Motivational Monday: Invest Today

Motivational Monday: Invest Today

Yes, another Monday is upon us, and you know what that means, right? Yep, time for a dose of motivation.

We think Mondays are the best days to kickstart goals. That includes all goals related to real estate investing. Because if you don’t start investing today, then you’ll wake up tomorrow and think, “Why didn’t I take the plunge yesterday?”

Look, we know how difficult it can be to begin something new…or something you haven’t done in a while.

Whether it’s quitting a bad habit, shedding a few pounds, or tackling new responsibilities, we completely understand how much effort it takes to make a change. We know how tough it is to get up on Monday morning and say, “I’m going to do THIS today.” Especially if “this” is telling yourself you’re going to invest today.

But we know you can do it.

Because we have to do it, too. We’re human just like you and everyone else. Therefore, we must challenge ourselves to find ways to improve and reach for the stars (yes, that sounds cheesy, but it’s the truth).

If we don’t look Monday (and every day) in the face and choose to better our lives, then our lives won’t change. And that’s never good, because when we remain stagnant too long we miss out on countless opportunities. The amazing, life-changing kind of opportunities that–although scary upfront–turn out to be the best thing that ever happened to us.

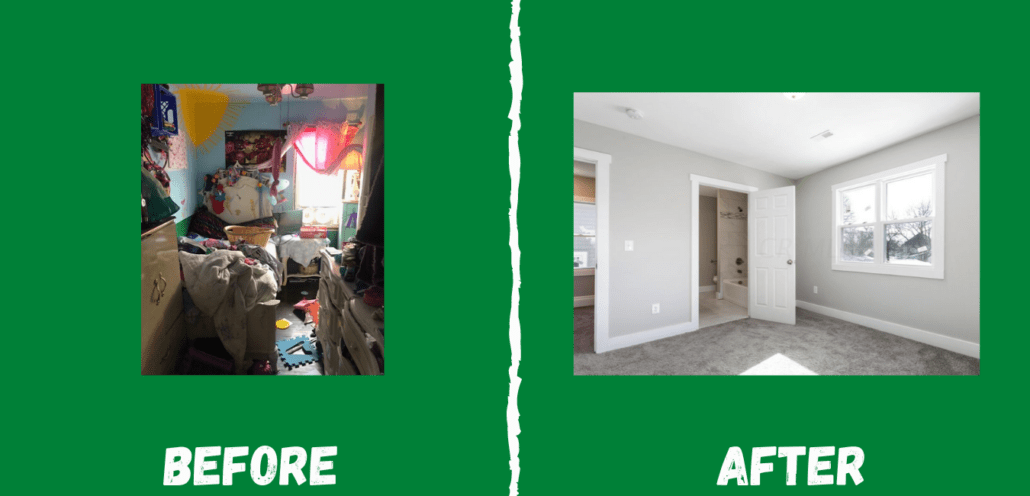

So, if you’re reading this and you’re debating taking the leap into real estate investing, then GO FOR IT! Truly. It might seem daunting and overwhelming right now, but if you don’t let yourself take risks, then you’ll never get a chance to reap the rewards.

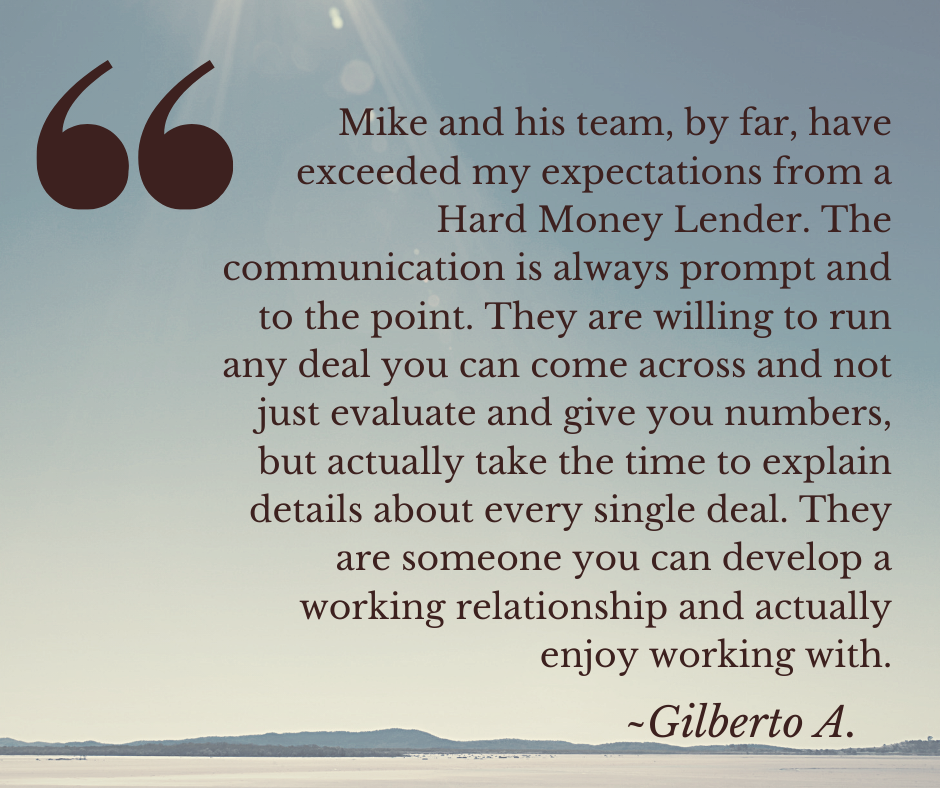

And, remember, you can always start small. In fact, we’ve just started a new Money Chat where you can join like-minded investors to learn more about investing in fix and flips, rentals, and other value-add properties.

Our entire team believes in you. And we would love to show you how you can start investing today so you won’t regret it tomorrow.

Happy Monday and happy investing!