How to Buy a Value-Add Property with No Money Down in 4 Steps

How to Buy a Value-Add Property with No Money Down in 4 Steps

Do you know how to buy a value-add property with no money down?

Because, believe it or not, it only takes 4 steps.

Let’s take a closer look at these 4 steps:

#1: Buying discounted properties

It’s pretty rare to find a discounted property on the MLS. You’d have far better luck finding cheap deals through a wholesaler or investor-friendly realtor. And buying a discounted property is very important to making a profit. If you pay full retail value…well, you’ll make far less. In fact, you might not make any money at all.

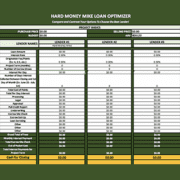

#2: Setting up a loan properly.

When you want to buy a value-add property like a rental, then you should consider our 2-Step Process. Because it’ll save you a lot of time, money, and stress.

What is the 2-Step Process?

Well, it’s strategic funding method. The first step is buying a property with a hard money loan. The second step is turning around and quickly refinancing with a long-term loan. When you do this, you’re able to qualify for the highest loan amount possible. Plus, you have a much better chance of getting out of a hard money loan fast and into a cheaper traditional loan.

#3: Use rate and term, NOT cash out.

Take a deep breath.

And don’t panic, because we’re not going to dive deep into these hefty mortgage terms. But we are going to highlight the significant differences.

It can be really tempting to set up your loans as cash outs, because you get money at closing. But did you know when you use a cash out loan, you end up:

- Paying higher costs

- Taking longer to refinance out of hard money loans (which come with pricy rates)

- Qualifying for lower loan amounts

Doesn’t sound so good anymore, does it?

So, let’s talk about the benefits of a rate and term refinance instead. With a rate and term, you:

- Spend less money upfront

- Refinance faster out of hard money loans. Like, months faster than a cash out refinance.

- Enjoy lower rates

Better yet, when you use a rate and term refinance, your cash flow will multiply because you get to do more with your money when you pay less for your loans.

This is actually a simple process if you work with someone who can help you with both your hard money and long-term loans, like our sister company the Cash Flow Mortgage Company.

#4: Put $0 down by finding the right lender

The last and most important step is to find a lender who can handle 2-Step loans.

The truth is, there aren’t many real estate lenders out there who are qualified to provide both hard money and conventional loans. That’s why we do.

So if you’re ready to take your real estate investments to the next level and put less money down on your deals, then reach out to our team. We’re always eager to set you on a path the helps you make the kind of money you need to live the life you want.

Happy investing.

Leave a Reply

Want to join the discussion?Feel free to contribute!