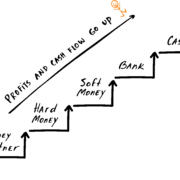

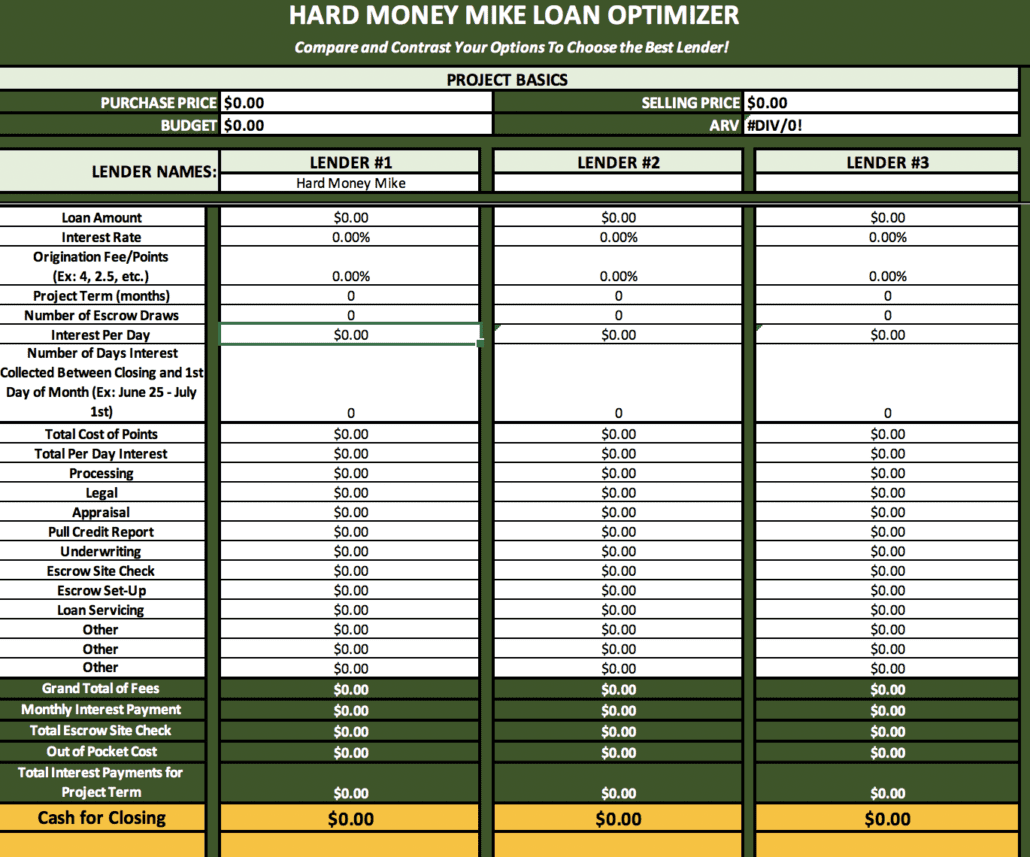

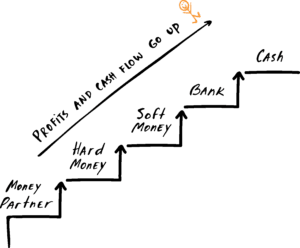

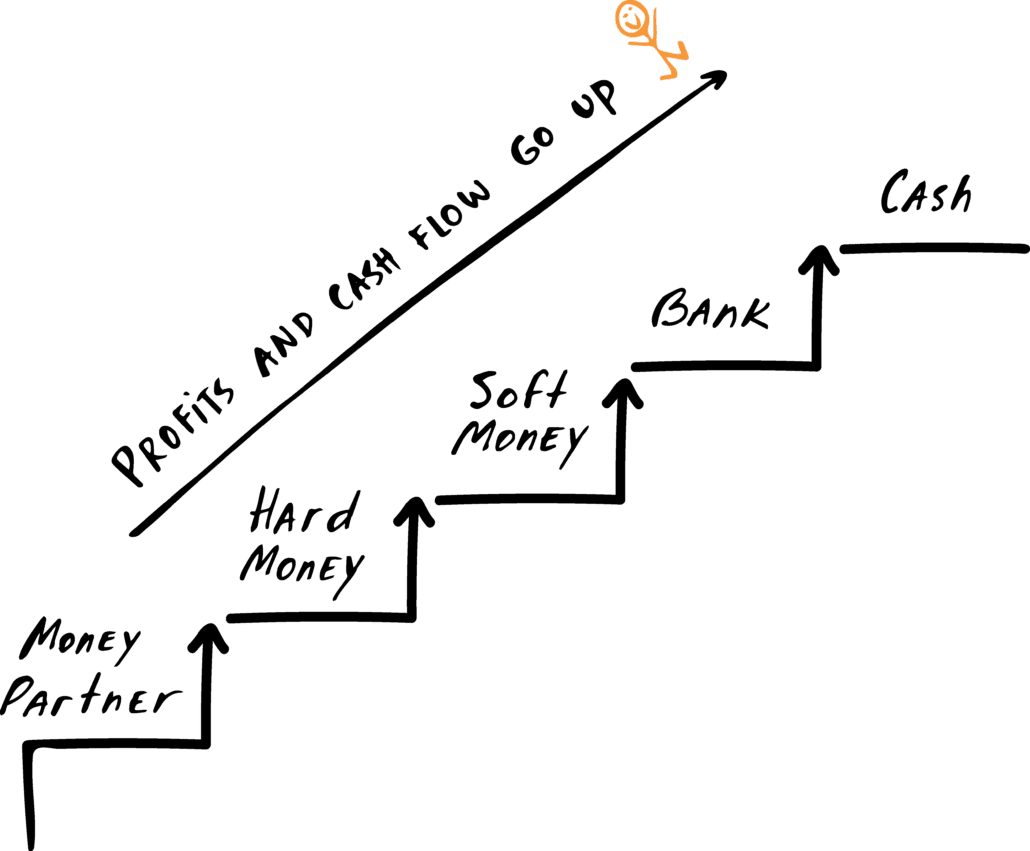

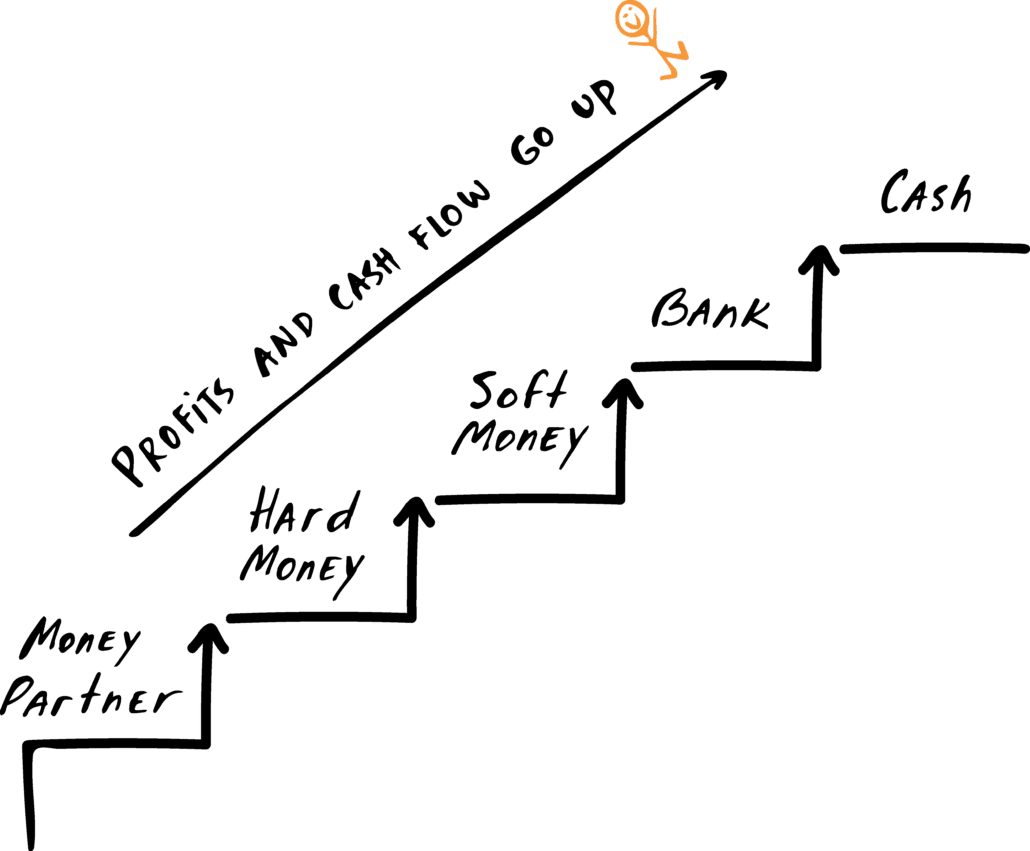

Fix and Flip Escalator: Bigger and Better

When you use the Fix and Flip Escalator, you’ll quickly realize it’s not magic. It’s SIMPLE math.

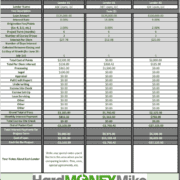

This week, let’s use the escalator to see what your money does when you complete four deals per year.

Hard Money > Soft Money

Profits increase by $12,000

$12,000 x 4 deals = $48,000

Hop up another step to bank financing, and this happens:

Hard Money > Banking

Profits increase by $17,000

$17,000 x 4 deals = $68,000

Then look at how your profits skyrocket over the course of two years:

Hard Money > Soft Money

$48,000 x 2 years = $96,000

Hard Money > Banking

$68,000 x 2 years = $136,000

You know what these numbers mean, right? Yes, instead of losing $136,000, you’re making $136,000. That’s money you can reinvest or spend on…anything! Hey, it’s your money. You can do whatever you want with it.

Are you ready to hop on the escalator yet? If so, contact us!