Stop Confusing These Loans! Fix and Flip vs Hard Money Explained

Stop confusing these loans! Fix and flip vs hard money explained! Are you a real estate investor wondering which loan to use? Maybe you’ve heard of fix and flip loans and hard money loans, but you’re not quite sure which one is right for your next deal.

Let’s break it down. These two loans may seem similar, but they are not the same. Understanding the difference can save you time, stress, and thousands of dollars.

What Is a Fix and Flip Loan?

A fix and flip loan comes from big lending companies—usually backed by Wall Street money. These lenders include names like Kiavi, RCN, and Lima One.

They work well if:

-

You have good credit (typically 680+)

-

You have money for down payments and reserves

-

You’re buying a standard single-family home

-

Your deal fits in their box

Here’s What “Their Box” Means:

Fix and flip lenders want:

-

Properties in clean neighborhoods

-

Homes that sell between $250K and $350K

-

Borrowers with 3–5 flips already under their belt

-

A simple exit strategy like resale or refinance

Example:

You find a house worth $100,000 that will be worth $200,000 after repairs.

The lender might offer:

-

90% of the purchase = $90,000

-

100% of rehab = $40,000

But—you’ll need to bring the 10% down, plus have extra money set aside for reserves, closing costs, and interest payments.

What Is a Hard Money Loan?

Hard money loans are different. They come from real people or small private lenders. These lenders focus more on the deal than on your credit or experience.

They work great if:

-

Your credit score is lower

-

Your deal is outside the box

-

You don’t have a lot of cash to put in

-

You need flexibility

Hard money lenders look at:

-

Loan-to-value

-

Market strength

-

Exit strategy

-

Your ability to finish the project

Example:

You find a house worth $200,000 after repairs.

You can buy it for $80,000 and fix it up for $20,000.

That’s only 50% of the ARV (After Repair Value).

With a deal this strong, a hard money lender might fund:

-

100% of the purchase

-

100% of the rehab

-

Even your closing costs

You walk in with $0 out of pocket because the deal makes sense.

Fix and Flip Lenders vs Hard Money Lenders

Let’s compare side by side:

| Feature | Fix and Flip Loans | Hard Money Loans |

|---|---|---|

| Credit Score Needed | 680+ | Not score-driven |

| Property Type | Standard, 1–4 unit | Unique, land, large, or small deals |

| Experience Required | 3–5 previous flips | Helpful, but not required |

| Cash Needed Upfront | Down payment + reserves | May offer 100% if the deal is strong |

| Speed and Paperwork | Slower, more docs | Faster, less paperwork |

| Who It’s Best For | Cookie-cutter flips | Unique or off-market opportunities |

So, Which Loan Should You Use?

It depends.

➡️ Use a fix and flip loan if your deal is clean, simple, and in a popular area. You’ll likely get a lower rate and lower points—but you must fit their box.

➡️ Use a hard money loan if your deal is messy, different, or small-town. You’ll pay a little more, but the lender will work with you. They care more about the property and less about perfect credit or experience.

Bonus: The Best Loan for BRRRR Investors

If you’re using the BRRRR strategy (Buy, Rehab, Rent, Refinance, Repeat), hard money can be a great fit. Why?

Because hard money lenders can fund 100% of the deal if the numbers work and you’re already pre-approved for your refinance loan.

Final Thoughts

Both types of loans can be powerful tools. The key is knowing:

-

What your deal looks like

-

How much cash you have

-

What kind of lender will work with you

👉 Fix and flip loans give you great terms if you fit the mold.

👉 Hard money loans give you flexibility when life—and deals—don’t fit the mold.

Need Help Finding the Right Fit?

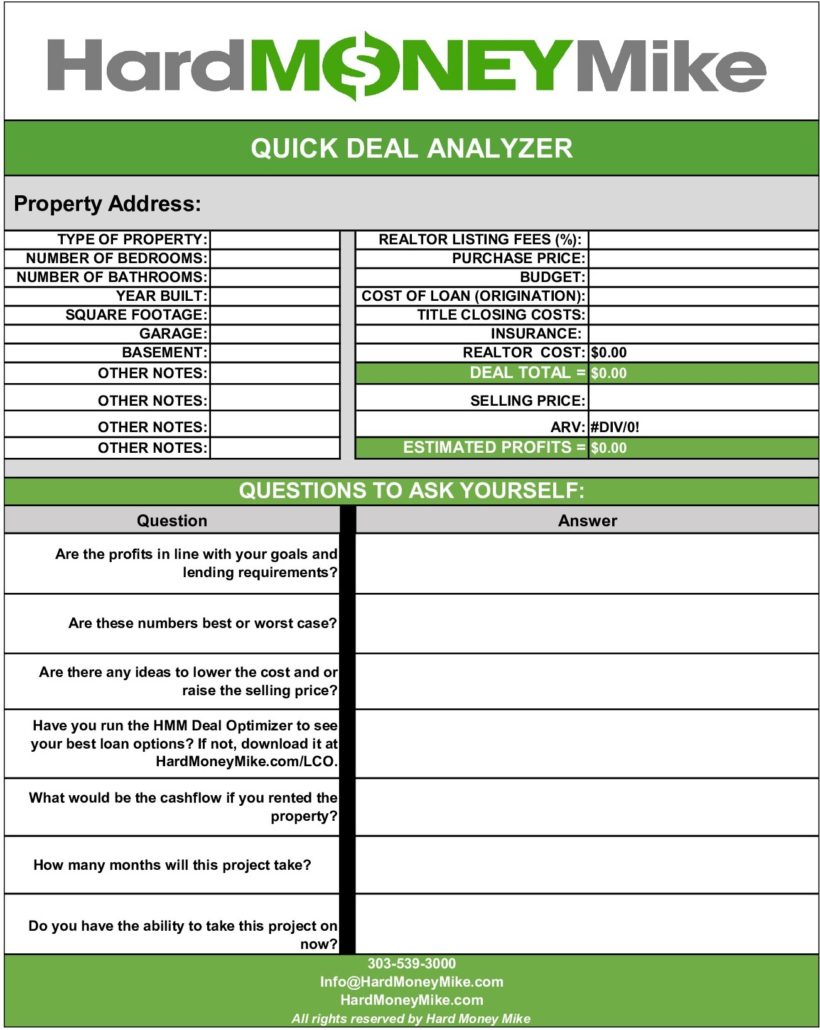

At Hard Money Mike, we work with both kinds of lenders. And we have free tools like:

-

✅ Cash Flow Worksheet

-

✅ Quick Deal Analyzer

These tools help you know if a deal is worth doing before you borrow a single dollar.

👉 Download them now and take the guesswork out of your next investment.

Stop confusing these loans! Fix and flip vs hard money explained! Watch our most recent video to find out more!