Cash Flow vs Profits

The Difference Between Cash Flow and Profits

Did you know there’s a difference between cash flow and profits? Actually, there’s a significant difference.

Cash flow is the money flowing in and out of your bank account every month to fuel a project from start to finish. The trick is to match incoming money to outgoing money. If cash flow is negative, you’ll spend more time juggling who gets paid and how instead of focusing on finishing and selling the project.

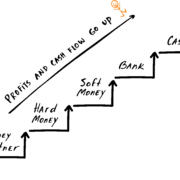

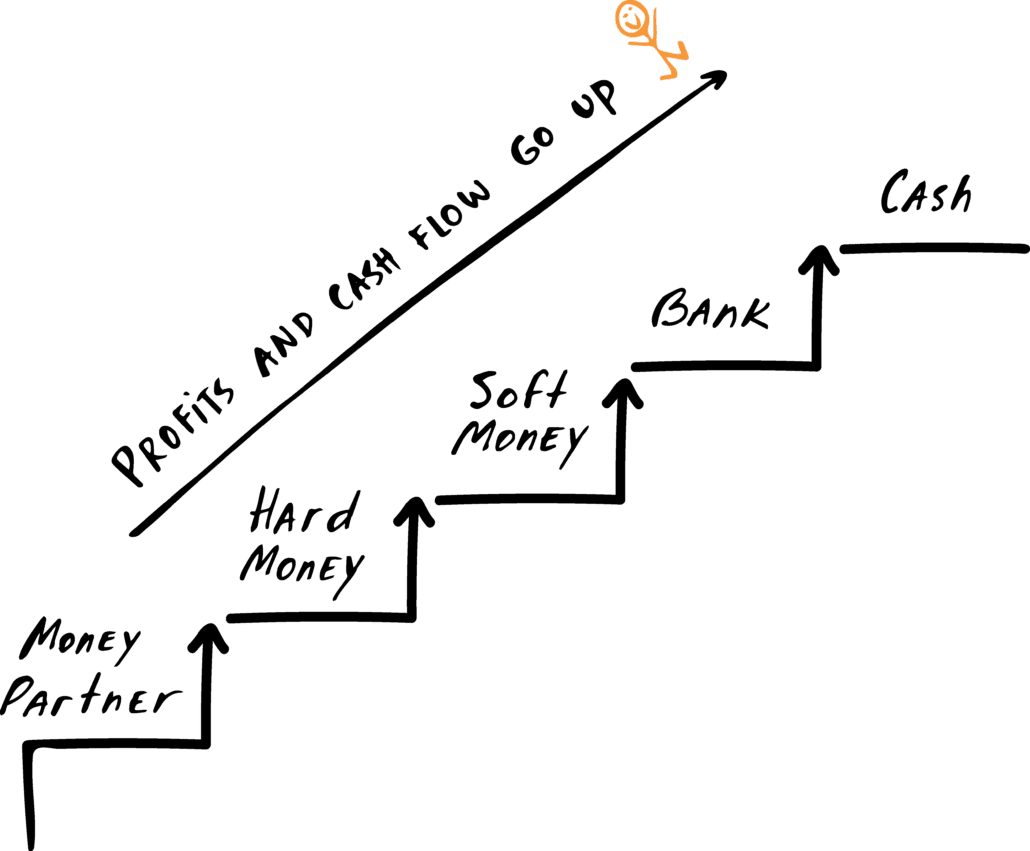

Profits are what you make after everything is paid. Basically, they’re the BIG payday at the end of a project. Profits replenish the pool of money you get to play with, apply toward your next project, and use to lower costs on your next deal. They can also help your cash flow by showing lenders you’re worthy of better products and rates. In their eyes, you’re successful and able to repay them.

Ready to boost your cash flow AND profits? Then contact us!