Credit score tips to prepare your real estate investment career for a recession.

The upcoming economy will be an opportunity to create generational wealth.

In the years after the 2008 crash, Hard Money Mike helped people create a great real estate portfolio. A portfolio that has taken them through the past decade and onto the next generation.

We know the opportunity is always there in a recession. But we also know that if you’re not money-ready… you’ll probably miss your chance.

Your credit score is more important now than it has been for a long time. With inflation hitting and a possible recession on the way, lenders are tightening up with loans. Your credit decides whether your real estate investment career will be easy or hard.

So what do you need to know about investing with your credit score? How can you turn a time of struggle into a time of opportunity?

What is a Good Credit Score?

Credit scores range from the 400s to 800s. But for the purposes of the lending world, that range shrinks to the mid-600s to upper-800s.

Over the past 6 months, with inflation and interest rates rising, big institution lenders have tightened their grip on loans. Not just anyone can get a loan – you’ve got to have a good score.

But what is a good credit score for real estate lenders?

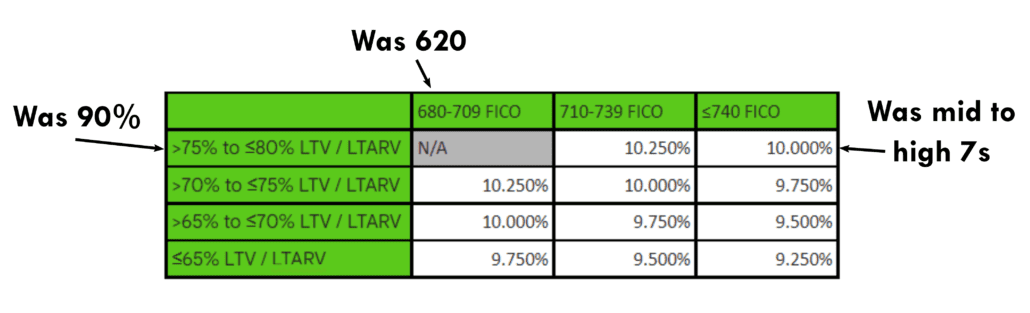

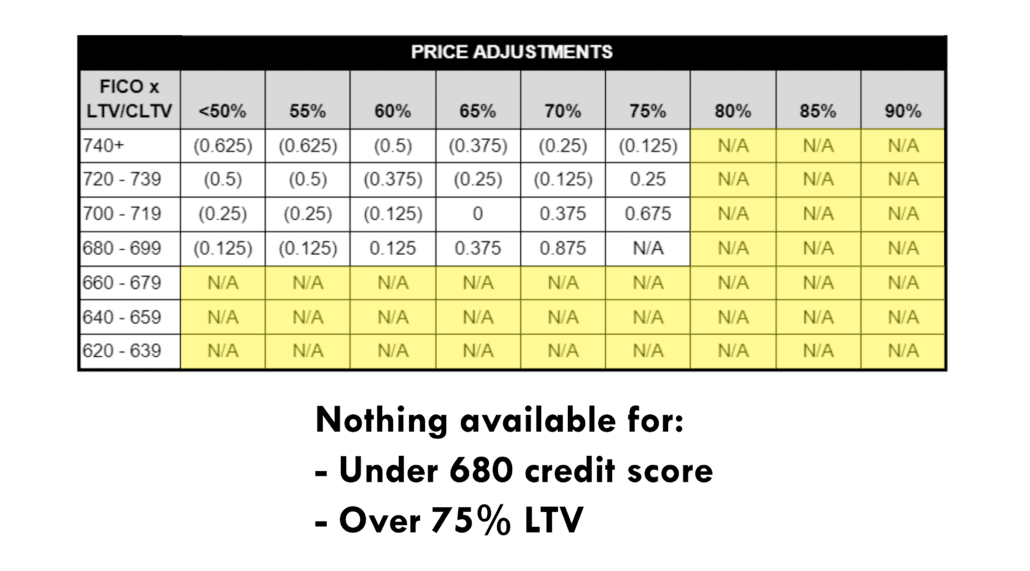

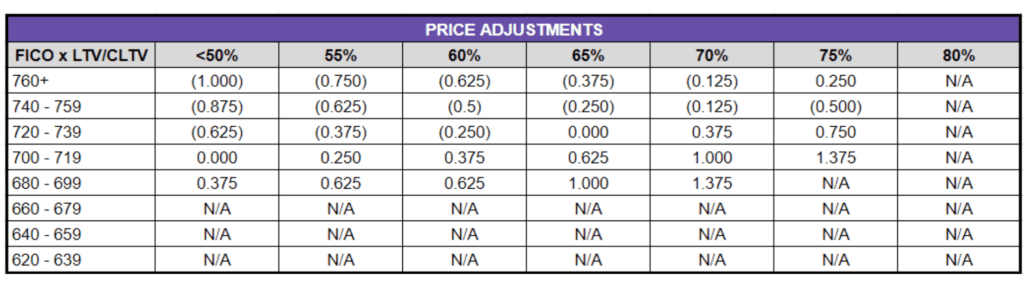

Before this recent shift in the economy, the lowest score considered by a lender was 640. Now, most lenders won’t look at anyone under 680. And that 680 minimum could soon turn into 720.

Institutions raise credit score minimum requirements to cut investors from the loan pool. This means many of your competitors will be unable to find the same kind of money they could 6 months ago.

You don’t need to be one of the investors squeezed out of the lending space. But you’ll need to understand exactly where your credit is, how to improve it, and what good credit score range lenders are looking for.

