7 Ways to Get the Best Rate on a Hard Money Loan In This Market

Interest rates can make or break your REI project. Here’s how to get the best rate on a hard money loan.

Investing is a leverage game.

You need other people’s money to make money – but that doesn’t mean you have to overpay for that money.

Let’s take a look at how to get the best rate on hard money loans in the current environment.

What Is Hard Money?

Hard money is sometimes called asset-based lending, or private money.

Hard money is a form of leverage focused on the property. All lenders have criteria they require from borrowers. For hard money lenders, the main lending requirement is about the property and project itself.

Lender Niches Will Affect Your Rates

Investors have their own niches, their own likes and wants for their investment experience. Maybe someone doesn’t want rural properties, someone else focuses only on high-end houses, another on low price points.

Lenders have individual likes and dislikes the same way. Every lender draws a box of what they like to lend for. The more your property fits in their box, the better rate they’ll give you.

This means that not all lenders will want your particular project – or that they won’t give you the best rate on your hard money loan. It’s not personal. Not every project will fit in every lender’s “box.”

If you want the best rate, then you’ll have to find the lender that likes your project, your experience, and your property.

Types of Private Money

There are three types of lenders that make up the private lending world: local, national, and OPM.

- Local Lenders: Lend regionally, in your state or city only.

- National Lenders: Backed by Wall Street hedge funds. They lend all throughout the US.

- Real OPM: Other People’s Money. A private loan from someone you know..

The best rate on a hard money loan will vary lender to lender, depending on the type of institution and their preferences. One lender might do land loans, but another won’t. One may offer great rates on new builds but not even offer scrapes.

Whatever your project, it’s important to find a lender that matches you. The closer you match a lender’s preferences, the better your rate.

Despite all these differences between lenders, there are some general rules between the three types of hard money.

Real OPM

The best possible rates come from OPM. A friend, family member, or other investor who wants a safe place to put their money will cost you a lot less than a formal lending institution.

You save on cost with an OPM loan because there are no points, fees, or appraisals. Every institution will charge you these extra on your loan.

OPM also saves you the most on interest rate. The interest rate criteria for most OPM lenders is, “more than they could get in an IRA.” Typically with OPM, interest rates are 3-4% less than other lenders.

National and Local Hard Money Lenders

Both local and national lenders will have similar pricing, for the most part.

Rates for these lenders depend on what they’re looking for in their portfolio. Now, in late 2022 to 2023, most lenders’ rates will be between 9-12%.

One difference, however, is that local lenders tend to not have extra underwriting and appraisal fees.

Shopping Around to Get the Best Rate on a Hard Money Loan

The best rates aren’t going to come to you. You’ll have to shop around to find the best lender for each of your projects.

Talk with lenders in your area and get estimates for loan costs. Then, you can use our free Loan Optimizer tool to quickly compare lenders and find out who’s cheapest.

Lowering Risk to Get the Best Rate on a Hard Money Loan

To get the best rate on a hard money loan, think of it from the lender’s perspective. They want to lend to people who are low risk. Therefore, the less risk you pose, the better your rates become.

So how do you lower the risk? Here are 7 ways you can lower your risk to get a better rate from a lender.

1. Straight Talk

Firstly, be able to back up everything you tell your lender. No lender wants to be in a position where they have to try and figure out what’s true and what’s not.

If you do this, lenders will put you at the end of their long line of waiting borrowers – or they’ll increase your cost.

Give them all the information they need. Be honest about everything – even the ugly parts of your credit or investment history. If you think your rate will be worse if they knew the full store, just remember… It’ll be even worse if they find out you hid it.

