Secure 100% Financing for Your BRRRR Investment

Secure 100% Financing for Your BRRRR Investment

Today we are going to discuss how to finance a BRRRR at 100%. That means no money out of your pocket for the purchase, rehab, closing or even carry. For the past 14 years we have been helping people get 100% financing for BRRRR. It all comes down to one thing, making sure that the people are purchasing good properties at 75% or less. How can you secure 100% financing for your next BRRRR investment? Let’s take a closer look!

How can you achieve success in this current market?

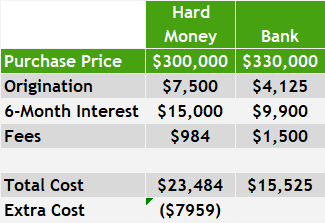

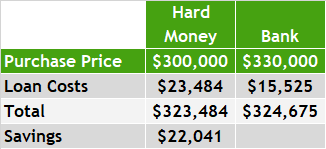

There are a lot of opportunities for real estate investors right now. Just the other day we had a client who had bought a property in the Denver market for $300K. After putting in $50K in rehab, the property was worth $550K in the end. There are many other real estate investors who have been successful in similar situations in spite of the challenging market. How do they achieve such success? The answer is getting the correct upfront loan. While predictions indicate that there will be more opportunities in 2024 and 2025, now is the time to invest. Now is the time to jump in.

Selecting the right loan for you.

Remember that conforming conventional loans have restrictions that prevent investors from refinancing properties within the first year. However, a rate and term loan, such as a DSCR or conventional loan, allows investors to refinance immediately after getting an appraisal. By having a great hard money lender for your purchase, you will be able to refinance and get cash out of the property quickly and easily.

Find the right hard money lender.

It is crucial that real estate investors work with a hard money lender who can get up to 75%. Just to clarify, the 75% is based on the amount that you can refinance. Here at Hard Money Mike we say 75% because most clients can refinance into a conforming or DSCR at 75%. However, if you’re only able to finance up to 70%, then we will have to match whatever you qualify for on the long term or take out loan. It is important to remember that a BRRRR includes a buy, which is the first loan, and then there is a refinance. The refinance dictates how much a lender on the buy can give you. By finding the right hard money lender you will be on the path to success.

Let’s look at some numbers on the buy side.

The first calculation that needs to be done prior to purchasing a property is determining the maximum loan amount. This can be found by multiplying the ARV by 75% or .75. Once the max loan value is determined, real estate investors can then calculate if the property will be able to qualify for 100% BRRRR financing.

Calculating Max loan amount.

Purchase price: $120K

ARV: $200K

Max loan: $200K x .75 = $150K

Will it qualify for 100% financing?

Purchase price: $120K

Rehab: $20K

Closing costs + Carry costs: $10K

It is important to remember that closing costs are not only on the buy, but they are on the refinance as well. Also, carry costs should be added to the total in order to cover a few months of monthly payments, taxes, and insurance on the property until it can be rented. In most cases, investors are able to get the property rented before refinancing, which will in turn lower the carry costs. By keeping the purchase price, rehab costs, closing costs, and carry costs all under the maximum loan amount, real estate investors can finance a BRRRR at 100%.

Finance a BRRRR at 100% today!

In order to finance a BRRRR at 100%, you need to make sure that all of your costs are less than the max loan amount. It is important to have a hard money lender who understands BRRRR’s. Here at Hard Money Mike we can help you run through numbers to make sure that you are in line to get 100% BRRRR financing.

Watch our most recent video to find out more about how you can Secure 100% Financing for Your BRRRR Investment.