Where do you start with private money in real estate investing?

There are two pillars to successful real estate investing.

First, finding good, undermarket properties. And second, having the leverage to actually purchase those properties.

Private lending is the key to unlock that money side of investing. But when you’re just starting out, how do you get involved?

How much money should you start with? How do you find the right loans for your situation?

Well, here’s your starting point:

How Much Money Do I Need to Start Investing in Real Estate?

How much money should you have if you want to start investing? It all depends on the deal.

No Money Down Investments

We regularly help people start with no money for a project.

BRRRR rental properties work great for this. Investors can invest in them without putting any money into the property purchase or the flip.

Another way we frequently see people succeed with zero down is when they have really, really good deals. It’s a rare find, but if you do come across a property for sale for 60% or lower of the ARV, you can get 100% financing. Smaller, local hard money lenders will jump at the opportunity for such a great deal.

How Much Money Should I Normally Expect to Bring In?

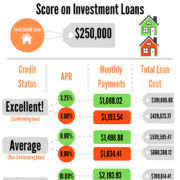

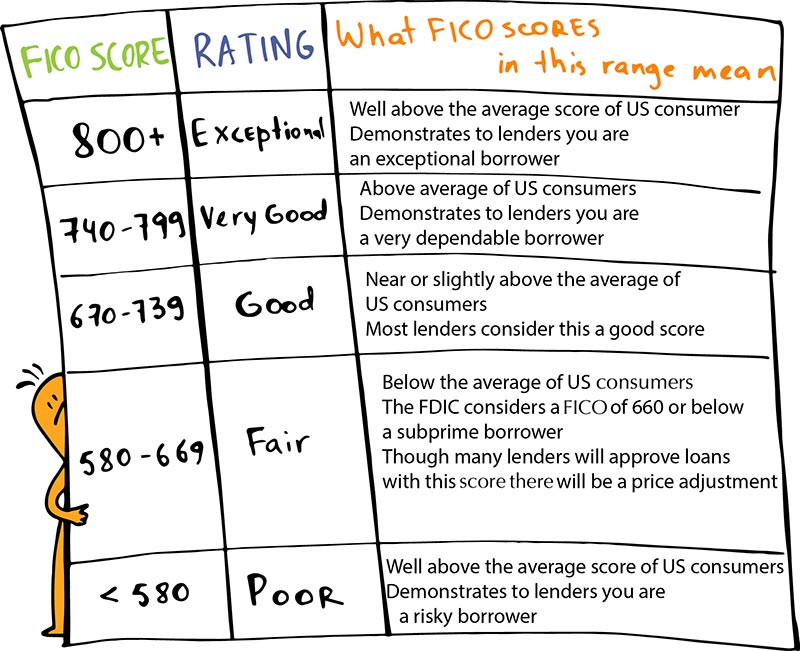

Traditionally, when you’re starting out investing, you’ll use either hard money loans or a bank finance. It depends on your credit score and the amount of money you’re able to bring into a deal.

When you’re going into these loans, it’s good to expect to pay between 10% to 20% of the total cost of the project out-of-pocket. This includes 10% to 20% of the property purchase and 10% to 20% of the fix-up costs.

As an example, say you have a $100,000 purchase that will require a $50,000 rehab budget. If you’re bringing in 20%, you’ll need $20,000 as down payment for the house, plus $10,000 to cover construction – so $30,000 total out-of-pocket to start.

What Will My Financing Depend On?

How much you as a new investor will need to bring into a deal will depend on several factors:

- The kind of deal you find

- Your qualifications – with or without real estate experience

- Your income

- Your savings

- Your credit score

Hard money lenders tend to lend based on your deal. Banks tend to lend based on you. A higher credit score will give you better chances at bank loans. And banks love lending to those who don’t need money. So if you already have a lot of savings and income, you can get 100% financing. But the more you put in, the cheaper it’ll be.

Overall, you can get involved in real estate investing with no money, especially for rental projects. But if you really want to get a running start, you’ll need some money for your investments.

Where Can I Find Private Money Lenders?

We’re mostly focusing on private money lenders for beginner investors because that’s where you’ll naturally have to start.

The timeline of financing options for most investment careers goes:

Private Lending → Bank Financing → Cash

You’ll start with relying on private lenders and hard money. But you’ll be working your way toward less expensive methods of financing. As you gain experience, credit, and money, it gets easier to move toward cash and lower interest loans in your investment business.

So, people at the beginning of their real estate investment careers hard money lenders… But if you’re just starting out, you’re probably not sure where to find them.

Here are the basics for finding private money lenders:

1) Google

A simple Google search can help you find private lenders near you.

The majority of hard money lenders will be local investors or small companies lending in your area only. Google is a simple, reliable way to see who’s out there lending locally.

Read the Google reviews. You’ll feel more confident moving forward with a lender if you can see people who vouch for the company.

2) Ask Local Investors Online

Use resources like biggerpockets.com, connectedinvestors.com, or other online forums to learn from people in your area. See who they use, why they use them, and what some general costs are.

3) Meet-ups and Live Events

Talk to people in person. Chat with other investors to hear about their experiences with local lenders. Many events will give you the chance to meet those local lenders and get to know what they offer.

You’ll need a pool of options for money, so it’s good to know many companies and private individuals.

Communicate with banks, too. Even if you can’t get a bank loan right now, that’s the next step you’re working toward in your career. It’s never too early to build those connections.

Are Hard Money Lenders Safe?

A major question from people who are starting real estate investing is: Are hard money lenders safe? Are they just loan sharks who will take all the profits from my project?

Private Lending Business Model

Hard money is not built to be against you. Private lenders intend to: lend money, get it back, and get their interest. They only want a return on their investment; they don’t want to bleed you dry.