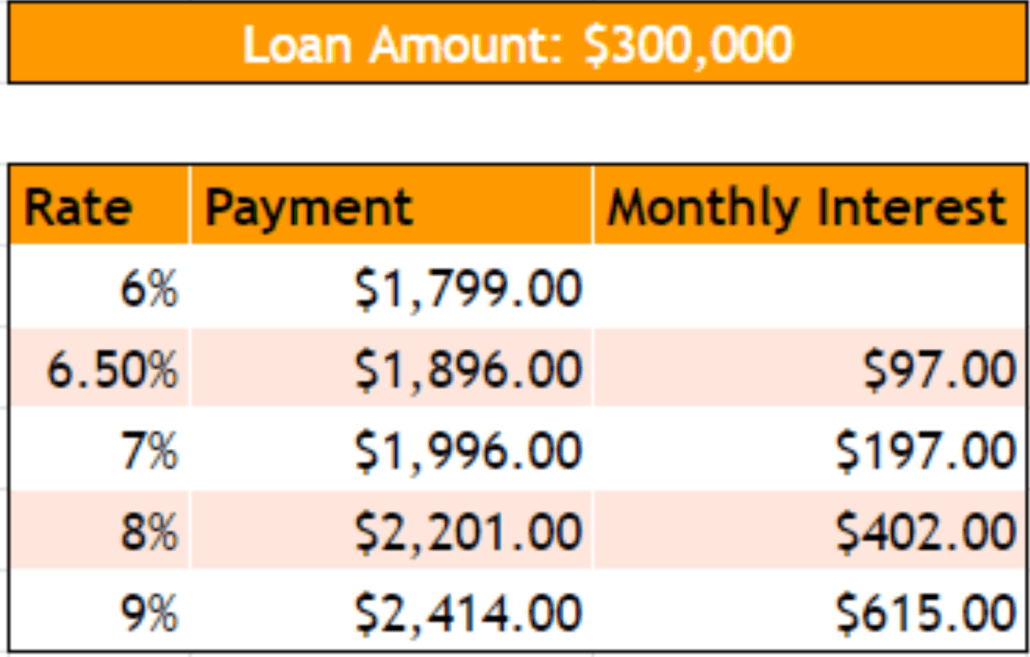

2. LTV

The lower the loan amount on a property, the less risk for the lender. The less risk for the lender, the more likely they’re going to give you a better rate.

Putting more money down results in a lower rate overall.

3. Experience

If you can show a lender that you’ve had success flipping houses, building homes, or developing land, you pose less risk. Investors with projects under their belt usually see lower interest rates.