Make sure you’re credit-ready for these upcoming opportunities.

How to Increase Your Credit Score

To take advantage of this next market, you’ll need to keep money coming in. Banks and hard money lenders will be stricter with loans. You’ll need a good credit score to not be squeezed out of opportunities with lack of funding.

There are a few simple things you can do to raise your credit score.

Pay Your Bills on Time

This is the absolute most important action to increase your credit score. Payment history makes up at least 40% of your score. Lenders who don’t require a minimum credit score will still look at whether or not you pay your debts back.

Focus on this habit if you haven’t. Missing payments is the biggest red flag to lenders. No one – from banks to small hard money companies to OPM lenders – will want to give money to someone who has a history of not paying back.

Reduce Your Credit Card Balances

If you’re using a credit card to fund fixes on your projects, make sure to pay it off completely after every flip. Pay off as much as possible as you go. Keeping a lower balance on your cards will:

- Improve your credit score.

- Ensure you won’t run into late payment.

- Keep your balance from getting out of control.

It’s smart to have credit cards paid down before applying for a bank loan. To do this fast, you can get money in ways that won’t show up on your credit report. You could use a personal loan or OPM, a 401k loan, or a HELOC.

Get Authorized on Someone’s Good Credit

If you’re struggling with your score, find someone with good credit who will authorize you on their account.

This person will likely be a little older. They’ll have a great credit score, and their accounts will be established. Older people will naturally have an advantage you don’t – the length of their accounts.

Simply getting authorized on another person’s good credit will bump your credit score up.

