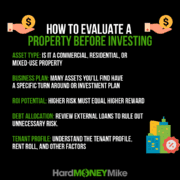

Thursday Tips: How To Analyze Investment Properties

Thursday Tips: How To Analyze Investment Properties

Ready to learn how to analyze investment properties?

In this great Bigger Pockets article, you’ll learn the nuts and bolts of evaluating real estate deals.

You’ll also discover how to get the information you need to complete a comprehensive evaluation of a neighborhood. That way you can determine which neighborhoods and properties will give you the best return.

And getting the best return is what this business is all about. Because generating positive cash flow is the answer to your financial independence.

But the only way to produce strong income is to put your money in the right properties. And the right properties depend on your analysis.

If you fail to evaluate your deals correctly, then the numbers won’t add up. And that means you might lose money.

A lot of money.

Yikes.

Yes, we’ve said it once and we’ll say it again: Numbers don’t lie.

Before diving into real estate investing, make sure you understand how to compare markets and properties. Whether you’re trying to decide between investing in Boise or Sacramento—or you’re just comparing two similar homes—this guide will walk you through all the numbers you need to know. From calculating cash-on-cash return to running a comparative market analysis, the experts at BiggerPockets demonstrate the steps you need to follow and the statistics you must know with The Beginner’s Guide to Real Estate Market Analysis.

Ready to learn more about evaluating your real estate investments? Great! Check out the entire Bigger Pockets article here:

Or if you’re ready to chat about your fix and flips, rentals, and other value-add properties, give our team a head’s up.

Happy investing!

13

13