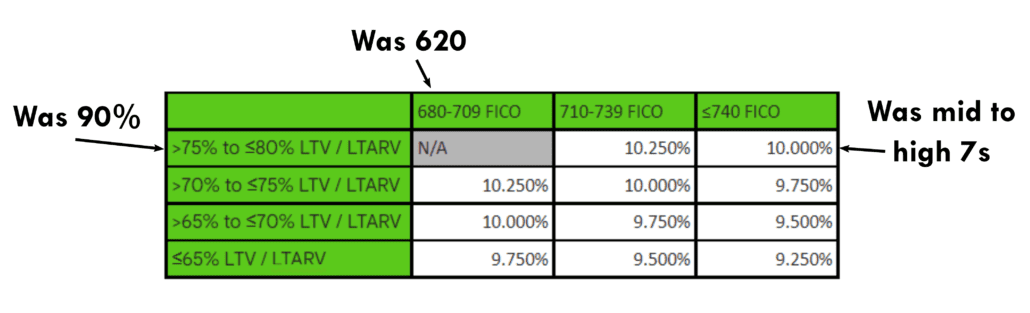

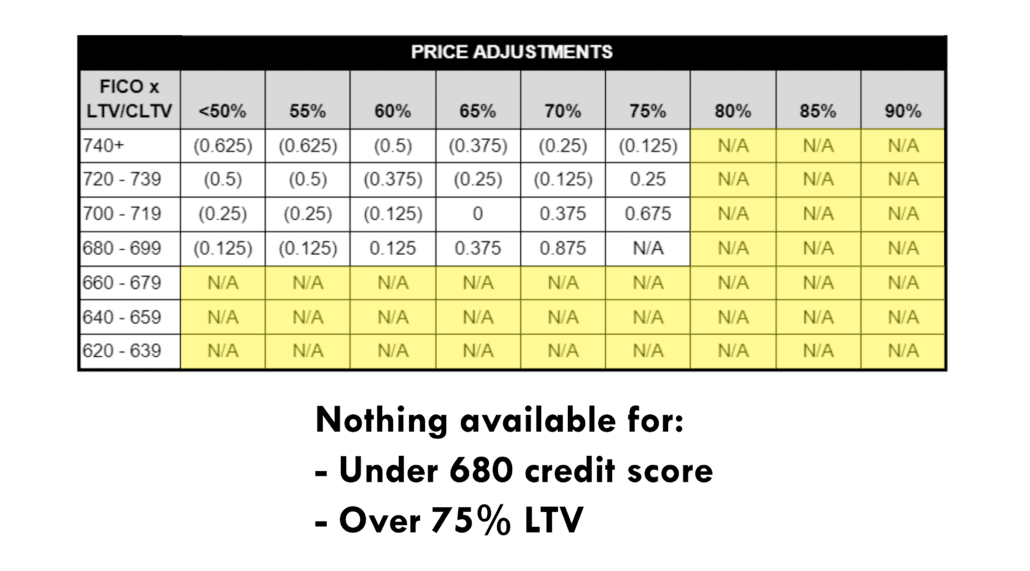

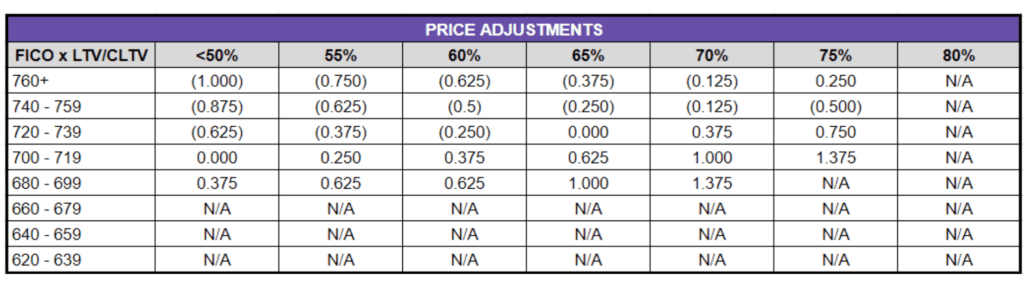

4. Credit

National lenders (hedge funds) use credit as one of their main criteria for rates. The better your credit, the better the interest rate they can offer you.

The difference between a 640 score and a 740 could be a difference of 1-1.5% on your interest rate.

Local lenders and OPM lenders don’t consider your credit score as a major requirement. They will look at your credit, but only to make sure you’re not defaulting or have a foreclosure or bankruptcy.

5. Property & Project Types

As mentioned before, each lender has a real estate niche. If your project fits in their box, you can catch a bit of a break on the interest rate. If it does not fit in their box, they may still lend to you, but they can charge you a little more, making your project less profitable.

6. Loan Size

Some lenders won’t lend under a certain amount.

Hedge funds often dislike smaller loans. Some won’t lend under $100,000 – some have a threshold at $500,000.

Smaller loans, like $25k or $50k, are more suitable for OPM. OPM lenders often have smaller available reserves to lend.

7. Location

Local lenders tend to have a specific region of service. National lenders tend to only loan in metropolitan areas. And OPM lenders tend to be more flexible.

But again, each individual lender will have their own preferences. To get the best rate on a hard money loan, find out the lender whose box you best fit in.

The Truth About How to Get the Best Rate on a Hard Money Loan

If you want the best interest rate on a private loan, you really need to shop around.

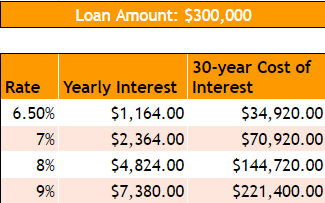

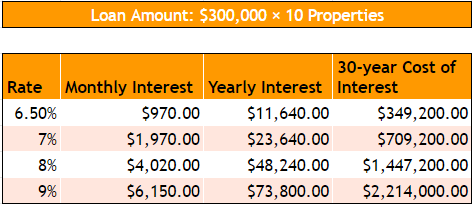

There’s money in the money, and the less you have to pay for leverage, the more successful your real estate investing career becomes. Hard money is a powerful investing tool, but the wrong interest rate can destroy your project.

You can download our Loan Optimizer here. Send us an email at Info@HardMoneyMike.com if you have any other questions about how to find the right hard money loan. And check out our YouTube channel for more free real estate investing information.

Happy Investing.