How to Get the Best Rates for a Hard Money Loan

/in Blog, Finance Tools, Lending Options, ResourcesToday we are going to discuss how to get the best rates for a hard money loan! Let’s talk about the truth about hard money rates. More importantly, let’s talk about how you can save real money on them.

After all, many investors wonder why two people send in the same deal, yet one gets better rates, better terms, and faster closings. The good news is this isn’t luck. Instead, it’s about preparation, fit, and presentation.

Let’s break it down step by step.

Why Hard Money Rates Are All Over the Place

First of all, hard money is not a bank loan.

Because of that, rates do not come from one big Wall Street rulebook. Instead, every lender sets their own guidelines. As a result, you may see one lender offer 9.5% while another offers 13.5% on the same deal.

At the same time, one lender may cap you at 70% LTV, while another offers 75% of ARV.

However, here’s the key point: most of the pricing comes down to you and your deal.

So yes, shopping around matters. Even more important, learning how to attract better terms matters even more.

Understand This First: Hard Money Is a Segmented Market

Before anything else, you need to know this:

Every hard money lender has their own bucket of money.

Because of that:

-

Each lender has different rules

-

Each lender wants different types of deals

-

Each lender tightens up when their money runs low

So, when one lender pulls back, another may still be aggressive. That’s why understanding the market helps you land better terms faster.

The 4 Biggest Mistakes That Drive Up Your Rates

Now, let’s look at the mistakes that quietly cost investors thousands.

