What should you know about hard money lending before looking for your first deal?

The real estate investing world revolves around using other people’s money strategically to build wealth for you and your family. If you’re new to the table, it can be tricky to get Wall Street companies to back your deals, but hard money lending is a different game.

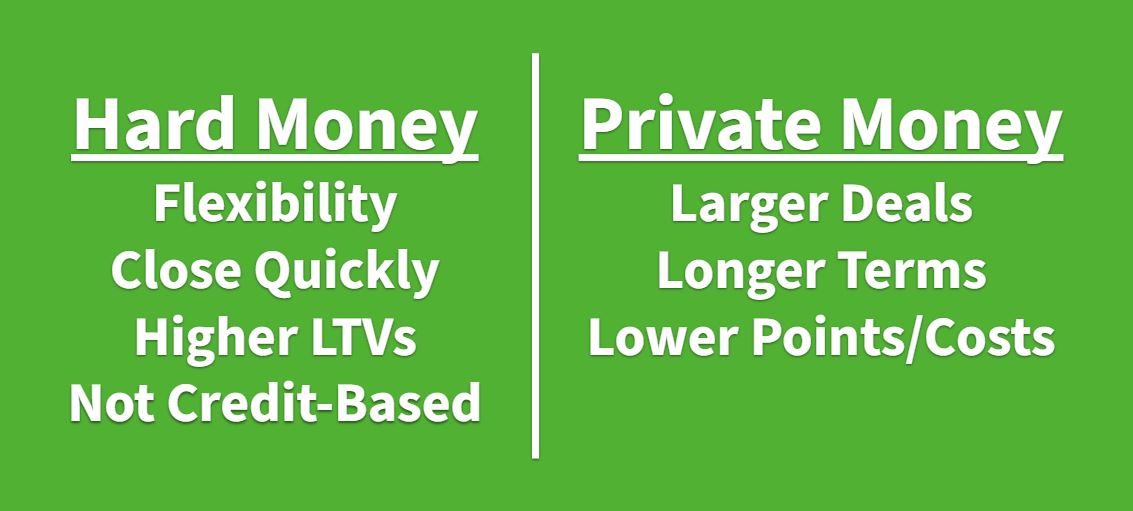

If you’re new to real estate investing, chances are hard money loans (also called Private Money Loans) are going to be the key to your success.

Here are 9 ways that hard money lending is a unique and great option for new investors.

1. Hard Money Lenders Tend To Be Relational and Local

Most hard money lenders are relational. Hard money lenders are frequently either individuals or smaller companies, so personal connection really does matter.

They like to invest in their local communities in projects that will help build the local economy. Even if you’re a new investor, by building a good relationship with small, local lenders, you can still find the finances you need.

2. Loans Are Not Score-Based

Unlike large banks, hard money lenders aren’t tied to particular credit scores.

You should still be honest with your lender, but the score typically matters less than the type of project and the LTV (loan to value).

3. Terms Are Not Based on Experience

In hard money lending, deals aren’t usually based on experience. Instead, lenders look closely at the individual deals.

If a particular deal has a good chance of creating wealth, you’ll likely find an investor.

4. Hard Money Lending is Flexible

If you have a unique property or project that falls outside of what larger banks will back, it’s probably a good option for hard money.

Flexibility is one of the most important distinctions with hard money lending. If the LTV is good and that lender wants to invest in that area, you’ve got a good chance of making a great deal.

5. Hard Money Can Fund More

Hard money loans can actually fund up to 100% of your project depending on the LTV.

If you’re strategic about the projects you take on, you can increase your leverage by choosing good properties and going through a hard money lender.

6. It’s Fast!

Hard money lending is fast.

Typically, you can close deals in days instead of weeks. Because the real estate market moves fast, this can be a great option to make sure you’re not missing out because of slow lenders.

7. You Can Do a Lot with Hard Money

You can use hard money for all sorts of things. From gap funding to purchasing costs to usage loans that raise your credit score, hard money isn’t limited to only one aspect of investing.

It’s good to find multiple hard money lenders in your area because a lot of them have expertise in particular areas.

8. Use it to Pre-Fund Escrow

One of the great things about hard money is that you can use it to help get projects moving. Because escrow typically works as a reimbursement system, you usually need to personally fund your first (and sometimes second) escrow draw.

Especially as a new investor, the first few escrow draws can be a huge strain financially.

With the flexibility of hard money lending, you can use that loan to cover those draws. Then, once you’re able to access those escrow funds, you can pay off the hard money loan.

9. Hard Money Lending Comes in all Sizes

As mentioned earlier, hard money lenders are sometimes willing to fund up to 100% of the purchase cost.

They’ll frequently fund $50,000 or $110,000 loans whereas a lot of the big equity firms don’t really like this size loan.

Time to Invest!

If you’re new to investing, remember that leverage is king. Leverage—the way you use other people’s money—is how you generate wealth and income.

Reach out and find the local hard money lenders in your community.

We have a few tools on our website that can help you find resources in your area. Check out our location pages to find hard money resources in your area. You can also download our free Loan Cost Optimizer to help you compare different loan options.

As always, feel free to check out our YouTube channel or reach out to us at Info@HardMoneyMike.com for more information.

Happy investing!