Know How to Increase Your Credit Score

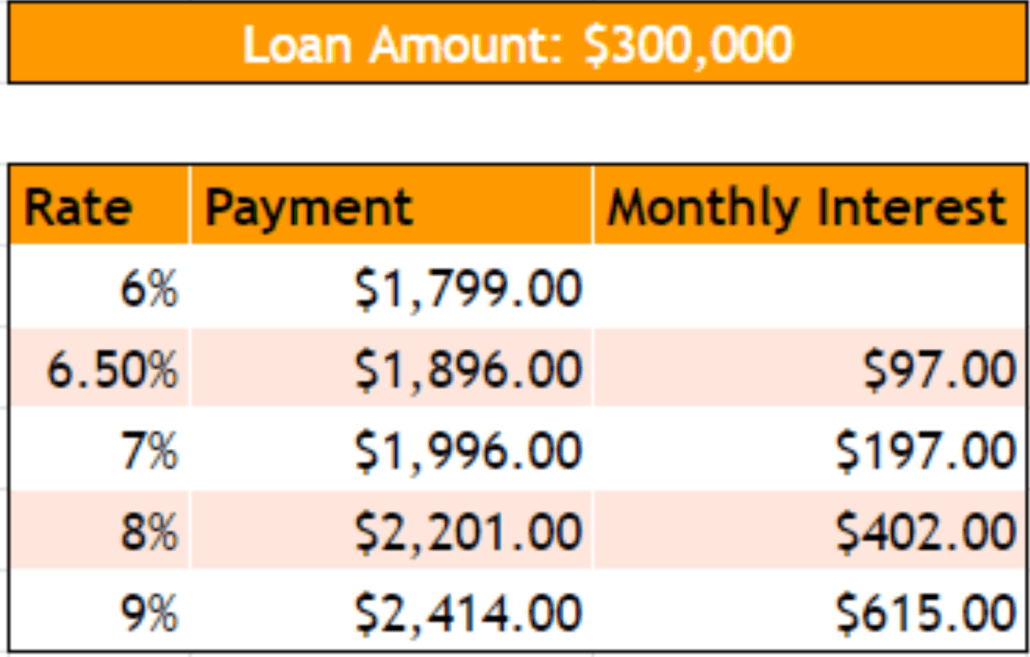

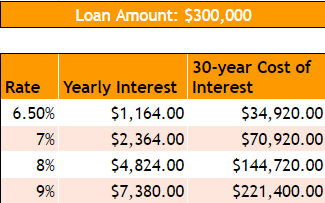

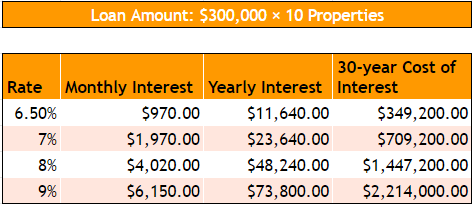

It’s important to give your credit score all the boosts you can before trying for a loan. Right now, the difference between a 680 credit score and a 679 is the difference between getting a loan and not getting a loan. The difference between a 720 and a 719 is getting a 9.5% rate rather than 11%.

Real Estate Investing with a Low Credit Score

Investing in real estate when you have a low score is definitely more difficult, but it’s not impossible.

If you’re researching how to invest with a bad credit score, raising your score should be your number one priority. These options aren’t replacements for a good score. But you also shouldn’t have to pause all investments until your credit is good.

So, what are your lending options with a low score?

You’re essentially out of the market for both banks and national hard money lenders.

You’re down to two options.

1) Using Small, Local Hard Money Lenders When You Have Bad Credit

Individuals or small hard money companies (like Hard Money Mike) don’t depend so much on credit. Instead, they focus on the quality of the deals.

Corporate hard money lenders can afford to turn off their lending and turn it back on. Small lenders rely on loans to make a living, so they’ll always be willing to offer you money if you have a good deal.

If you know how to put a deal together, if you understand all the numbers, if you can prove a deal is good – small hard money lenders will want to work with you, regardless of your credit score.

Small hard money lenders probably won’t require a certain credit score… But they will check your credit. Particularly your payment history. If you have habitual late payments, even a smaller lender won’t want to lend to you.

However, a small hard money lender will be more likely to understand that life happens. Sometimes certain life events negatively impact your credit. National lenders won’t ask for the story behind the number; they’ll just see that your credit score doesn’t fit their criteria. Small lenders will work with you.

2) Using Real OPM for Money When Your Credit Score is Low

As lenders are tightening up, investors aren’t the only ones who will feel the squeeze of the economy. There are regular people out there – with money – who will also be affected by inflation, interest rates, and the market.

