The $1.8 Million Dollar Mistake: DSCR Loan Interest Rates

DSCR loan interest rates vary like crazy. Here’s exactly how to avoid a costly mistake.

DSCR loans are unlike any other loan out there.

Traditional loans are standard – every lender will have the same interest rates, terms, points, and closing costs. There is one system, one set of brackets that decides loan prices, and one approval process.

Not so with DSCR loan interest rates and other terms. This style of loan is the Wild West of underwriting.

With so much variance between DSCR loans, it’s more important than usual to shop between lenders. Let’s go over the $1.8 million mistake some investors make with DSCR loan interest rates.

Current DSCR Loan Interest Rates

We’d like to share a couple of examples we see in the DSCR loan world.

As a mortgage broker, we have a program that allows us to look at different rates from different companies. Every day, 10 to 15 different lenders put their rates on this search engine.

We search the same information daily to get a picture of the rates on these loans. We put the same:

- Credit score

- Debt service coverage ratio

- Loan-to-value

Yet every lender offers a different rate. On the same 30-year DSCR loan, interest rates have looked like this:

- The best: 7.04%

- The worst: 9.46%

- The average: 7.9% – 8.25%

These differences are not based on credit score, experience, property size or type, or debt ratio. These are the options for the same person calling around for the same deal. They could find anywhere between 7.04% and 9.46% – all depending on the lender.

The DSCR loan market is extremely segmented. And that is why it’s vital to shop around.

We want to break down the difference in DSCR loan interest rates for you. How much money do you lose on the worst DSCR interest rate vs the best?

How Much Different Interest Rates Cost You

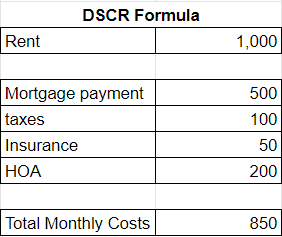

Let’s say we have a $300,000 deal we want a DSCR loan for. We’ll look at 3 common interest rates: the high end (9.46%), the low end (7.04%), and the average (7.99%).

In this example, we have the same credit score, same rent income, same property expenses, and the same loan amount. These interest rate differences are purely about the lenders we’re using.

Low-End DSCR Interest Rates

With the lowest available rate, 7.04%, on a $300k, 30-year loan, payments are $2,003.

At the exact same time, with the exact same parameters, a 7.99% interest rate (average range) has payments of $2,199.

So, this is a difference of $195. Doesn’t seem like a big deal? If your rent is $2,100, a lower rate could mean the difference between positive cash flow and negative – or qualifying for the DSCR loan or not.

High-End DSCR Interest Rates

What’s this comparison at the other extreme?

Lenders with higher DSCR loan interest rates are usually the ones who take advantage of the segmented nature of this market. They raise their rates high, then raise their marketing budget too. They push their product hard to be the first option borrowers see; when they don’t shop around, they’ll settle for the higher rate.

And with this higher rate, a 9.46%, your monthly payment would be $2,513. That’s $509 more per month than the lender with the 7.04% rate!

All for the same property, same LTV, same credit score, but different lender.

Impact on Real Estate Investors

The monthly cash flow difference from DSCR loan interest rates will hurt everyone’s pockets. However, it’s especially rough for investors. What happens if you have three properties? Five? Ten?

If you got stuck with a 7.99% rate for all of your investments (rather than 7.04%), that’s $70k extra in interest over the life of the loan. How does that multiply with more investment properties?

- 3 properties → $210k extra in interest

- 5 properties → $350k extra in interest

- 10 properties → $700k extra in interest

Let’s make the same comparison with the higher-end interest rate of 9.46% compared to the low-end 7.04%. Over the life of the loans you’d be paying:

- 3 properties → $550k extra in interest

- 5 properties → $917k extra in interest

- 10 properties → $1.8M extra in interest

That money is all additional interest that could have been avoided. It’s going into the bankers’ pockets because you didn’t shop around for a better rate that’s easily available.

But what exactly do we mean when we say shop around?

How to Shop Around for DSCR Loan Interest Rates

The spreads on DSCR loans are large. But shopping around for any large purchase is no fun.

When you’re talking with any sort of salesperson, it’s nerve-wracking to not know whether they have your best interest in mind. What if you don’t know what questions to ask to get the right information? What if they try to take advantage of you?

We want to give you a couple of questions to ask to get the information you need to make an informed decision on your DSCR loans.

Questions to Ask DSCR Lenders

Firstly, a piece of advice: if a company won’t quote you a general range in a simple phone call, then keep calling. Find the ones that will.

Secondly, prepare all of your information ahead of time, and be sure to give every lender the same information. You’ll want to have the following information ready before you contact anyone:

- LTV

- Credit score

- Is it a purchase or refinance?

- Zip code of the property

- Type of property (single-family, duplex, etc)

- Rent (or estimated rent)

Next, you’ll want to have a set of questions to ask each lender. Even if you don’t have the property yet, coming with a specific example gives you an idea of who the good lenders are.

What to ask DSCR loan lenders:

- What interest rate could I get?

- Is there a prepay penalty? How long is it and how much? (The pricing of a 5-year prepay will always be better than a shorter-term prepay. But if you know you’ll want to sell the property within three years, you’ll need to keep a shorter prepay in mind).

- What are your closing costs?

- What’s your appraisal process for underwriting?

- Is this a 30-year product? 40-year? Interest-only?

How to Analyze the Price of Different Lenders

Now, once you have all the information and numbers from your different lenders, you have to make sure you’re comparing apples to apples. One lender may have a lower interest rate but an extra 1-2 points.

What’s important is the final number you’ll have to pay. You can download our free analyzer here for an easy way to figure that out.

We want to get you the lowest rate to keep your investment business turning. Rates have been fluctuating like crazy, though.

If you want a regular report on conventional and DSCR loan interest rates, LTVs, credit requirements, and more, ask us about it at Info@HardMoneyMike.com.

Happy Investing.