The Quick Deal Analyzer: How to Guarantee Positive Cash Flow

The Quick Deal Analyzer: How to Guarantee Positive Cash Flow

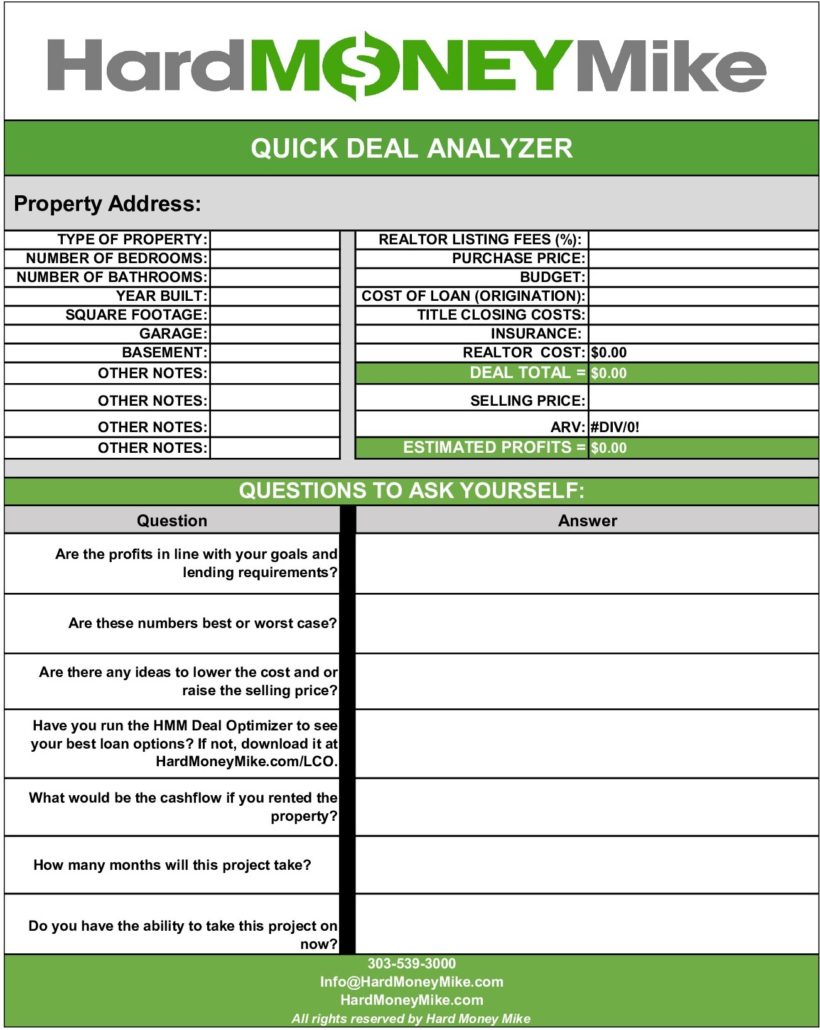

Have you heard of the Quick Deal Analyzer?

Because it’s an excellent tool to use BEFORE you buy a real estate property.

The Quick Deal Analyzer helps real estate investors decide if a property is worth their time, money, and effort.

It’s an easy-to-use tool that allows you to quickly evaluate a fix and flip, rental, or another value-add property to see where the numbers land. Because, why bother negotiating with a seller, finding a lender, closing a deal, and renovating if the numbers don’t make sense from the start?

Why bother with all of that work if you’ll end up making little to nothing?

The Quick Deal Analyzer also lists some important questions that will, again, impact your cash flow and profits.

For example, how many months will it take to complete the project? The longer a project takes, the less money you’ll see in your pocket. Because you won’t be collecting rent or selling the property. Instead, you’ll be making payments to your lender and contractor.

Just remember, the Quick Deal Analyzer only works if you answer everything as honestly and accurately as possible. If you fudge the numbers or make false assumptions about your timeline and costs, then the profits you expect won’t be there when you go to rent or sell.

If you utilize this financial tool as you search for real estate deals, then you should be able to decide if you should walk away and find a different property. Or if you should stick with it and walk away with the kind of money you were looking to make.

Are you ready to try the Quick Deal Analyzer? Great! It’s here to download at any time. We also have other real estate investment tools you can download, like our Loan Optimizer. Because our main goal is to help you succeed and start living the life you’ve always wanted.

If you need help with the analyzer, or would like to run through your numbers with our team of experts, then reach out to us. We’re always happy to help!

Happy investing.