Tag Archive for: Colorado hard money

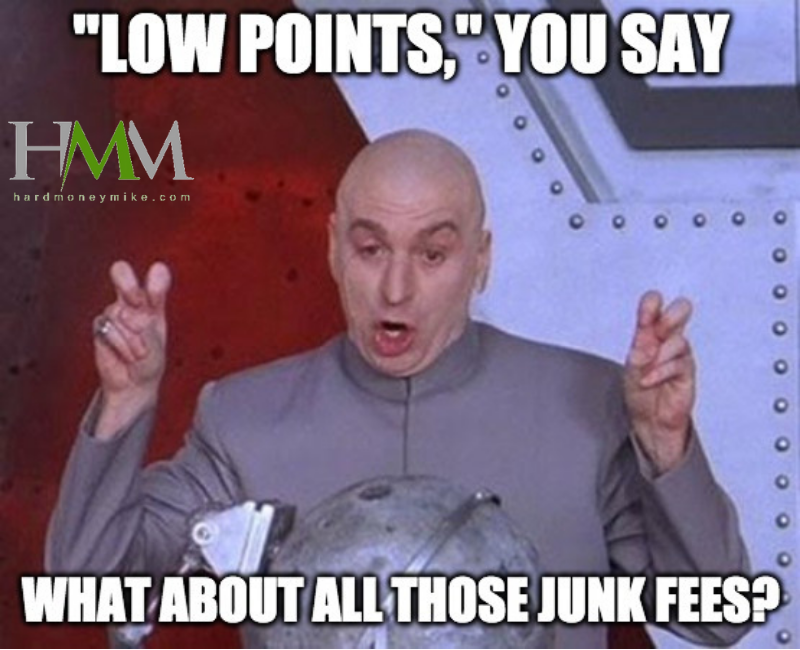

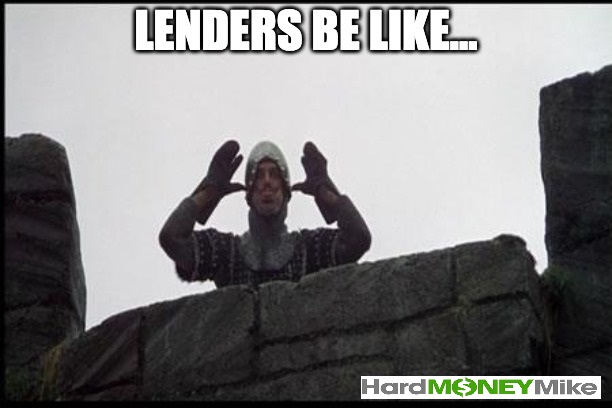

Fix and Flip Escalator: Bigger and Better

/in Finance Tools, ResourcesWhen you use the Fix and Flip Escalator, you’ll quickly realize it’s not magic. It’s SIMPLE math.

This week, let’s use the escalator to see what your money does when you complete four deals per year.

Hard Money > Soft Money

Profits increase by $12,000

$12,000 x 4 deals = $48,000

Hop up another step to bank financing, and this happens:

Hard Money > Banking

Profits increase by $17,000

$17,000 x 4 deals = $68,000

Then look at how your profits skyrocket over the course of two years:

Hard Money > Soft Money

$48,000 x 2 years = $96,000

Hard Money > Banking

$68,000 x 2 years = $136,000

You know what these numbers mean, right? Yes, instead of losing $136,000, you’re making $136,000. That’s money you can reinvest or spend on…anything! Hey, it’s your money. You can do whatever you want with it.

Are you ready to hop on the escalator yet? If so, contact us!

What’s Your 2-Year Plan?

/in MotivationClose your eyes. Clear your mind. Take a deep breath.

Now, let’s pretend we’re talking to each other two years from now. What happened during that time period that made you proud and put a smile on your face? How does your cash flow look? What kind of work schedule do you have? How does life look for you and your family?

When it comes to investing, we have discovered that thinking ahead two years leads to the most success. Why two years? Well, it’s short enough to imagine without being overwhelming, and it’s long enough to create tangible, positive change in your life.

Coming up with a plan is as easy as one, two, three:

Step 1: Imagine where you want to be in two years.

Step 2: Evaluate where you’re starting at today.

Step 3: Create a plan that connects your current reality to your future dreams.

How do you formulate an actual plan? Well, that’s what our team is here to help you do. It’s just a matter of picking up the phone and giving us a call to chat.

One conversation can change your future…and your life!

Tricks to Get Approved for a Loan

/in ResourcesSo, you keep getting turned down for a loan.

As mentioned in a previous post, there’s likely a valid reason. The most logical explanation is a lender doesn’t have the kind of loan you’re looking for. They might only offer loans that include:

- Lower LTV’s

- Shorter terms

- Smaller loan sizes

- Borrower entity requirements

- Loans for higher credit scores

- Loans for those with more experience

Even so, it gets old. So, what are some tricks can you try to avoid hearing, “No,” instead of “Yes”? Here are just a couple:

- Look for smaller banks in your area. They will charge a little more but don’t mind the churning because they have smaller buckets of money.

With that said, we recommend you always work with one or two small banks because they’ll tighten the money outflow as they fill their buckets up.

- Look for lenders who like real estate investors. How? Just ask them upfront if they work with fix and flippers before you go through the four-week process of being turned down.

Are you ready to set yourself up for success, rather than failure? Give us a call at 303.539.3000 to get the ball rolling!