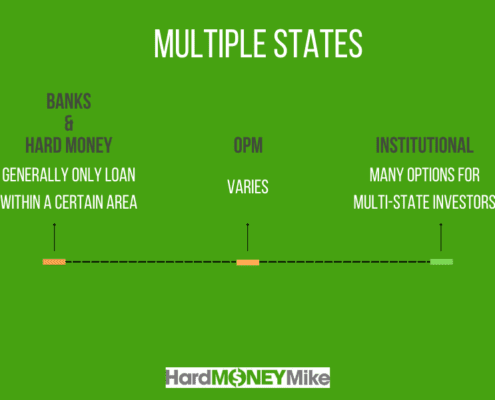

10. Multiple States

If you’re an investor who does deals in multiple states, who will be able to consistently help you? If you live in Oklahoma but invest in Texas, which lender can you count on?

Typically, institutions are your best bet for multi-state investments. If you need someone to grow with you state-to-state, this is your main option.

Many hard money lenders are local, and they focus their investments in a single community. Similarly, banks only lend within their region.

OPM’s multi-state lending ability depends on the client, but there is flexibility.

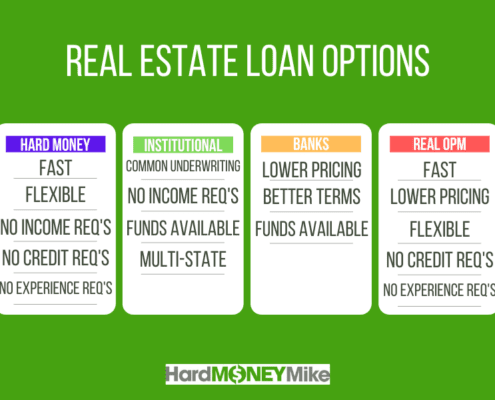

So What Is the Best Real Estate Loan?

All in all, there is no “best” real estate loan. Remember, you need all types of leverage for a flexible, lucrative investment career.

Each loan has its limitations and perks. Here’s a quick overview of each type of real estate loan.

More Info on Real Estate Loans

If you’re left with questions about the best leverage option for you, we’re here to help.

Email us at Mike@HardMoneyMike.com with questions about your deal.

Or join our weekly call here, every Thursday from 1:15 PM – 2:15 PM MST.