What is BRRRR?

What is BRRRR?

Did you know you can buy properties with as little as zero down? It just takes an easy investment strategy many investors call BRRRR.

Although the term “BRRRR” was coined by Bigger Pockets in recent years, the investment strategy has existed for decades. Some call it zero down, some call it Quick to Buy, Quick to Refi. Whatever you want to call it, it’s all based on buying properties with as little as zero down.

So, what is BRRRR?

Well, let’s break it down piece by piece so you understand how to approach each step. That way you can generate the highest cash flow possible.

The B in BRRRR stands for “Buy.”

Now, how do you buy properties correctly when using the BRRRR method?

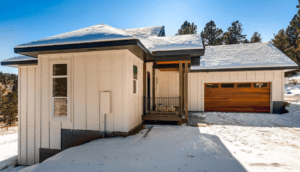

First, you need to buy under market properties with a short-term loan, like hard money. You shouldn’t buy retail properties that are already fixed up and ready for tenants. These are supposed to be value-add properties, meaning you add value to them. That way you immediately create equity in the project.

Second, you need to be able to buy properties FAST. The faster you can buy, the better the deals. Because sellers want to sell fast. Even if you bid lower than three other investors, you can still get the property if you can close quickly. Because speed nearly always wins.

The first R in BRRRR stands for “Rehab.”

The properties you buy using the BRRRR method will need rehab to bring them up to rental grade. That means simple, but durable renovations. You don’t need to aim for high end finishes like granite countertops or new, expensive cabinets.

Even so, the work you do should add value to the property. That way when an appraiser shows up, they can see you’ve improved it and now it’s worth more than what you bought it for. Again, think about creating equity. Equity is key!

The second R in BRRRR stands for “Rent.”

The moment you decide you want to try the BRRRR method, you should start researching rental numbers immediately. Go onto Zillow, Craigslist, or Rents.com and find out what other people in your target neighborhoods are charging for rent. That way you’ll know if a property will produce good cash flow BEFORE you buy it.

And once you know what your numbers are, go ahead and start accepting applications for tenants. It’s okay to look for quality, trustworthy people to live in your home even before you have the home ready for them.

The third R in BRRRR stands for Refinance.

Refinancing into a cheaper, long-term loan is the next step in the BRRRR method…and it’s where you get to capture the equity you created in the “Buy” and “Rehab” steps.

How?

Well, if you did those first two steps right, then you bought an under market property and then renovated it to add value. The gap between the buy and the rehab is your equity. And you can use that equity (rather than the money in your own pocket) to pay for your new loan’s down payment. That’s how the zero down portion of this strategy works.

Finally, the fourth R in BRRRR stands for Repeat.

The whole benefit of BRRRR is that you can repeat the process over and over…and over. As long as you find good, under-market properties and create good equity, you don’t need to wait to save up for a 20% down payment. You can complete this process whenever you want and however often you want.

And, at the end of the day, always remember your lender matters. When it comes to BRRRR, you want a lender who can help you maximize your hard money loan, and help you refinance into a traditional loan FAST.

So, if you’re ready to jump in and try out the BRRRR method, our team is always here to help.

Happy investing!