The Beginner’s Guide to Hard Money Loans

Hard money basics you need to know before real estate investing.

We’ve been in the hard money loan business for 20 years. Half the calls we receive are still beginner real estate investors trying to learn the money side of investing.

If that’s you, you’ve likely applied for, heard of, or thought about using hard money lenders. But maybe you don’t fully understand the private lending world yet. How does a hard money loan work? How much interest do private lenders charge? Do hard money lenders require a minimum credit score? Should you just wait until you qualify for better bank loans?

This guide will help answer:

- What is hard money?

- What do hard money lenders look for?

- How is hard money different than other loans?

- How do you qualify for hard money?

- Is hard money better than banks?

Becoming hard money proficient will put you miles ahead as an investor.

Ready to nail the basics?

What is Hard Money?

Hard money is a short-term loan designed for real estate investors. Hard money lenders focus on lending money on undervalued properties in need of rehab.

Hard money loans are short term – usually around six months or a year – and are designed to help buy properties to fix up.

While “easier” than traditional bank loans, hard money loans are also more expensive due to higher interest rates. Which brings us to the most important quality of hard money loans: they’re fast.

In real estate investing, discounted properties typically require fast-closing deals. Hard money loans can help you take advantage of prices while they’re low, and:

- Save on the property cost to begin with

- Get more from selling or refinancing the property.

These savings more than cover the costs of a hard money loan for most investors.

The speed of hard money makes it valuable for newbie and seasoned investors alike. Hard money loans are made for real estate investors.

How Does A Hard Money Loan Work?

What do hard money lenders look at? There are two main factors lenders of hard money consider.

Loan-to-Value Ratio

An important number a lender takes into account is the cost of the property. The ratio of the loan they offer and the cost is important for you to know.

Let’s say you have a property with a current appraisal of $200,000. Then you get a loan for $100,000. The loan is half of the value of the home, so your loan-to-value is 50%.

After Repair Value (ARV)

ARV, after repair value, is another important factor hard money lenders consider. The properties targeted by real estate investors are undervalued. They need work to be brought up to the standards of the surrounding community.

So, lenders look at not only the current value of the house, but also the future value of the house, after it’s all fixed up.

Many hard money loans are based on after repair value rather than loan-to-value. Your lender might offer you up to 75% – not of what you’re buying it for, but what you could sell it for by the end.

What Does ARV Cover?

A key factor to ARV is that lenders will lend not only for the initial purchase, but for the fix-up costs.

Many lenders will put money aside in escrows to use throughout the project to pay contractors and cover other renovation costs.

If your loan considers ARV, it’s possible for you, with ZERO money down, to:

- Buy a property.

- Fix it up.

- Either sell it (fix-and-flip) or refinance it (BRRRR).

After selling or refinancing, you use that money to pay the loan back.

Hard money is designed to build value into real estate. Understanding the role of the after repair value will help you immensely in your hard money investments.

How Is Hard Money Different from Other Loans?