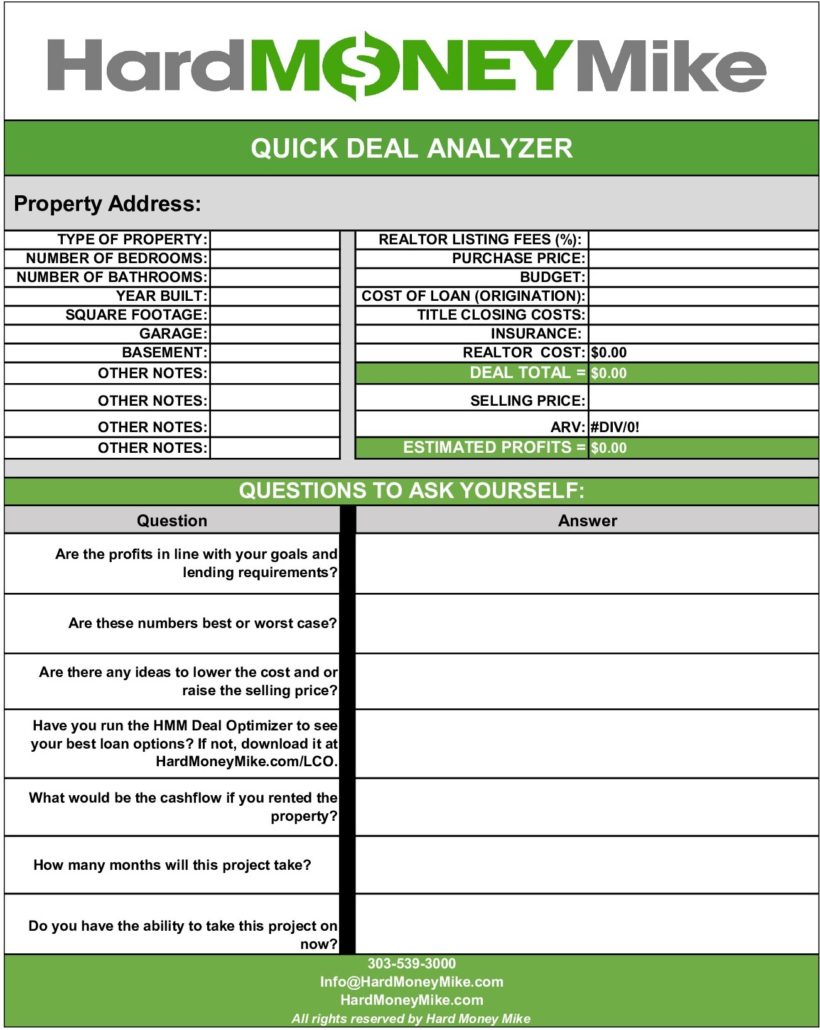

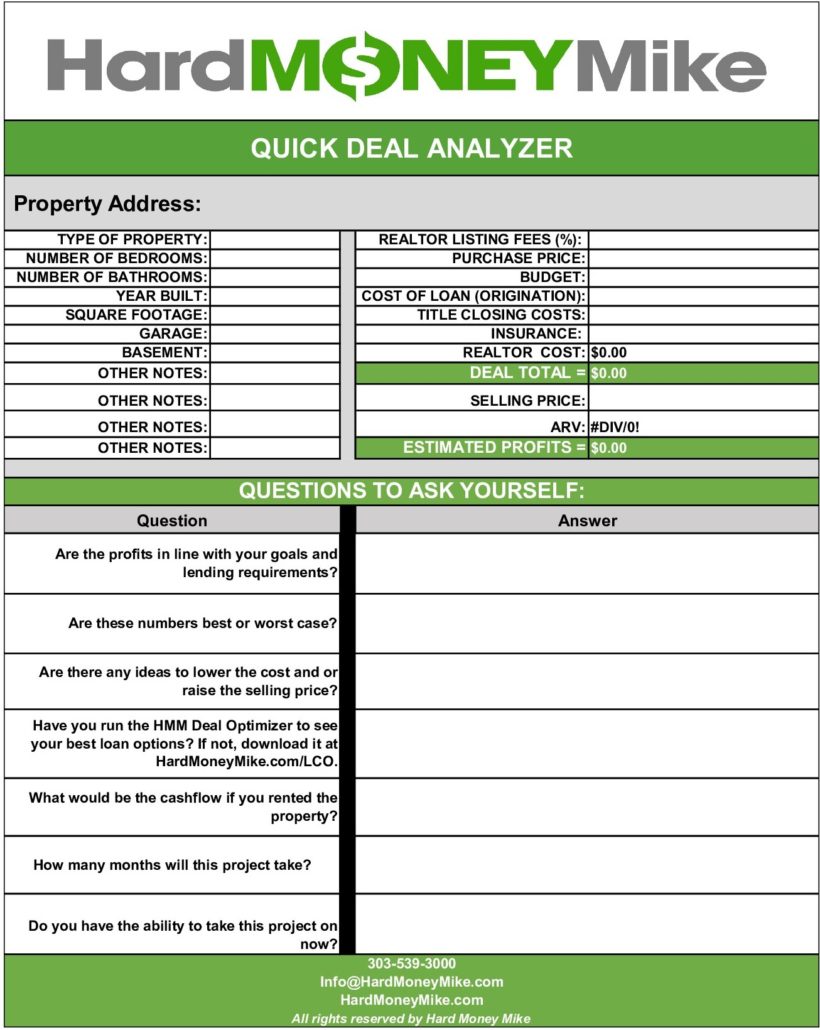

1. Not Having Your Numbers Ready

First and foremost, lenders want to know you understand your deal frontwards and backwards.

So before you submit anything, make sure you know:

-

Purchase price

-

ARV

-

Scope of work

-

Rehab budget

-

Timeline

For example, when you clearly explain your numbers, you signal confidence. Because of that, lenders often move faster and sharpen their terms. On the other hand, when numbers feel fuzzy, your deal often drops to the bottom of the pile.

Preparation matters.

2. Not Showing Enough Liquidity

Next, liquidity plays a big role in hard money underwriting.

Why? Because lenders want to know:

-

You can make payments

-

You can handle surprises

-

You won’t stall the project

For instance, if an unexpected repair pops up, liquidity keeps the project moving. As a result, lenders feel safer, which often leads to better pricing.

3. Missing the Mark on ARV

Just as important, your ARV must be spot-on.

That means:

-

Using nearby comps

-

Matching square footage

-

Matching beds, baths, and garages

-

Staying in the same property type

Remember, appraisers follow national standards. So if your comps stretch too far, your deal weakens. However, when your ARV makes sense, lenders gain confidence. And when you buy right, you can fix almost anything that comes later.

4. Not Knowing the Lender’s Sweet Spot

Finally, many investors send good deals to the wrong lender.

Some lenders prefer:

-

Small commercial

-

Condos

-

Rural properties

-

City-center homes

-

Small loan sizes

-

Large loan sizes

So before you submit, ask yourself: Does this deal match what this lender likes?

When it does, rates and terms often improve. When it doesn’t, pricing usually gets worse, or the deal gets declined.

How Hard Money Lenders Actually Price Deals

Now let’s talk about how lenders really think.

In simple terms, pricing depends on:

-

Your experience

-

The deal fit

-

Available capital

-

Loan size

-

Clean documentation

For example, when lenders have extra money to place, pricing often improves. Meanwhile, when money is tight, lenders get picky.

Most importantly, lenders focus on math—not emotion. They want:

-

Interest paid on time

-

Clean exits

-

Fast turnover to the next deal

So the easier you make that process, the better your leverage becomes.

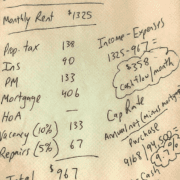

Rates, LTV, and How to Lower Your Costs

Here’s another powerful lever: loan-to-value.

When you reduce lender risk, rates usually drop.

For instance:

-

Putting in 10–25% down often improves terms

-

Covering repairs yourself can lower rates

-

Using outside funds reduces points and interest

At the same time, tools like HELOCs or 0% credit cards can lower your blended cost. For example, borrowing repairs at 7.5% with no points often beats paying 10–12% plus points through hard money.

So always ask lenders:

-

What happens at 10% down?

-

What happens at 20% down?

-

What if I cover the rehab?

Then compare the total cost. Small changes add up fast.

Hard Money vs Banks: Know the Difference

Of course, banks offer lower rates. However, they also require:

-

Tax returns

-

Work history

-

Long approval timelines

In contrast, hard money costs more on paper but offers:

-

Faster closings

-

Higher LTVs

-

Flexible property types

-

Creative structures

Because of that, hard money can actually save you money when speed, flexibility, or deal certainty matters.

How to Get the Best Deal Every Time

To wrap this up, getting the best hard money rates comes down to this:

-

Know your numbers

-

Match the right lender

-

Reduce risk where possible

-

Present a clean, clear deal

When lenders see a solid plan, they respond with better terms.

And finally, if you want help comparing options, use a Loan Cost Optimizer. It lets you compare multiple scenarios side by side, so you can see the true cost of each option.

Because in the end, every deal is different. And the investor who compares wins.

Bottom line:

Shop every deal. Prepare every file. And always know your numbers. That’s how you stay on the fast track and keep more money in your pocket.

Watch our most recent video to find out more about: How to Get the Best Rates for a Hard Money Loan

Download our free Loan Optimizer, to see which loan option is best for you!