How to Get That Property Done: The “Finish a Project” Loan

4 “finish a project” loan case studies.

One of our most popular loans is what we call a “finish a project” loan.

We call it that because… That’s exactly what it does! We want to help you finish your real estate project no matter what comes up.

Local hard money lenders like us are different than private money or banks. We finance things no one else will.

Let’s go over a couple examples of how this loan has worked with our past clients to see if it’ll fit with your current project.

Finish a New Construction Project

Once a new build is started, banks don’t like to give out more loans partway through. This is the situation our client James found himself in.

He was building a house for himself. After he bought the property and got started, he became boxed in and ran out of money. He told the bank, “I have a property on five acres. It’s going to be worth $800,000. I only need $250,000 to finish it.”

But none of the banks would lend to him, for several reasons:

- The project had already begun. Banks never like funding a project that’s already started.

- His income didn’t meet their requirements. The property itself didn’t matter to the bank because James’s income was lower than they were willing to lend to.

So, James came to us instead. The project was only stalled because of money. He needed the $250k to finish the project in 5 to 6 months so he could get his family out of the trailer they were staying in on the property in the meantime.

Here’s what we did: we gave him the money out in escrows, or draws. He got $70k from us up front, then another $70k later, then another $80k, and so on.

We didn’t need to pull his credit score, scrutinize his income, and make sure he checks every box. We just needed the property to CO.

Finish a Bootstrapped Project

When any sort of flip is sitting stale for too long, sometimes the owner needs extra outside money to get things moving along so the property will start generating income.

Our client CW was a realtor who was finishing a project by turning a traditional rental into a short-term one. He had been bootstrapping the project (aka, funding it from his own resources).

His funds were slowing down with the change in the market, and Airbnb season was quickly approaching for the area. He needed a last $50k to finish the project.

So, he came to us, and here’s how it worked for him:

- He kept his mortgage on the property.

- We gave him $50,000 in a second-lien position on the same property.

He was able to get the house finished up and fully booked out for 6 months – generating plenty of income to pay off his loan with us.

Finish a Project That Goes Over Budget

With certain types of loans, banks can halt part of the funding if the project goes over budget. Here’s how it played out for our client John.

He had a construction loan with a bank. It was a great deal: they gave him all the money to build the property, then in the end it converts into a permanent loan at 3%.

However, he went over budget… so the bank stalled it. He needed $60k to get the project back on track and keep that 3% loan.

Here’s how John did it:

- We gave him $60k.

- He finished the project.

- He could lock in the 3% bank loan for a 5-year term.

- He took out a HELOC and paid off his loan with us.

Finish a Flip!

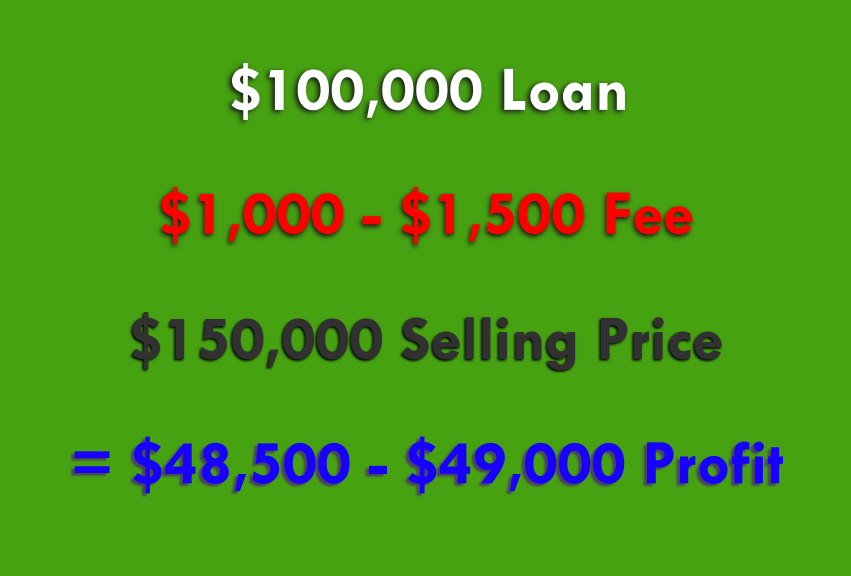

This fourth “finish a project” loan is our most common: working with fix-and-flippers.

Our client, PS, had a flip. Or rather, he had too many flips going at once. This one had been sitting for over 6 months, and he just needed $25,000 to finish up the rehab.

For those 6 months, this property was eating up funds. He was making mortgage payments, hard money interest payments, taxes, utilities, and everything with zero inflowing cash.

He had another hard money loan on the property, so we were able to come up behind him and get him the $25k.

Within 3 weeks, the project was complete and put on the market. Four weeks later, it sold, and he paid both loans off.

Why We Do These Loans

Big lenders won’t do deals like this for you. But as long as we’re in a safe lien position, we love being able to help you with these project finishes.

A couple of tens of thousands of dollars right when you need it can save you years of financial recovery.

Do you need a “finish a project” loan? Feel free to reach out at Info@HardMoneyMike.com. We’d love to see if we can help.

Happy Investing.