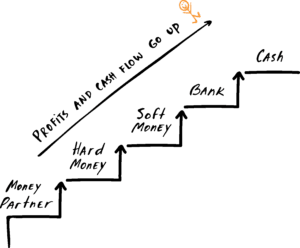

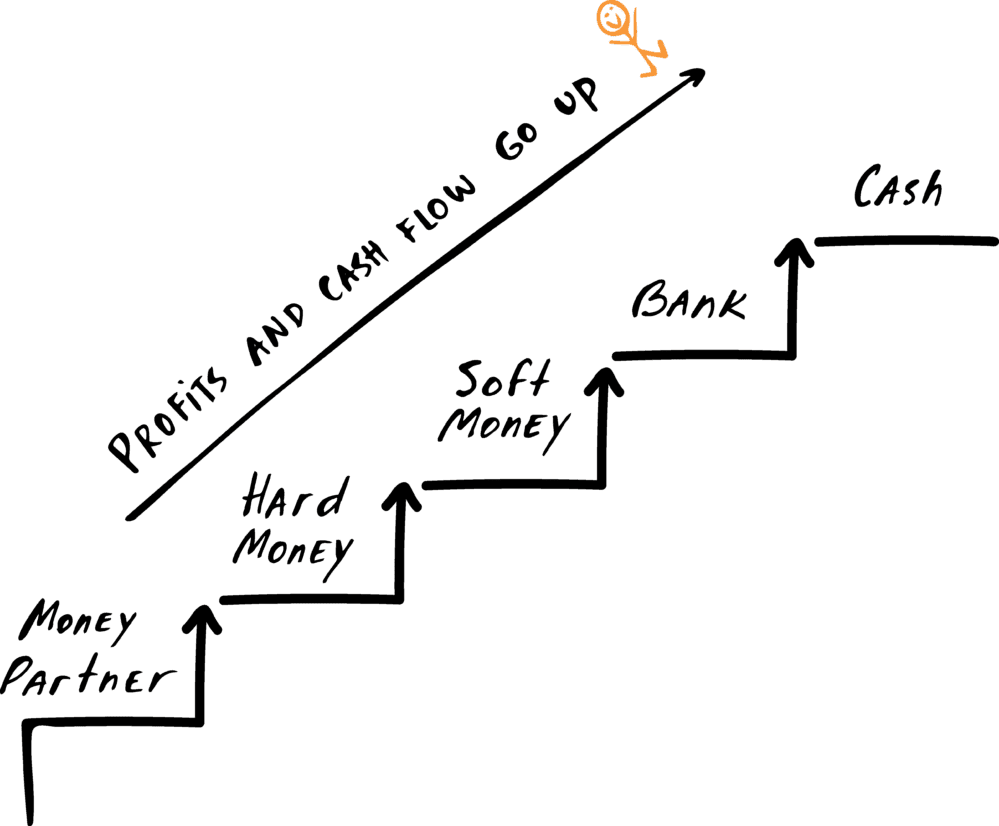

Fix and Flip Escalator – A Closer Look

Let’s continue with the example we used last week and examine the Fix and Flip Escalator a little closer.

As reminder, we used the following scenario to evaluate figures:

You need a loan for $250,000. That covers purchase price and repairs. After 6 months of hard work, you fix the property and sell it for $335,000 (nice job!). Once you take into account all of your holding, closing, and realtor costs, you should walk away with $50,000.

So, now let’s see what happens when you jump from a higher step (i.e. hard money), to a lower step:

When you move from hard money to soft money, you:

- Make $12,000 more in profits.

- Drop your monthly payment by $1,100—that’s more money in your pocket!

When you move from hard money to banking, you:

- Make $17,000 more in profits.

- Drop your monthly payment by $1,500—again, more money in your pocket.

Are you following along? We hope so, because it’s pretty cool to see how much you can make when you consider the actual math.

Yeah, yeah. We know.

Math.

But it’s worth running some small numbers to see BIG results, right? If you’re ready to tackle the numbers for your project, give us a call.

Leave a Reply

Want to join the discussion?Feel free to contribute!