What Is Bad Debt Versus Good Debt?

What Is Bad Versus Good Debt?

So, what is bad and good debt?

Well, before we jump into that, did you know there are two types? Because most of us were raised to believe ALL debt was bad.

But no. That’s not true. At all!

In fact, good debt is necessary to build your credit score. Without it, you can’t boost your FICO score and obtain low-rate loans for things like fix and flips, rentals, and other value-add properties.

So, now that you know there is such a thing a good debt, let’s look at the difference between the good kind and the bad kind…

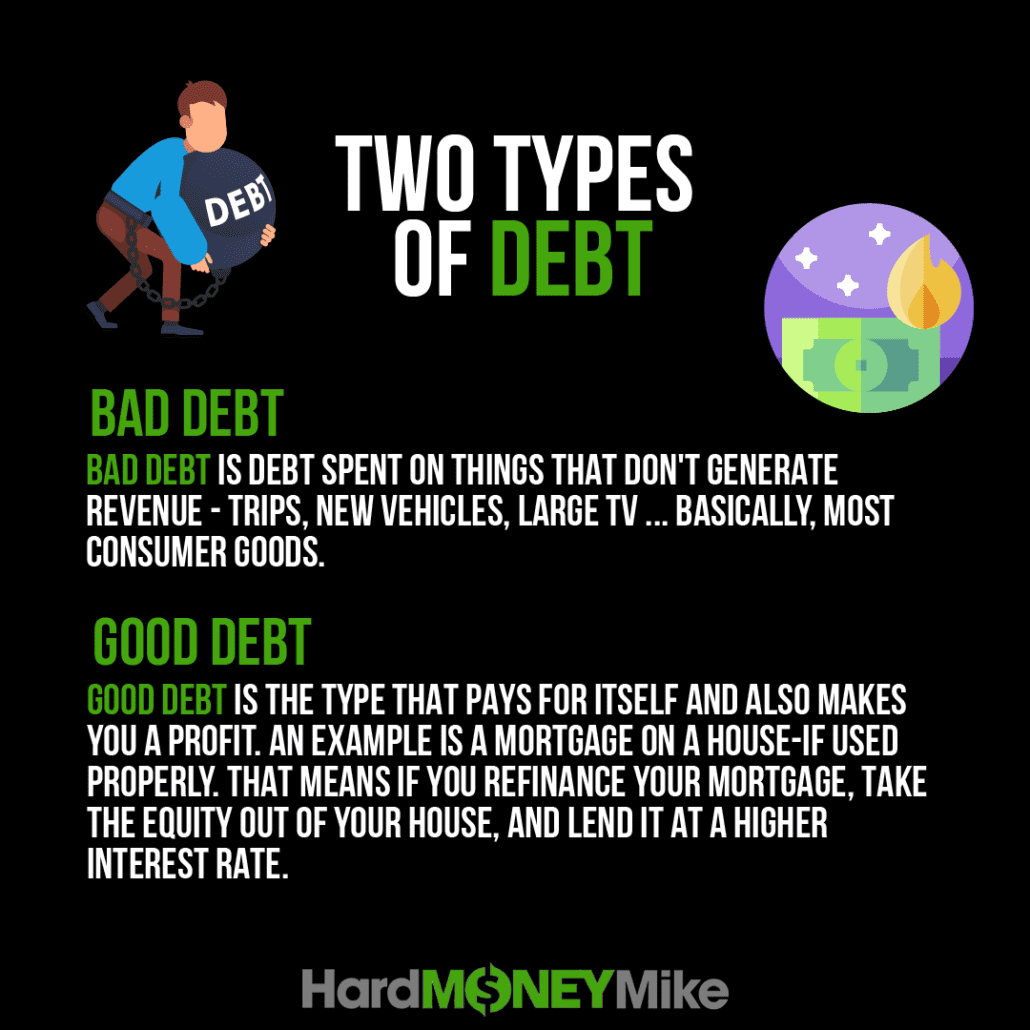

As you can see in the image above, bad debt is essentially any kind of consumer good. It’s something that doesn’t create cash flow. So, think about your vacations, cars, TVs, clothing, etc. They’re fun to have but not helpful to your bank account.

Good debt, on the other hand, pays for itself AND generates a profit. The best example is a real estate property. If done right, you’ll gain equity on most of the properties you purchase. It can be instant equity (aka, a fix and flip) or long-term equity (your personal home that has a 15-30 year mortgage). But, as long as you pay your monthly mortgage, owning a home tends to be a great investment.

So, the next time you hear the word “debt,” don’t cringe. Instead, ask yourself, “Is this the kind I want?”

If it’s bad (because nobody can get through life without having some bad), stop and ask yourself this: “Is this something I need?” Or, more importantly, “How quickly can I remove this from my credit history?” In other words, how can you pay for it without using a credit card? Because as long as you pay your bills and maintain a healthy credit usage (under 30%), even bad debt can be okay.

It’s all about balance and healthy finances!

Have questions? No problem. Our team is always here to chat.

Happy investing!