What Is a Transactional Loan?

Many wholesalers need to use transactional funding. Here are the basics – what is a transactional loan?

There are many different types of hard money loans. One less talked about loan is transactional funding.

A transactional loan facilitates funding when someone, usually a wholesaler, is buying a property and selling it the same day.

Here are the basics of transactional funding – what a transactional loan is, when you should use it, and where you can get one.

What Is a Transactional Loan and When Should You Use It?

In the real estate world, transactional funding is a very short-term loan, lasting 1-2 days. Most people who use transactional loans are wholesalers. They have a property under contract, and they need to close on it and sell it to someone else on the same day.

Why Use a Transactional Loan?

Normally in a situation like this, the wholesaler would simply sell the contract. A transactional loan comes in when they can’t easily do that. There are 3 common instances when this might happen.

- The contract is not assignable.

- Financing for the end buyer does not allow the contract to be transferred.

- The wholesaler’s transactional fee is high, and they’d rather not show the end buyer their profit amount.

Example of Transactional Funding

Let’s break down a brief example of a situation that needs a transactional loan.

A wholesaler has a property under contract for $100,000. They have also sold it to someone else for $150,000. They don’t really want their buyer to see that they’re making $50,000. And the person buying might not be happy knowing the wholesaler is making such a steep profit.

The price of the transactional fee can matter to one or both of the parties involved. This is where a transactional loan comes in. Using a loan prevents the buyer from seeing the original price paid for the property.

At the end of the day, both parties ideally make a profit off the property, so the fee amount “shouldn’t” matter. However, everyone has different reactions to money, and using a loan is a safe way to keep the transaction smooth.

What Is a Transactional Loan’s Terminology?

There are a few important terms you’ll hear in the midst of a transaction like this.

The main point of a transactional loan is that it’s used in one day. A lender will fund and be paid back usually within a few hours. In that time, ownership transfers from the original seller to the wholesaler, then from the wholesaler to the end buyer.

With these two transactions happening almost simultaneously, the title company needs a simple way to keep everything straight.

So, they label the person who is originally selling the property the “A” person. The wholesaler is the “B” person. And the “C” person is the end buyer.

Using these labels, a transactional loan has two sides: AB and BC. The AB transaction is the first part, from owner to wholesaler. The BC side is the second half, from wholesaler to buyer.

What Is a Transactional Loan Closing Like?

There are a couple steps that happen on closing day with the typical use of a transactional loan.

First, the lender sends the typical closing documents and the wire on the same day. The lender lets the title company know they won’t fund the loan until the end buyer and their funding is verified. The lender will only approve funding once they’re certain the end buyer will actually complete the process.

A one-day closing requires all three parties to be present and prepared. The AB transaction happens first. Then, a few minutes later, the wholesaler completes the BC transaction with the end buyer.

After everything is signed and completed, the title company does their thing. They complete the paperwork, clear the wires, and send the money back to the transactional loan lender.

By the end of the day, the end buyer owns the property. Plus, the wholesaler made their profit without any potential conflict about the fee.

What Does a Transactional Loan Cost?

Transactional funding costs depend on your LTV, the length of the loan, and your lender.

There are some transactional loans that merge into bridge loan territory and take up to 30 to 60 days. But true transactional funding happens in one day (maximum two). The typical cost is about 1 to 1.5 points for a transactional loan.

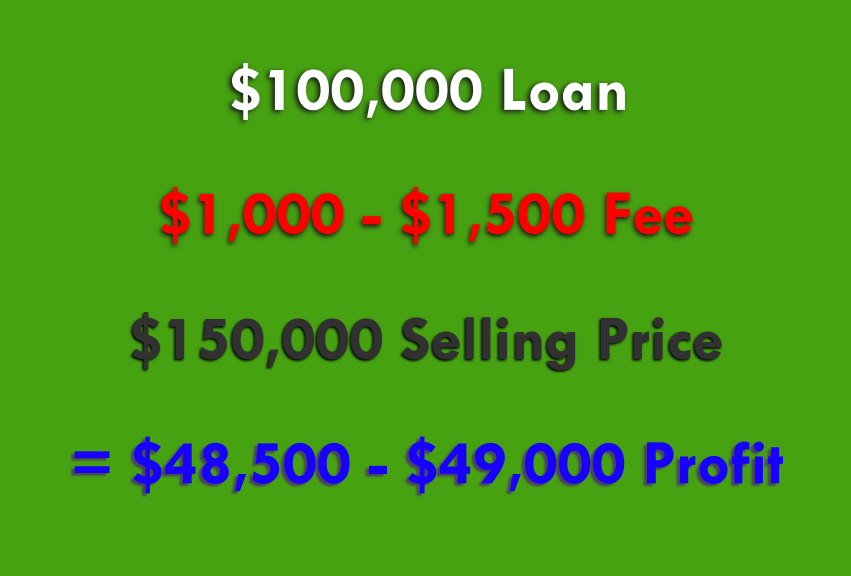

If a wholesaler needs a loan for $100,000, then the loan fee would be between $1,000 and $1,500. In the example we used earlier, this would allow the wholesaler to safely charge their $50,000 fee and get around $49,000 of profit.

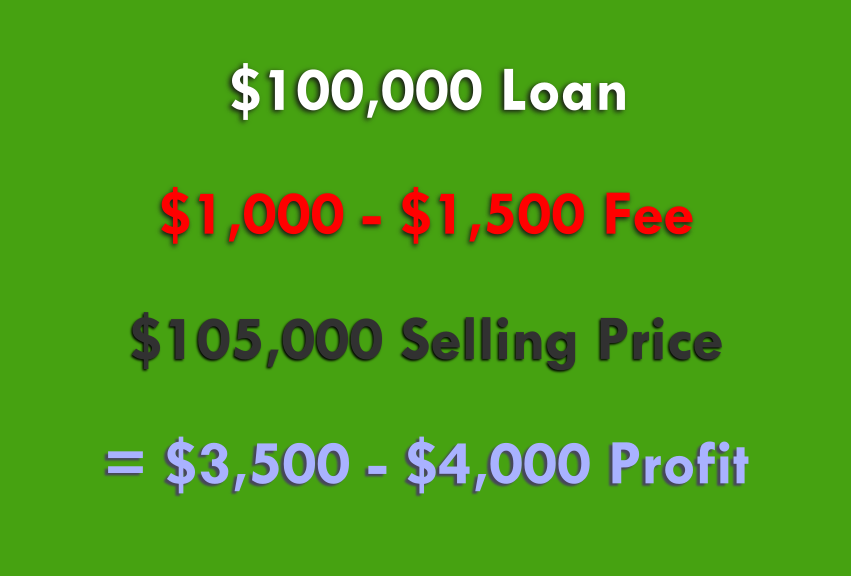

However, a transactional loan is much less helpful when the wholesaler fee is smaller. If they buy the house for $100,000 and sell for $105,000, then the fee would leave them with a total profit of $3,500 to $4,000. In that case, it’s more worthwhile to sell the contract rather than do a transactional loan.

Transactional deals are for:

- When the margins are good on a deal.

- When financing for the end buyer requires it.

- In a special case where a contract is non-assignable.

Who Does Transactional Funding?

You can get a transactional loan from a hard money lender.

Large lenders typically only loan 80-85% of the original purchase price. Smaller lenders, like Hard Money Mike, typically loan 100%.

We’ve been doing transactional loans for over 20 years. We expect to start doing even more as the economy changes.

If you have a deal, send us an email. We’re happy to look at it, price it out, and see if it’s something we can do. At the very least, we can help walk you through the process. Reach out to us at Info@HardMoneyMike.com.

Happy Investing.