Hard Money vs. Private Money Loans: What’s the Difference?

Sometimes these terms are used in similar situations, but what actually makes private money loans different from hard money?

One of the most beautiful and attractive aspects of real estate investing is its accessibility.

Anyone can enter the game and create wealth, provided they understand their available options and use other people’s money (in the form of loans, etc.) to fund their projects. This is called using leverage.

The best leverage for each deal might be a little different. Sometimes you need to close quickly. Sometimes you need to prioritize low interest rates.

Whatever the top priority, private money and hard money are tools to have in your investing toolbox.

Private Money Loans vs. Hard Money Loans

Hard money loans have been around for a long time, but recently we’re seeing a rise in private money loans.

Knowing the differences between the two can help you find the best deal for the specific needs of your project.

1. Credit Scores

- Hard Money: Credit scores aren’t typically a factor.

- Private Money: Score based.

Instead of looking at your credit score, hard money lenders look at your financial history for things like bankruptcy, foreclosures, etc.

Additionally, not only is hard money not determined by your credit score, but hard money loans can also be used to help fix your credit score (something that private money isn’t necessarily designed to do).

If you have concerns about your credit score, check out our information about usage loans.

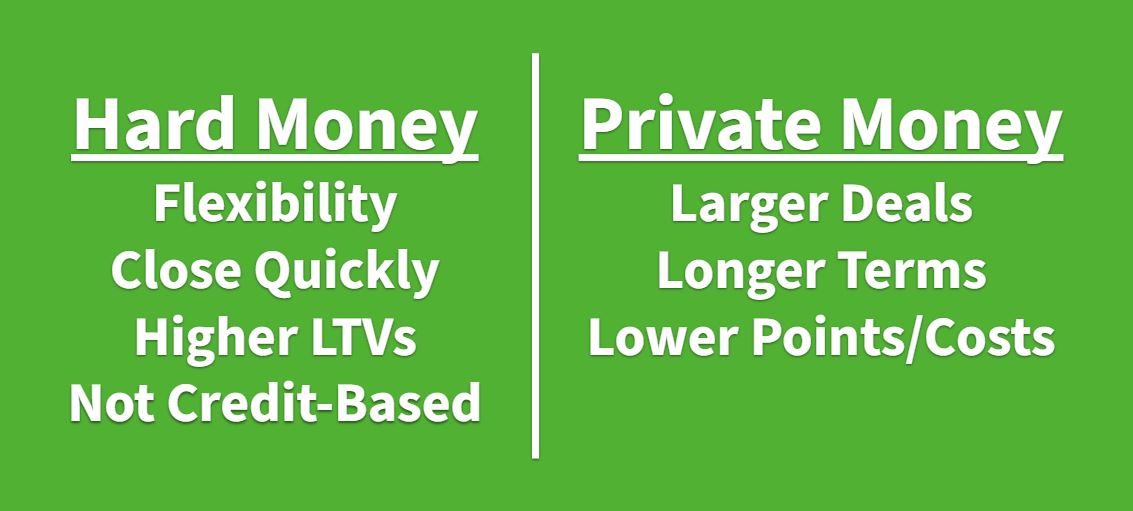

2. Flexibility

- Hard Money: Super flexible and great for unique projects!

- Private Money: Less flexible, often better for larger communities.

If you have a project that’s a bit outside of the box, hard money is often the way to go since these loans aren’t restricted as much as traditional bank loans.

In contrast, private money tends to be best for projects that are a bit more “typical” in real estate investing. It can be tricky to get private money loans below $125,000, so if you’re looking for a fast, small loan, hard money might be a better deal.

3. Loan to Value

- Hard Money: Up to 100% financing.

- Private Money: Typically maxes out at 70% of the repair value and 90% of the purchase.

Sometimes you can find private money loans with great terms, but typically hard money can offer higher LTVs.

4. Markets

- Hard Money: Local.

- Private Money: National.

Private money has the advantage over hard money when you’re looking in larger communities. Most hard money lenders have smaller areas (or two or three states) they specialize in, and they like to stay focused on those areas.

5. Pricing

- Hard Money: More expensive.

- Private Money: Less expensive.

If you’re in a large city, and you’re looking for the best pricing, private money will typically be less expensive than hard money.

It’s important to note that the difference in cost between these loans is often in the points, not the rate.

Often, hard money loans are anywhere between 2 and 3 points, with loans around 6-9 months. In contrast, private money loans are often closer to 1-1.5 and offer longer loans of 12-18 months.

Which Loan is Better?

It depends what you need!

If you need a flexible, quick loan with higher LTVs that isn’t going to penalize you for a less-than-spectacular credit score, hard money is the way to go.

If you need longer terms, better points, and something that’s designed for larger communities and typical projects, check out private money loans.

Explore Our Resources

Real estate investing is great, and both of these loans should be in your investing toolbox.

If you want to explore a hard money loan, feel free to contact us at Info@HardMoneyMike.com. We’re always happy to talk through a deal or help you figure out what sort of loans are right for you.

You can also check out the free tools on our website or our YouTube channel where we offer investment tips and tricks. Our #1 goal is that you feel confident and equipped to succeed as a real estate investor.

Happy investing!

Leave a Reply

Want to join the discussion?Feel free to contribute!