These people are typically 50 or older and looking for ways to live off the retirement money they’ve accumulated. Banks are still only paying around 1% rates, but someone could get a rate of 5 or 6% by loaning money to you.

Inflation matched with stagnant bank rates make your potential OPM lenders lose money. Lending to you is a way for their money to keep its value.

OPM lenders will also care less about whether you have a 620 credit score or an 800 score. They’ll just care that you’ll secure their money and do deals the right way.

Don’t let the economy fool you into thinking there aren’t any big pools of money out there. You just need to know how to find them, navigate them, and keep them.

There’s No Replacement for Good Credit

Again, these are some of your options if you have low credit, but they are not a replacement for high credit. This is your business. Take your credit seriously.

Higher credit scores open up other options. Having other options make hard money loans and OPM work even better for you.

Your business will be easier, faster, and smoother when you have a credit score that doesn’t work against you.

BRRRR and Fix-and-flips During a Recession

You’ll soon be able to make money like no other time in the last 12 years. Deals will be easier to find than ever.

In the last decade, loans have been easy to come by. But home prices have been going up, so it’s been hard to find good properties. What will happen next is money will get tighter, but deals will get better and better as rates go up and property values go down.

So what can you do in the upcoming fix-and-flip and BRRRR market? Especially when your credit score is low?

Fix-and-flip Loans with Bad Credit

If you have bad credit while doing fix-and-flips, local hard money lenders will become your best friends.

Reach out to your real estate community, go to biggerpockets.com, and find those small lenders in your community.

You’ll need to keep plenty of lenders in your back pocket. Local hard money companies will be swamped by other investors with low credit scores. To have a good chance at getting money when you need it, you’ll want to know five or six good lenders.

BRRRR Properties and Long-term Rentals with Bad Credit

There’s always two loans with BRRRR – the acquisition, and later, the refinance. Some smaller hard money lenders can help with that first loan, but longer term, you’ll have to start looking at other options. If you run into trouble with the refinance, it can be hard to pay the hard money loan back. OPM could become vital for getting money for these properties.

Another route is to find something like a subject to, rather than a traditional BRRRR. There will be people who need to get rid of a property because they’re behind on payments. You can jump in and take over the property and the payments without assuming the loan. You don’t necessarily need a good credit score – you just need to be able to make the monthly payments and rent the property.

Overall, be aware that your pool of options will be much smaller with a bad credit score. Your price point will be lower, your range of options is smaller, and your ability to close on deals is slower.

Private Lending Options for Investors with Bad Credit: OPM

OPM is other people’s money. Real people that you know – friends, neighbors, family, people in local real estate groups. OPM can help with down payments, construction, monthly payments – it fills the gaps of your project. And if you really find the right people, the entire cost of a property could get funded with a $500,000 check.

OPM lenders won’t care about the same qualifications as institutional lenders. Your credit score is less important than whether you secure their money and pay them back as agreed. Good credit or bad, OPM will be one of the best tools for you as an investor in this next market.

Usually these are people closer to retirement. They want to get off the roller coaster of the stock market and get more reliable, consistent returns.

Someone with $300,000 in a bank account at 1% makes $3,000 a year on that money. If you can give them 5%, they make $15,000 instead. OPM will be mutually beneficial in this upcoming economy – you just need to know where to find OPM lenders and how to make it work.

With OPM, you can do more deals, better deals, faster deals, and deals other people can’t afford. We want to help you take advantage of this opportunity.

Hard Money Mike has funded over $1 billion of loans with Real OPM. During the crash in 2008, we couldn’t get money from banks, so we went the OPM route and have stayed that way ever since. We know how to do it right, and we know that it works.

Where to Go From Here

Few real estate investors will be prepared to take advantage of the impending recession.

You can be the one to take this opportunity, get the information, and be ready with your credit score. We have the experience to help you get ahead.

Download our free Credit Score Checklist here and free OPM checklist here.

Watch videos on credit tips here.

Reach out to us with any questions at HardMoneyMike.com.

Happy Investing.