How Lenders Use Your FICO Score

How Lenders Use Your FICO Score

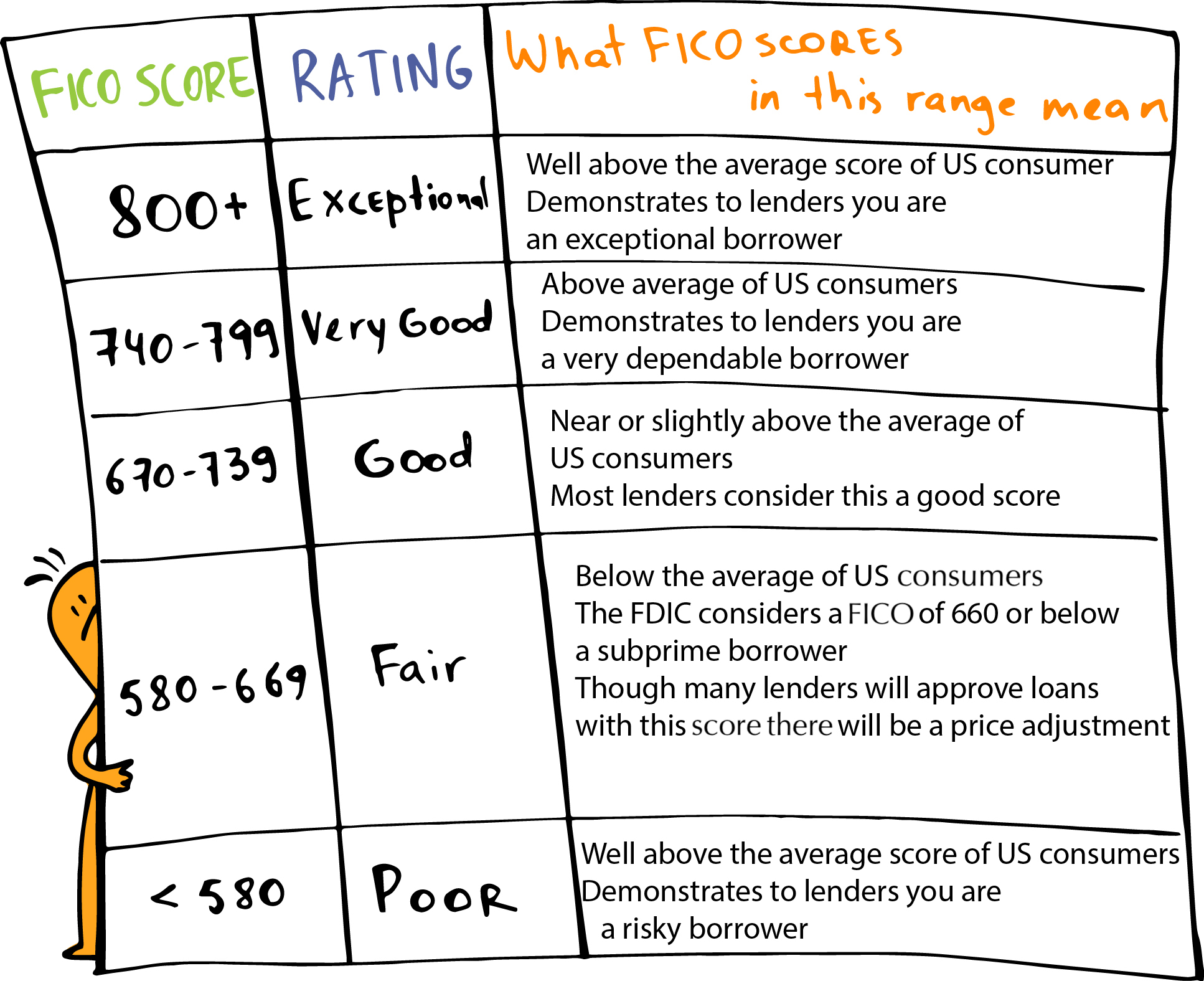

Do you know how lenders use your FICO score? Because it’s vital to whether or not you get approved for a loan.

If you understand credit score basics, then you’ll have a much better chance of hearing a “yes” rather than a “no” from a lender. You’ll also gain a much deeper understanding of how your score impacts your monthly payments.

You see, when you have a decent credit score (700+), then you can expect to see more loan approvals. Especially from traditional lenders, like banks.

Plus, a good credit score will lead to good rates. And that means cheaper bills.

For real estate investors, a good credit score can make all the difference between positive and negative cash flow. And over time, that kind of business model can run you…well, out of business.

If you’d like a quick overview of how credit scores work and how lenders use them, then check out this explanatory video from FICO.

In this video, you’ll get a simple and fast explanation of how credit scores work. Again, this is vital if you want to succeed with your real estate deals. And your overall financial health. Your wallet will thank you for taking such good care of your credit score.

If you want more credit score tips, check out our Youtube channel! As we’ve stated throughout this article, we highly encourage you to understand the importance of your score so when it’s time to get a loan for your next value-add property (fix and flip or rental), you’ll have lots of options. And access to great rates.

Need some extra input on your credit score and how you can raise it? Our team is always here to offer advice and guidance.

As always, happy investing!