I’m Stuck in a Hard Money Loan: How to Get Out

I’m Stuck in a Hard Money Loan: How to Get Out

Today we will discuss the common reasons why investors get stuck in a hard money loan and provide practical strategies to break free. From exploring refinancing options to making timely decisions, we’ll guide you toward regaining control of your investment journey.

Two main reasons:

-

Project Delays:

Construction or permit delays extend project timelines far beyond what was initially planned. Since most hard money loans have fixed terms, borrowers are faced with the option to either secure additional funding to complete the project or sell the property.

-

Property Not Selling:

This is due to either overpricing or market conditions. By continuing to hold onto the property without adjusting the price, it results in significant financial losses.

How to Get Out:

-

Refinance with Another Hard Money or Bridge Loan:

Secure a new loan in order to provide the necessary funds to either complete the project or aid in the sale of the property. This option allows investors to regain control and momentum in their projects.

-

Sell the Property As-Is:

Sometimes, the best course of action is to sell the property in its current condition to another investor. While this may result in a loss, it also prevents further financial bleeding caused by holding onto the property.

-

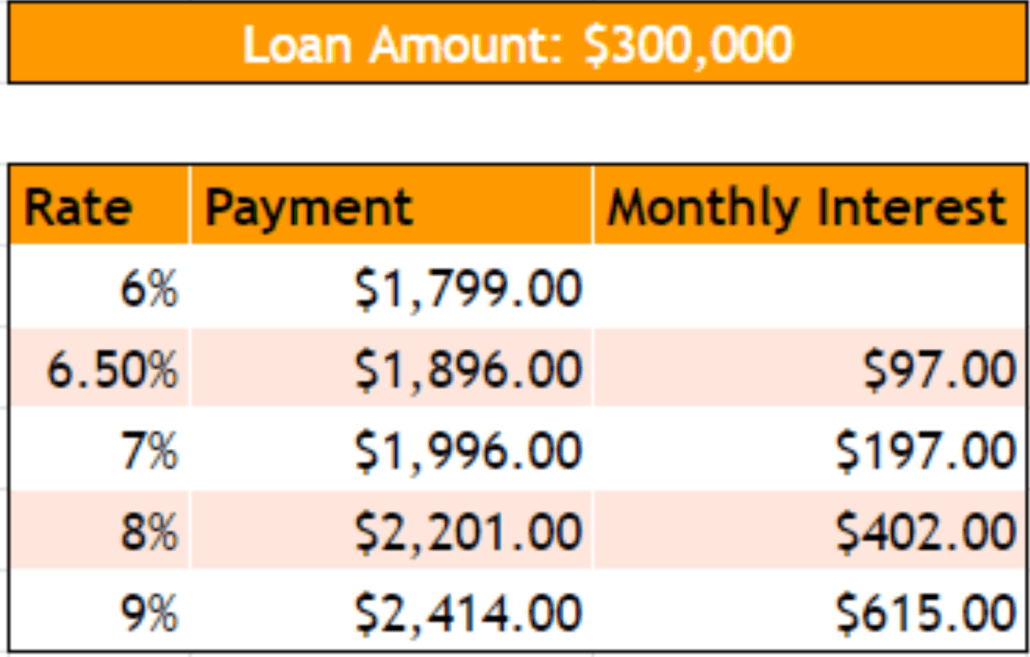

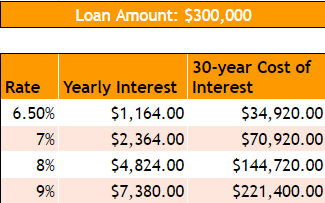

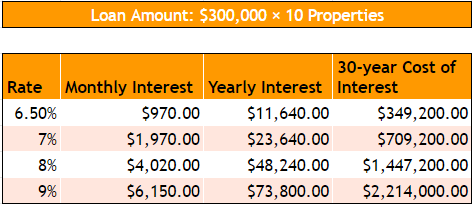

Refinance into a Long-Term Loan:

Investors can refinance into a long-term loan, such as a permanent loan or a traditional bank loan. This option also allows investors to transition the property into a rental, which can decrease monthly losses or potentially create a profit.

Save Your Deal:

-

Don’t Get Stuck:

Don’t fall into the trap of continuing to invest in a project solely because you’ve already sunk money into it. Assess the current market conditions and make decisions based on realistic projections rather than past investments.

-

Quick Decision Making:

When faced with a stagnant property, make timely decisions to either adjust the price for a quick sale or pursue refinancing options. Don’t risk losing time and money because of indecision.

-

Seek Professional Guidance:

Reach out for expert advice and assistance today. Consulting with experienced lenders or real estate professionals can provide valuable insights and help navigate challenging situations.

Get Help Today!

Contact us today! There are solutions available to help you regain control of your investment. Reach out to HardMoneyMike.com for expert guidance and support. Whether you need refinancing options, project advice, or assistance with navigating your loan terms, we’re here to help.

Watch our most recent video to find out more.