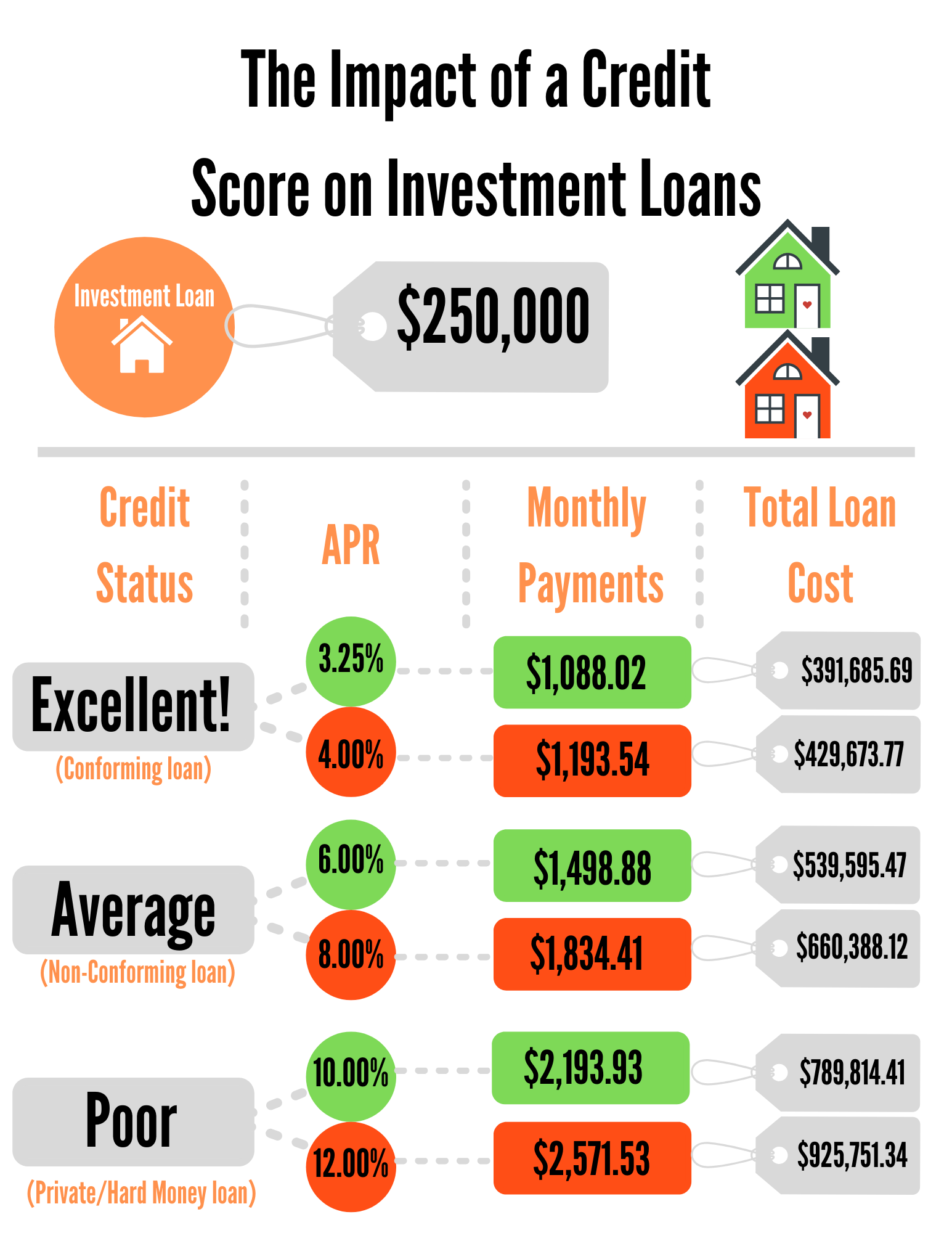

Interest rates on hard money are between 2-5% higher than what you’ll find at banks. You can expect origination fees to be about twice as much. Appraisals will be close to the same.

So on paper, the rates and fees are higher, so it feels like you’re spending more. Which you are! But with hard money loans, you’re paying for:

- Accessibility

- Convenience

- Flexibility

- The opportunity to purchase properties you’d never be able to while relying on bank loans.

While hard money costs more than other loans, the potential value is also way higher. When sellers have discounted real estate, they want it sold fast. Banks can take 25-30 days to close. You can receive hard money in a matter of days.

Every week, we see hard money work to save people money.

When a recent client of ours bought a property, he saved 10% – just because he could close faster than the other five bidders. His savings on that purchase were $30,000: much more than double what he’ll spend on the loan transaction.

How Do You Qualify for a Hard Money Loan?

There are two kinds of hard money lenders. They each have different qualification requirements.

National Hard Money Lenders

National lenders lend in almost every state. They are larger organizations, backed by hedge funds and private equity.

National hard money lenders require:

- A credit score check, and a good score.

- Experience – at least five deals in the last three years.

- Properties to be in specific larger communities.

So if you’re new to investing, need to improve your credit score, or are looking at more rural properties, you may need to look into local lenders.

Local or Private Hard Money Lenders

A local, or private, lender will specialize in your state or area. Local lenders are much more likely to:

- Not ask for a credit score.

- Not require experience.

- Lend for rural areas.

Local lenders are focused on the deal itself and whether it has good value.

When deciding which lender to use for hard money, always shop around to see what fits your situation now. And be aware that another lender may fit you better in the future.

Are Private Lenders Better Than Banks?

It’s impossible to say whether hard money lenders or banks are “better” for real estate. It all depends on your deal and where you are in your investment career.

When to Use Bank Loans vs Hard Money Loans

Bank loans will have lower rates and may be the better route if you:

- Have had a successful investment business for over two years.

- Make a lot of money at a W-2 job.

- Have 3-4 weeks to close.

Hard money loans will be easier, faster, and may work better if you:

- Are newer to real estate investing.

- Don’t have money up-front to invest.

- Don’t want to put your own money into a deal.

- Need to close within a week or two.

As long as a property promises income, hard money more than makes up for its higher rates with the speed and greater potential savings. Starting in hard money paves the way for you to work up to bigger funding opportunities.

Ultimately, your investment career should always have a mix of funding types. Bank loans, hard money, and OPM all have their place to work for you in real estate investing.

Where to Go from Here

Understanding money is key to successful real estate investments. When you put time into understanding money, you get control of it. With control, you can multiply your investment earnings four times over.

It doesn’t stop here. We want to help with your hard money education:

- Check out our YouTube channel here.

- Download our free real estate investment resources here.

- And reach out to us anytime at hardmoneymike.com.