How to Invest in Value-Add Properties: Do It Right From the Start

How to Invest in Value-Add Properties: Do It Right From the Start

Do you know how to invest in value-add properties so it’s done the right way from the start?

Like, how do you know it’ll be a good investment that generates positive cash flow?

Well, today, we’re going to break down some basic terms and offer some key tips to help you decide if a real estate property will generate cash flow…or break the bank.

How to buy value-add properties

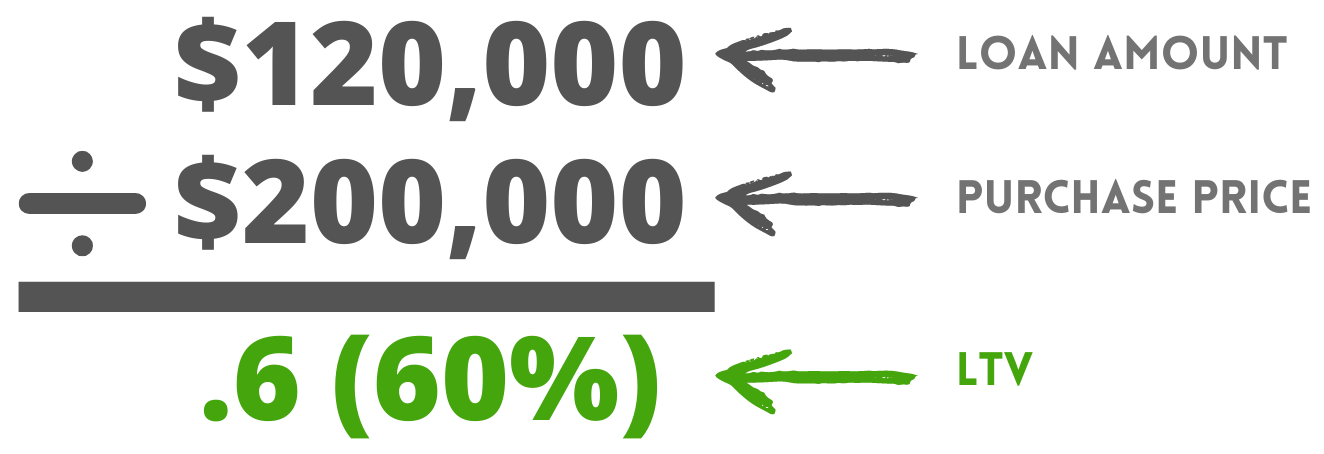

One of the most important terms you need to understand before you begin investing in value-add properties is Loan to Value (LTV).

The LTV is the amount of the loan divided by the purchase price (or appraised value) of the property.

Let’s take a look at an example.

You’re looking at a house with a purchase price of $200,000.00, and you need a loan for $120,000. So that means the LTV equals 60%.

When you’re trying to figure out the amount of your loan, remember to factor in your rehab costs. You’ll need money to fix the property so you can flip or rent it.

Your rehab costs could make or break your deal’s cash flow, so it’s important you take the time to collect accurate numbers and calculate them correctly. The best way to determined your rehab costs is to get a written estimate from a trustworthy contractor or inspector.

Believe us, it pays to get a professional opinion.

The ARV

It’s important to get an accurate renovation budget for your value-add properties because lenders will look at it and compare it to the after repair value (ARV).

Lenders need to make sure the cost of fixing the property doesn’t outweigh the value after it’s repaired.

Let’s take a look at another example.

So, you find a property for $100,000. Your contractor tells you it’ll cost $20,000 to renovate. Now you’re looking at $120,000 for purchase and rehab.

The lender you want to use requires at least 10% down.

Next, you need to look at comparable properties in the neighborhood. These comps must have the same number of bedrooms and bathrooms, and be sized within 50 square feet of your property.

With the help of a realtor, you find out the comps come in around $200,000.

So, now you know your property will be worth $200,000 once you renovate it.

This is your ARV.

Is it worth the risk?

So, how do you know if a property is worth the risk? Well, let’s do the math.

So then we can take that number and calculate your risk:

The basic rule of thumb is to stay under 65%, because it gives you wiggle room for unexpected expenses. If this percentage is higher than 65%, then you should consult with your lender. They might be okay taking a higher risk due to other factors.

