The Must-Know Basics About Your Credit Score

What a credit score is and why you should care (if you care about your investments).

There’s a magical triple-digit number that seems to decide your fate in this world.

It can determine what car you drive, where you live, and how much money you can have at your disposal.

And in some cases, it can make or break your success as a real estate investor.

It’s your credit score.

But it’s not as magical as it seems. There’s a logic to your score, and you have the power to change it.

So let’s break it down.

What is a Credit Score?

A credit score is a way for lenders to determine your “creditworthiness.” In other words, your “you-can-trust-me-to-pay-back-your-money”-ness.

Because you know whether someone can trust you with their money. But financial institutions don’t know you like you do.

Lenders need a way to decide if you’re safe to lend to. So your score tells them the story of your financial habits.

How Is My Credit Score Calculated?

There are a couple different types of credit scores, but the numbers we’ll use here reflect FICO scores (the most widely used credit score for most lenders).

Credit scores range between 0 and 850. More than 740 is great, and a score of less than 700 begins to limit your options.

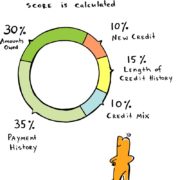

This number is calculated by looking at five main pieces of information:

- Credit mix

- New Credit

- Credit History

- Payment history

- Amounts owed

Credit Mix

Close to 10% of your score is based on the mix of credit you already have.

Do you have seven credit cards?

Or zero?

Do you have a car payment, a mortgage, student loans, personal loans?

Typically, the more diverse your lines of credit are, the better it is for your score.

New Credit

Around 10% is based on “new credit,” or how often you get credit inquiries or open a new line of credit.

New credit can temporarily lower your score. So for example, if you buy a new car, you’ll probably have trouble securing a loan for a property right away.

Length of Credit History

About 15% of your score is calculated based on how long you’ve had your lines of credit.

If you opened your first line of credit less than 5 years ago, you’ll have a lower score than someone whose credit is 40 years old.

Amounts Owed

These last two categories are the most important. They make up two-thirds of your credit score.

About 30% of your score is determined by something called amounts owed. Amounts owed is about your debt. More specifically, it’s about how much of your available credit you’re using.

For example, let’s say your credit card has a max of $1,000. You buy a new set of tires and brakes, so now you owe $1,000 on your card. You’re using 100% of your $1,000 limit – you’re maxed out.

The story creditors see when they look at you is that you’re not managing your credit well. They’ll assume you won’t manage other loans well either, so you get a lower score.

But let’s look at another situation.

Say you got a different credit card with a max of $5,000. That same borrowed $1,000 has a way different effect on your credit score. You’re only using 20% of your credit line, and you’re leaving 80% at your disposal. Creditors like that story. So you get a higher score.

Payment History

The biggest amount of your score, up to 35%, is based on your payment history.

Payment history is exactly what it sounds like:

- How are you paying your bills?

- Do you always pay on time?

- Have you had any bankruptcies?

Financial institutions can see this information, and it’s the top factor they consider. At the end of the day, lenders want to know: Will you pay them back? On time?

Need More Information?

Your score is incredibly important to keep on your radar. Especially when you’re investing in real estate.

It’s not a made up number that has no effect on your life. But it’s also not as difficult to understand as it may seem at first.

For more tips on building good credit and maximizing real estate investment leverage, check out these helpful videos on our Youtube Channel.

You can also download our Credit Score Checklist at this link.

Happy investing.