How to Price a Property When Interest Rates Rise

Interest rates are changing, and buying power is changing with it. Here’s how to price a property.

“We started looking at this property back in early 2022 when the sale price could have been $800,000… But now what do we do?”

A wholesaler who has a property with us called with this question.

This client isn’t the only one stuck in this situation. If you bought a house earlier this year with a certain price in mind… What should you do now that it won’t sell at that price anymore?

Let’s look at how to price a property when buying power changes.

Interest Rates Change Buying Power

Our client purchased a property in early 2022 with the intent to sell it for $800,000. Unfortunately, 8 months later, that price is very unrealistic for the property.

Right now, they have the property listed at $650k. They’re doing showings but are frustrated with zero offers. Does no one want this property? How much farther will they have to drop the price?

Interest rates have affected buyers’ buying power. Let’s look at some of the numbers at play here.

What Is the Current Buying Power?

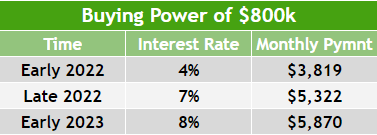

Back in the spring, someone looking at a house for $800k could have gotten a 4% interest rate, leaving them with a $3,819 monthly payment.

Now, interest rates are up to 7%. That same $800k property just jumped to a $5,322 monthly payment. If rates climb to the expected 8% next year, that becomes $5,870/month.

In the first quarter of this year, people could buy comfortably at a $800k price tag. Now, due to interest rates, those same people probably can’t even qualify for a loan that large.

How to Price a Property Based on Buying Power

You have to look at it this way: The monthly payment for this property increased by about $1,500 in a matter of months. That’s a 39% increase. Next year will be a 54% increase from early 2022’s buying power! This puts a major strain on the DTI of a buyer trying to qualify.

But what does this all mean when it comes to how to price the property?

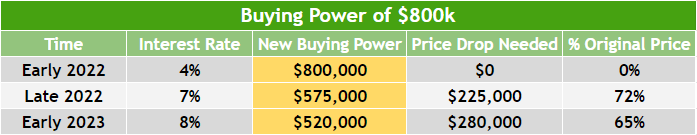

Let’s keep working with our previous example. We have the same buyer wanting to keep the same down payment, same monthly payments, and same DTI. Here’s how their buying power changes:

At the beginning of this year, they could afford a $800,000 home.

Now, those same people could only qualify for $575,000.

Next year, only $520,000.

This reality of buying power needs to inform your listing price.

Deciding Listing Price

We recommended our client to sell for $575,000 – the current buying power of their target buyers.

If this client still has this property into next year, they may need to drop the price all the way to $520,000, just to find a buyer who can qualify.

Example at a Lower Price

The trouble with buying power isn’t specific to higher-value homes. Let’s look at an example from a lower price point.

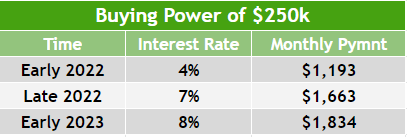

A $250,000 house, at the beginning of 2022, would have cost a homeowner $1,193/month. Now, that same house would cost the same person $1,663. That’s a 39% increase. From earlier this year to early next year, the monthly payments will have gone up by 54%, to $1,834/month.

These numbers are still probably cheaper than rent for a comparable property. However, that doesn’t necessarily mean buyers will be able to qualify with lenders.

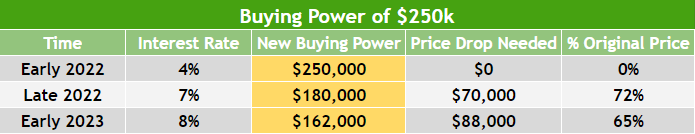

If someone could buy a $250,000 house at the beginning of 2022, now the same exact person could only afford $180,000. By next year, they can only afford $162,000.

Since 2021, buyers have lost 60% of their available purchasing power. The market isn’t the same as it used to be, and unfortunately, your selling expectations need to be adjusted.

Affordability and Quality Decide a House’s Value

Two main things decide how much you can sell for: affordability and value.

Affordability changes for buyers when interest rates change. People qualify for loans and choose houses based on what they can truly afford. If you have a house on the market, you have to sell it for what people can financially manage.

Quality also impacts price point. People expect a different level of quality from an $800k house than a $500k house. Our client could keep the $800,000 price tag if the quality of the house matched that number. In that case, the property begins appealing to a different tier of buyer, whose purchase power can get them that house.

We’re still seeing some of our clients selling properties at high numbers. But it’s because their quality is outstanding, and they’ve gone above and beyond to add value. A poor to average house or flip means a minimum of a 10-20% price cut in this market.

Selling Options In This Market

If you’re struggling with a property on the market, there are a few things you could do.

- Price based on buying power. You need to think about payment sensitivity, purchase power, and whether your target buyers could qualify for a loan. Use the numbers we looked at in this article to determine how to price the property.

- Use a DSCR loan. If you don’t want to sell at a loss, this is a good option for you. Take the property off the market, hold for 3+ years with a DSCR loan, and turn it into a rental in the meantime. Put it back on the market when buying power improves.

- Buy down the rate. If you pay to bring the rate down, you can attract buyers at a slightly higher listing price. Buying down the rate might cost $10,000, but it could save you from discounting the list price by $50k.

Help for How to Price a Property

Do you want a second opinion on the pricing numbers for your property? Are you curious about what a DSCR loan might look like for your property?

Send us an email at Info@HardMoneyMike.com, and we’d be glad to help.

For other real estate investment information, check out our YouTube channel here.

Happy Investing.