Real estate opportunities are coming in 2024, and we want you to be ready!

The stats are clear: it’s a great time to be a real estate investor. So how can you prepare your money to take advantage of the market?

Let’s start with looking at why this opportunity is coming and how it’s leading to a beneficial market for investors. Then we’ll dive into what you can do to be prepared.

Rising Debt Levels and Stress

Rates are rising, and with that, consumer debt, credit cards, and student loans have also increased. According to the Fed, they’ve all hit a new high at $17 trillion in consumer debt.

With more debt out there (and higher balances), consumers are under more stress as banks look for even higher credit scores. Because of this, even though home prices are stabilizing—potentially even going down—a lot of people can’t tap into that equity.

Implications for Real Estate Investors

This might sound like bad news. However, if you’re a real estate investor who’s prepared for these changes, this is going to create some real opportunities in the near future!

As consumers credit cards, rates, payments, and stress rise, a lot of people are going to be vacating their properties.

We can help those people who are in need of relief to take over properties and create the generational wealth and the mailbox income they need.

We didn’t create the problems these people are facing. But through smart investment and coming alongside new investors, we can turn the situation around.

Key Statistics to Understand the Opportunities

Consumer Debt: We already mentioned the $17 trillion in consumer debt.

Credit Card Delinquency: According to the Fed, over the past six quarters, we’ve seen a rise in credit card delinquencies. While the numbers aren’t astronomical, they are rising. If rates keep going up, we’re going to start seeing more defaults.

Mortgage Delinquency: Credit cards will also stress people’s money which can trickle into mortgage delinquencies. Although mortgage delinquencies haven’t shot up yet, we can expect a boomerang effect in about six months because of the rising rates of consumer debt.

How Does This Affect Consumers?

Let’s look at an example.

Let’s say a year and a half ago, someone had a credit card balance of $10,000. Interest rates were low. We’ll say they had a 14% interest rate, and they maintained that $10,000 balance throughout the year. So that would mean they have about a $1,400 payment of interest to the credit cards over that time, or just a little over a hundred dollars each month.

Today, interest rates and balances have gone up, while credit scores have gone down.

Now, for the same consumer, interest rates are likely to be closer to 29%. Instead of paying $1,400 for the year, that rate has more than doubled at $2,900 or just under $250 a month.

Those numbers are pretty small in comparison to what a lot of consumers are facing: $30,000-$50,000 in credit card debt, car payments, student loans.

Additionally, most people’s income isn’t rising as fast as their interest payments.

This Creates Real Estate Opportunities… If You’re Prepared!

If real estate investors take these signs seriously, there’s a huge opportunity for business. But you have to start getting your money in line now.

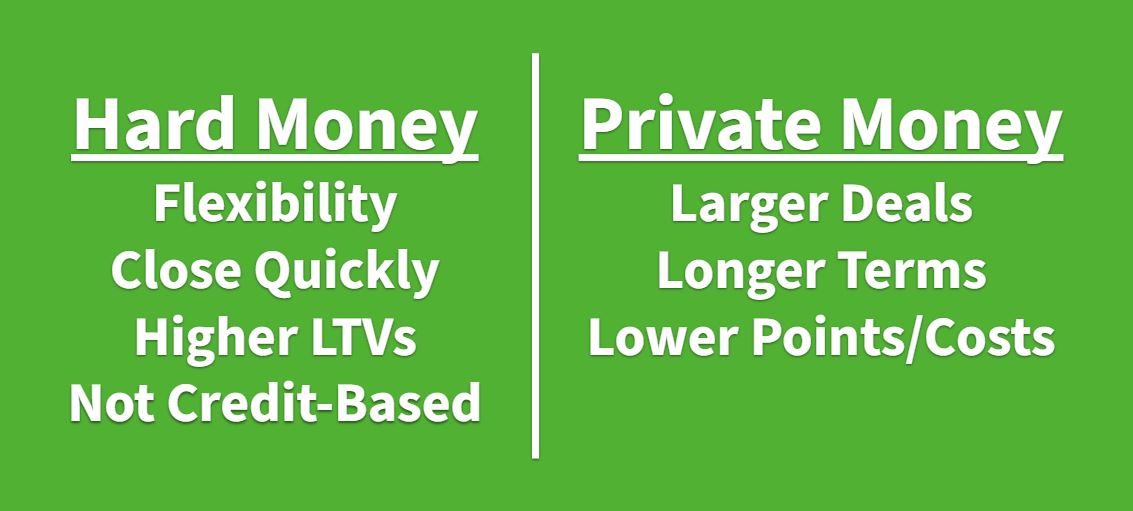

1. Find hard money.

Hard money is extremely versatile. Because of this, it’s great for when you need to make quick deals or close in days instead of weeks.

Hard money can also offer a higher loan to value which is perfect for the market we’re looking at in 2024. If you want to learn more about hard money, check out our recent post on all the different things you can do with hard money.

2. Raise your credit score.

In order to take advantage of the coming opportunities, you need to make sure your credit score is in line.

Lenders aren’t always going to cover everything, so you need credit cards in your money bucket to cover those other expenses.

3. Fill your money bucket.

Where does that money for your money bucket come from?

There are a few ways to fill your money bucket. One of the most important ways to make sure you have funds is to use business credit cards whenever possible. By separating your personal credit from your business credit, you protect your credit score and can keep it higher.

If you need help settling personal credit cards to fix your score, our sister company The Cashflow Company can help with that.

In addition to credit, you can fill your money bucket with HELOCs, other lines of credit, or other people’s money. Getting friends and family to invest in your projects often gives them a better return. It also ensures you have the funds to work with while your lenders are still determining your approval.

4. Partner with a reliable lending company.

Companies like us work really well with these types of real estate opportunities. With hard money, you’re able to take advantage of these moments because you won’t have to wait for slower lenders.

Similarly, if you’re in a rural area or smaller town, you might have trouble finding a good deal with Wall Street-type lenders. Large lenders often add additional rules and regulations to rural areas, whereas hard money is flexible no matter who or where you are.

It’s important to find the right lender for your project.

If it’s unique and you’re looking to close quickly, look at hard money loans. Hard money is going to be more important in the coming real estate wave than ever before.

Don’t Miss Your Opportunity!

In the next year, look out for real estate opportunities. This is your chance to create that generational wealth that can change everything.

Our whole goal here is to make sure you’re successful.

We have tons of free tools on our website, so make sure you check those out as you’re preparing for 2024. They’re free and easy to use!

Again, if you have questions about the next wave of real estate investing or want to see if a hard money loan is right for you, send us a message at Info@HardMoneyMike.com.

Happy Investing.