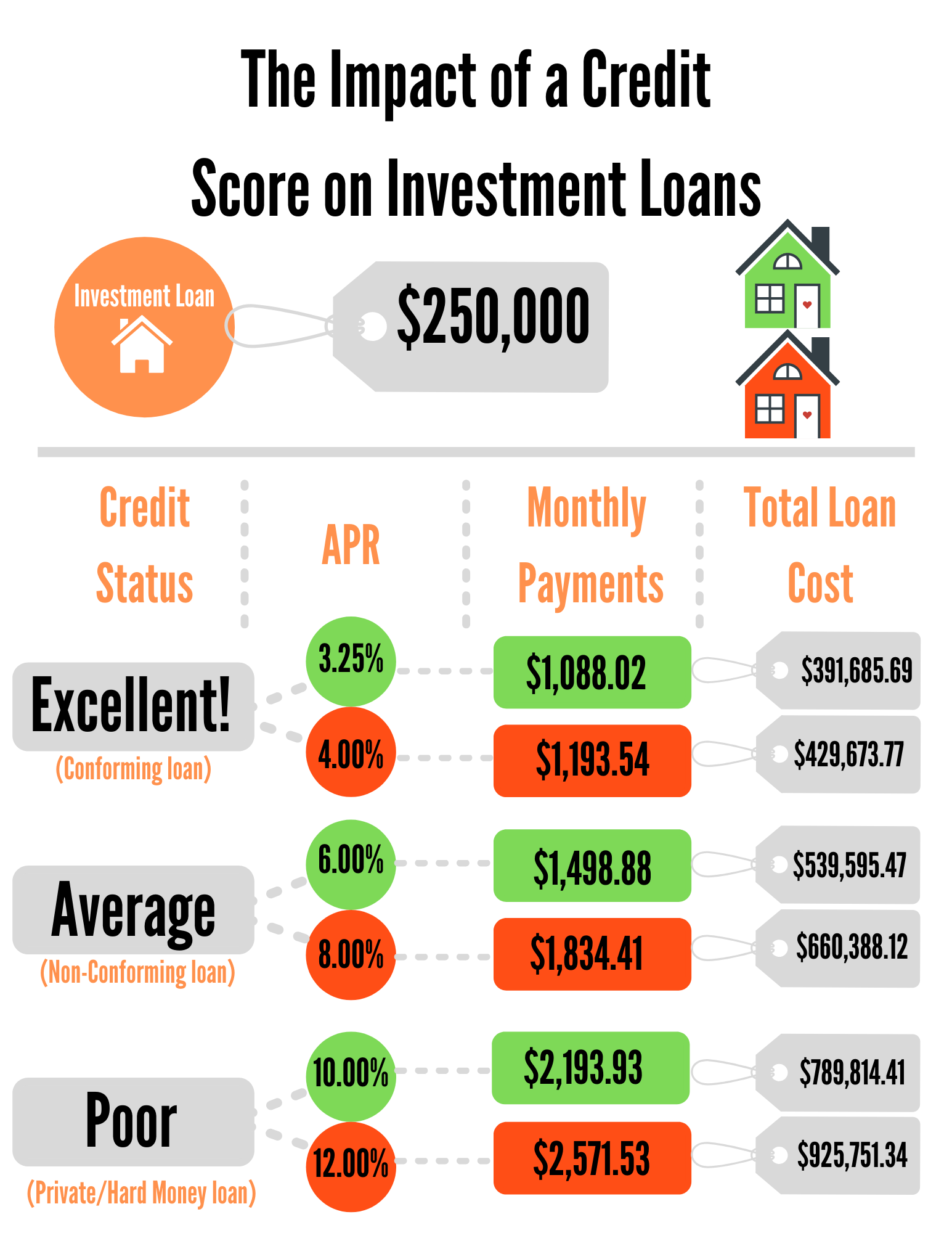

What is your credit score costing you?

/in Finance Tools, Resources, Tips, UncategorizedHow much money might a lackluster credit score be costing you over the life of your investment business?

You probably hear a lot of talk in the mortgage industry about your credit score and the effect it can have on your interest rates, but do you really have an idea of how much it’s affecting your bottom dollar?

Do you know how to determine your Return on Credit (ROC)?

Can you crunch the numbers to figure out how much your score is helping your cash-flow? How about how much money it’s sucking out every month?)

These calculations can get complicated, but the takeaway here is that a less-than-stellar score can really be costing your tens of thousands of dollars over the lifetime of your loan. And when your loan is on investment property, (or several,) you may as well be lighting your profits on fire.

We want to help! Contact our team so we can help you see where you’re currently at, and where you could be going instead.

Let’s get you to your goals faster by trimming some of the fat from your financing!

Hard Money Mike is a lender based in Colorado offering services in several states. We lend money for all varieties of commercial-based properties. So whether you’re trying to finance a fix-and-flip, vacant land, whole-tailing, or looking for a builder bridge loan, we’ve got you covered.

Call Mike Bonn at: 303-539-3000 or email Mike@HardMoneyMike.com

Investors and S Corp Info.

/in Tipshttps://www.biggerpockets.com/blog/s-corp-election-active-income

Investing Rules You Must Know

/in TipsEvery investor should know 3 rules of thumb:

The 2%, 50%, and 70% Rules.

If you don’t know what these are, check out this video from Bigger Pockets.

Ready to talk about your deals and how you can fund them with our 2-Step Loan Process? Then contact us today!

Buying a Duplex – What NOT To Do

/in TipsWhether you’re getting ready to invest in your first rental units, or you’ve been renting for years, it’s always a good idea to learn from other people’s mistakes. In this video, Chandler David Smith tells us about the lessons he’s learned and what NOT to do as an investor. Check it out!

Ready to start investing? Need some guidance? Then contact our team. We’re ready to show you how to invest and invest right!

Real estate investors may need to test every property for meth.

/in TipsReal estate investors may need to test every property for meth.

There may be a need now to test every home before you purchase it for meth…or end up with a huge bill or lawsuit. Most self tests cost around $30 to check if meth was used in a home, a lot cheaper than remediation or a lawyer.

We will see where this flipper (the seller) ends up and what it will cost them.

Here is the story from CBS Denver:

Littleton Family Unknowingly Buys House Contaminated With Meth, Home Is Condemned 3 Weeks After Closing