How to Make Money with Your Credit Score

How to Make Money with Your Credit Score

Today, let’s chat about how to make money with your credit score.

Your credit score is kind of like a baseball game. With it, you can knock it out of the park and enjoy great success with your finances. Or you can strike out, and–well–lose (ouch).

When you “win” the credit score game, you win countless opportunities. These include:

- The best interest rates

- Affordable loans

- And, in the end, hundreds of thousands of dollars.

Yes, you read that last one right. Hundreds of thousands of dollars. Because a good credit score means cheaper rates. Which means cheaper bills. Which means you save A LOT of money over the years.

Before we go on, let’s talk about what a “winning credit score” look like.

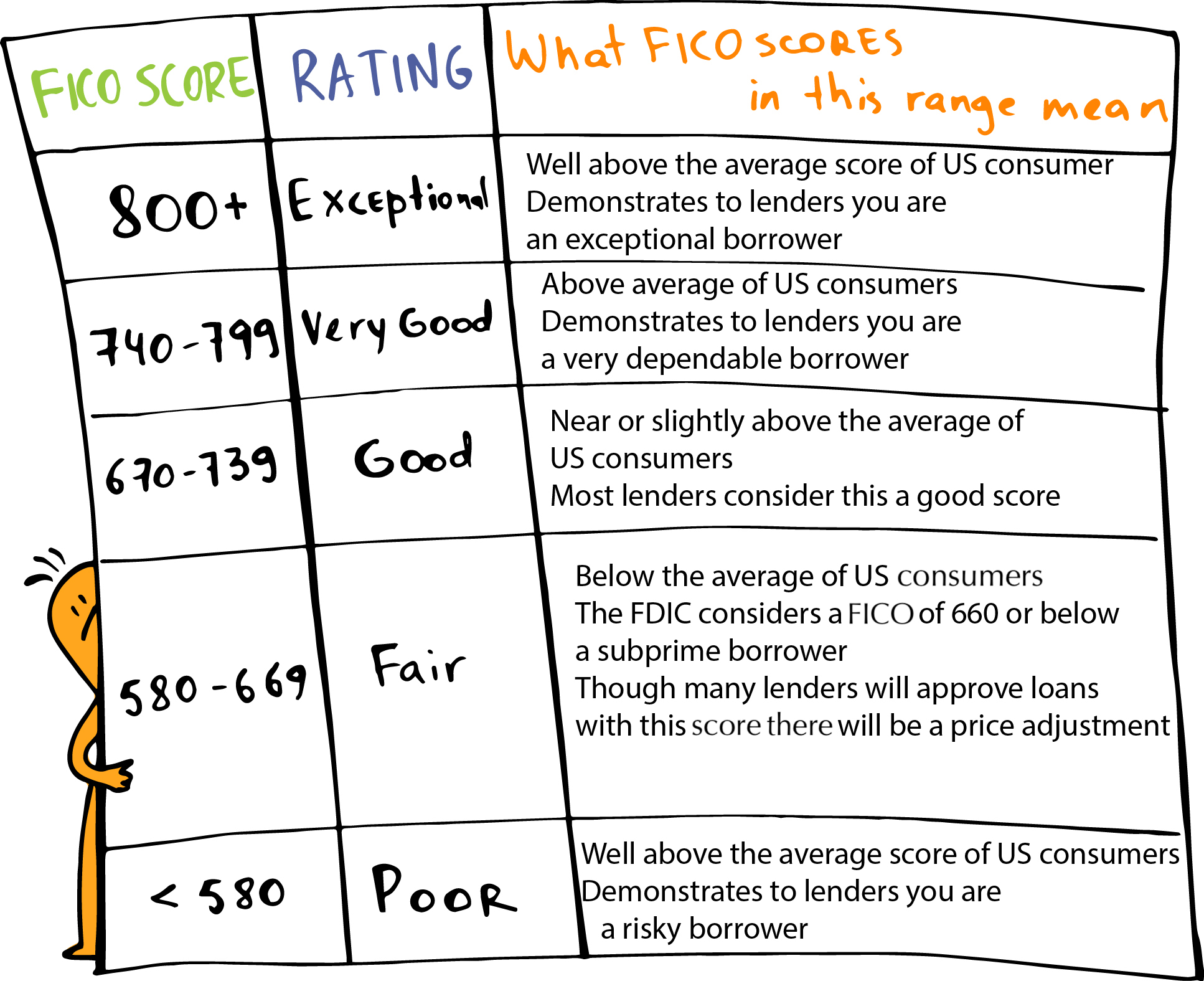

Most lenders like to see scores in the 700’s or higher. Anything lower will likely lead to rejections and expensive rates.

But what if you have a score under 700? Nobody wants to walk up to the plate and strike out, right?

Well, let’s take a look at 3 strategies to help you prepare for this financial ballgame.

Increase Your Available Credit

Pick up the phone and call your credit card company so you can apply for a higher limit. Why? Because then it’ll be easier to keep your credit usage at or below 30%.

What do we mean by that? Well, let’s take a look.

If your credit card balance is $8,000 and you have a maximum credit line of $10,000, then creditors can see you’re using 80% of your available funds. Yikes! In their critical eyes, this means you’re a risk–a BIG one–and you might not be able to meet your financial obligations (i.e. you won’t be able to pay them back).

Not good.

Now, if your credit card balance is $3,000 and you have a maximum credit line of $10,000, then creditors see you’re only using 30% of your available funds. That’s much, much better. In fact, it could be a home run in the eyes of lenders.

Because when you manage your credit usage, creditors will think you’re financially responsible. AKA, you pay your bills. And that will lead to more loan approvals and lower rates.

Yay!

Pay Extra

A large chunk of your credit score revolves around your monthly reported balances to the credit bureaus.

So, it always helps to pay extra on your credit cards before your next statement. If you do this, the credit bureaus will be happy with you. Very happy! That means your score will rise.

Now, if those first two strategies don’t work for you, then you can always take a more creative third approach (one we’ve recommended to many clients).

Get a 60 to 90 Day Note

Basically, you can get a loan to pay down or pay off your credit cards. You can get one from a bank, a family member, a friend, or a private lender. This way you can keep your real estate projects moving along and your cash flow, well, flowing.

Make Money with Your Credit Score

If you take one, two, or all three of these steps to boosting your credit score, then you’ll have a much better chance of getting lower rates and generating thousands of dollars over time.

And if you play the game right, you can knock it out of the park and make hundreds of thousands of dollars!

Happy investing!