But, in general, it’s all about how much risk is involved. The higher the risk, the more money you’ll need to front for your value-add properties.

Do your due diligence

It’s important to do your homework. So, make sure to check values over the last few years in the area you’re looking to purchase. Consider the neighborhood, city, and state.

Here are a few questions to ask:

- Are the properties holding their value?

- Have prices reflected a steady increase or decline?

- Did you check for pros and cons? Like busy streets, crime rates, schools, and nearby shopping? Remember, you’re looking for a short-term or long-term investment here. Whether you’re planning to fix and flip or rent, you want the highest dollar value for your deal.

And don’t forget to ask a title company to check for liens, easements, or exceptions against the property.

Inspection time!

You should also ask a trusted contractor or inspector to check the property for the following:

- Mold and or drug residue

- Asbestos, especially in homes built in the 1930’s-1950’s. This harmful building material was officially banned in 1977, but it’s still worth confirming it wasn’t used in your property.

- Lead paint. Beware of homes built before 1978.

- Leaky faucets/poor plumbing. Make sure it’s up to code!

- Electrical issues. Check for broken outlets, and, again, make sure it’s up to code.

- Roof age/leaks

- HVAC issues

- Broken appliances. These include the garbage disposal, garage door, doorbell, sprinklers, and kitchen appliances.

- Sticky/creaky doors or windows. Take a moment to open and close them to make sure they work.

- Signs of pests. Search for dead bugs, droppings, sagging floors, and small holes in wall or baseboards.

- Foundation! Look for cracks above doors and large gaps or cracks where walls meet. One trick is to take a ball and set it on the floors and in hallways. The ball should stay in same place. If it doesn’t, have the foundation checked. And, when in doubt, always have a professional take a peek.

- Fencing/landscaping

- Warranties and repair information that can transfer from seller to buyer.

How to find a good contractor

You’ll want to work with someone with a great reputation and quality work. So, it’s important to do your research before choosing your contractor.

Here are some tips for finding the right contractor for you:

- Ask friends and other investors for referrals. Be sure to ask them if they were happy with their work, reliability, communication, experience, and quality.

- Interview several contractors until you find the right one for you. Some good questions to ask during this interview include:

- How many employees do you have and how long have you been in business?

- Do you have a referral list with current and past customers (and their phone numbers)?

- Are you insured? Ask for copy of their policy binder page showing their name and coverage. They should have General Liability and Worker’s Comp.

- Who will be doing the work? Will there be any sub-contracting or will you and/or your team being doing the work?

- Has your company ever been sued or had a lawsuit against it?

- Have you ever sued a client or filed lien against a property?

- Have you ever declared bankruptcy or had a company under a different name?

- If the project falls behind schedule, what happens?

- Has your company ever had a serious accident/hospitalization on the job?

- Who will be at my house and when? Ask if background checks have been completed, and if there’s a set schedule.

- May I have a written contract? You’ll want your attorney to review it before signing. Make sure the contract spells out timeframes, as well as how and when the contractor gets paid.

Red flags and precautions

Before you get started, take some of these important precautions to heart.

- Do not EVER give your contractor large sums of money upfront, especially if you’ve never worked with them before.

- If your contractor asks or demands 25%-50% upfront, then find someone else. Because a good contractor will have reserves to get the job started on 20% or less down. And they’ll have pre-set dates for payments and money for materials.

- GET EVERYTHING IN WRITING! Because it’s your only resource if you need it later.

- Never assume anything.

A professional contractor should have enough reserves to cover minor expenses to get the job started, except for materials. As for those, you should order everything and have it delivered to your property.

If the contractor has a problem with this, take it as a red flag. Find another contractor or tell your current one to purchase the materials themselves (pre-approved by you, of course). You can always compensate them when the job’s done.

These are just samples of questions to start with.

We suggest making a list of all the questions you wish to ask ahead of time. That way you won’t forget anything during the conversation.

At the end of the day, it’s all about having a contractor that will respect you and your property. They should:

- Be trustworthy and treat you fairly

- Complete the job on time

- Meet your budget

- Provide quality work

This might seem like a lot of work to do before the real work begins, but trust us, it’s worth it! If you take the time to find the right property, the right lender, and the right contractor, then your flip or rental project will be a lot easier.

Need help evaluating your next value-add property? Our team is always here to help!

Happy investing.