How to Raise Your Credit Score with Hard Money

If you’re struggling with knowing how to raise your credit score, it might be time to check out a hard money usage loan.

Real estate investing is all about creative wealth using available leverage (other people’s money in the form of bank loans, hard money, etc.) to make a profit. It’s an accessible and lucrative field for first-time investors.

However, a bad credit score can change the game.

Especially if you’re looking for larger, traditional loans, a bad credit score can immediately disqualify you from consideration.

But there is good news! Hard money (sometimes called “private money”) can save the day.

The Cost of a Bad Score

A bad credit score (anything below 670 is often considered “poor”) can lower the quality of deals you find. If they do approve you for a loan, a bank will likely ask for an additional 10-20% down.

You might be stuck with higher rates on a DSCR loan.

At worst, you won’t be approved for a loan at all.

This is both frustrating and very expensive.

How do Credit Scores Work?

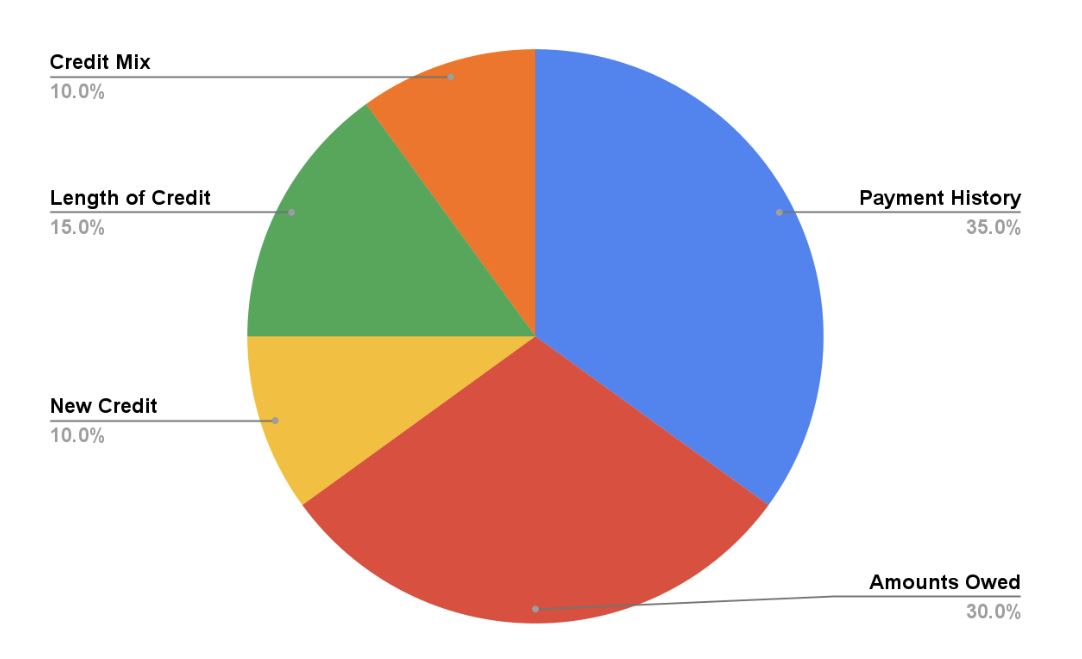

Your FICO score is essentially based off of 5 categories:

You’ll notice that the vast majority (over 2/3rds) of the score comes down to just 2 components:

- Payment History

- Amounts Owed (Usage)

If your score is low because of payment history, then there isn’t much we can do to fix that with a hard money loan. That’s a problem that takes time to resolve.

However, if your score is low because of the usage, hard money can provide a very quick fix that can raise your score in as little as 14 days.

What is Credit Usage?

Credit usage (that Amounts Owed section) measures the ratio of total money you could use with how much you do use.

Essentially, if you have a total available balance of $1,000 and you’re constantly maxing out that credit card, then you have 100% usage.

Credit card companies typically like to see usage around 30%. If you’re new to the investment game and you don’t have constant cash flow from current properties, it can be really tricky to have optimal credit usage.

How to Raise Your Credit Score Using Hard Money

You can use a hard money usage loan to pay off your credit card.

This lowers your usage percentage almost instantly which in turn boosts your credit score. Because hard money loans move quickly, you could see your credit score go up in only a few weeks—we’re only waiting for the next statement to be processed!

Once that credit score is back above 700, you shouldn’t have a problem getting your next necessary loan and getting a good deal.

You should also consider opening a 0% business credit card.

The Cash Flow Company encourages moving expenses to business credit cards. This protects those higher real estate investment expenses from reporting on your personal credit score.

Reach Out if You Need a Usage Loan!

At Hard Money Mike, we offer secure usage loans for investors looking to fix their credit scores.

Also, make sure to check out our free tools. Our loan calculators in particular can help you find the best loan options for your projects. It’s important to shop around as you invest and create wealth.

If you’re looking to raise your credit score fast, reach out to us at Mike@HardMoneyMike.com, and we’d be happy to discuss a deal.