Granted, there is a potential for lenders to take advantage of you, and there are a small percentage of lenders like that out there.

Hard money lending is no different than any other business – there are good people in it and bad people. It’s your responsibility as an investor to be sure you’re working with good, safe people.

Finding Good, Safe Lenders

Just like anything else, it’s wise to shop around. The best ways to find good hard money lenders are:

- Personal Experience

- Asking about other people’s experience

- Checking online reviews

You’ll be able to tell right away from other people’s experiences whether a lender is safe or not. You can even ask lenders for references of people who have closed with them in the past.

Doing your research should save you the trouble of trial and error with your local lenders.

Broaden Your Pool of Lenders

To successfully start in real estate investing, you’ll need to get a good list of lenders. Don’t be connected just to one. You’ll need them for different reasons, different deals, and different loans.

It’s good to have a lot of money options – something quick, something long-term, something with a lower rate, etc.

If you focus on building your base of lenders, you’ll feel safe. Spread your reliance over multiple lenders to be more confident in your real estate investing career.

What Are Private Lender Interest Rates?

You know you’ll have to buy the property, cover fix-up costs, and pay back the cost of the loan. But if you’re new to real estate investing, you also need to know what other costs will come with your loan. Like interest rates.

The biggest cost on your mind is probably: What interest rates do hard money lenders charge?

What’s a Typical Hard Money Interest Rate?

The rate depends on several factors, and interest rates will vary lender to lender.

Now, in July 2022, inflation is hitting, and the federal interest rates are rising. With these recent changes, you’ll find rates are between 9% and 11%. But just six months ago, interest rate averages where two percentage points less.

Always check on your local lenders’ rates. Especially at a time like this, they can change relatively quickly.

How Interest Works on a Hard Money Loan

We’ve had people come to us discouraged about interest rates – just because they misunderstood how interest works.

For example, let’s say you need a loan for $800,000, but you only need it for three months. The lender gives you a 9% interest rate. Will you have to pay 9% of $800,000 for those three months? No, that’s not how interest works in hard money.

That percentage they give you is an annual rate. So in this case, you’d be paying that 9% in monthly chunks over the course of the year. If you only need that loan for three months, you’ll be paying closer to $18,000 in interest – much better than around $72,000, 9% of the full total.

Always make sure to shop around for the best deal. The more money you can put in, the lower your interest rate.

How Important Are Interest Rates?

Typically in real estate investing, it’s not just about the interest rate. It’s about how fast you can close.

We see speed make the difference for our clients all the time. Often, if someone can close a week or two earlier than other buyers, they get a better deal.

In that case, interest rates become a non-factor. The bargain you can get on closing fast on a property can more than makes up for the interest charges.

Banks’ interest rates are generally 2% to 5% lower than private lenders. So if you can go to banks, you probably should for the better rate. But if you’re new to real estate investing, bank loans are typically out of reach, so hard money is the best way to start investing.

How Much Do Private Money Lenders Charge Overall?

Interest rates are just one of the costs to be aware of with hard money. With private lenders, there are two major costs to consider:

- Interest rates

- Fees and other charges

You’ll have to consider these two factors at the same time. Every lender is different.

One company might offer a 14% interest rate but have low fees. Another may only charge 9.5% interest but their fees are much higher.

How do you calculate which loan will be the better deal for you? A simple way is to use this free loan optimizer tool. You can add in all the information from each lender, and this tool will help tell you which loan saves you the most money.

What Are the Other Costs Associated with Hard Money?

Fees can vary widely in the hard money world. There’s no standard; it’s up to each lender what they charge.

Origination Charge

The most common fee you’ll see is the origination charge. This is to guarantee profit for your lender or salesperson.

An origination fee is calculated as a percentage of the loan amount. It varies between 1 and 4 points. (A “point” is a “percentage.” So if you hear a lender say they charge 2 points for a fee, that’s 2%).

Other Fees

Some lenders have none of these fees, some have nearly all of them:

- Processing charges

- Underwriting fees

- Appraisal charge

- Legal fees

- Title fees

- Charges to set up an escrow

- Charges to take draws on an escrow

- And more.

The amounts vary widely. Some of these charges are a flat rate, and some are based on a percentage of the loan. One lender might have eight or nine of these fees, another may have just one or two.

How Do You Know Which Loan Is Best When You First Start Investing in Real Estate?

At the end of the day, you’ll have to find out what’s best for you.

Don’t get too hung up on interest. Some people see lenders charge 10% when banks are charging 6%, and they assume it’s some sort of rip-off. Then they never use hard money, and their investment career suffers.

There’s no such thing as a loan that you don’t have to pay for. Every lender will have between one and eight additional costs besides simply paying the money back.

Sometimes people who start investing in real estate zoom in on a low interest rate from a private lender, then miss the bigger picture of fees and the length of the loan.

You’re responsible for the success of your loan. Most consumer loans will give you a detailed sheet with all the charges. Private lenders will give you that information, but it may not be in a nice little form.

This loan optimizer tool can help you understand which lender will offer the better deal for you.

Understanding these costs and loans will make or break your real estate deals. This side of investing where you’re spending money is the same side where you make money.

Hard Money Mike Can Help You Start Investing in Real Estate

It’s a knack to find great properties, but it’s impossible to start investing in real estate if you can’t get the money to fuel those purchases.

We’ve done tens of thousands of transactions, billions of dollars in loans, in every kind of market, with any kind of deal.

We don’t just lend our own loans. We help investors understand hard money, get help with bank loans, and be educated on the money side of real estate investment.

If you still feel unsure about the next steps to make your dream of real estate financial freedom a reality, reach out to us with your questions.

The people who understand the money side of investing are the ones who become more profitable, faster. Let’s make you one of those people.

Happy Investing.