The Ultimate Guide To Credit During a Recession

Take a peek behind the curtain at what your loan officers know about credit during a recession.

One thing’s for certain with the oncoming recession in 2022: your credit score will change everything for your real estate investment career.

Lenders are changing all loan rates and requirements. Loan amounts are down. Interest rates are up.

In inflationary times, central banks tighten money by raising federal interest rates in an attempt to reduce inflation. Lenders and brokers get a new set of rules they have to abide by during a recession.

Let’s look at some examples of the “new rules” loan officers and underwriters are looking at. We’ll see what credit score you need, and how your credit will impact the type of loan you can get.

Credit’s Impact on Loans for Real Estate Investing During a Recession: The Charts

Loan officers look at a scale while pricing out a loan. They get this chart from the underwriters, and this becomes the basis for the loan.

These scales show the LTVs and interest rates an investor could get based on their credit score.

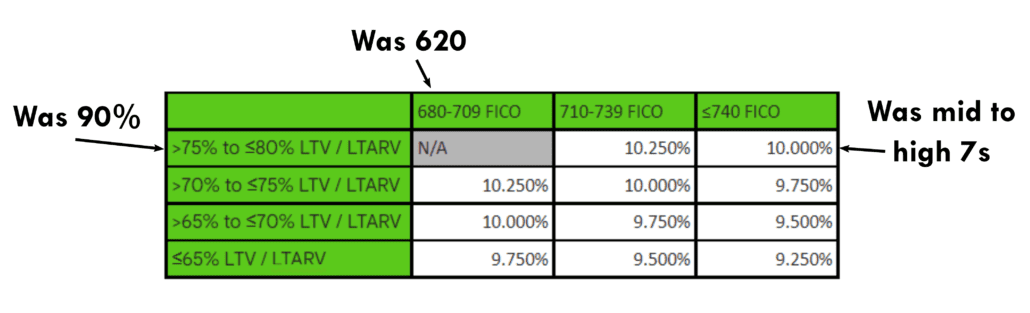

National Hard Money Lender Credit Chart During a Recession

Here’s an example of a scale for a national hard money lender:

A minimum acceptable credit score used to be 620. Now it’s 680. So now, from this hard money lender, anyone with a credit score from 620 to 679 no longer has an option.

LTVs have also taken a dive. Most lenders used to loan up to 90% of the cost of the property or ARV. Now, you’d be lucky to get 80%.

Rates are now sitting around 10%+. When LTVs were at 90%, the rates were in the mid-7s. This means rates have gone up almost 3% – just over the last 6 months.

There’s less money available in general. To get a piece of what little there is, you’ll need to maintain a higher credit score than before. Your credit has a deep impact on your loan options.

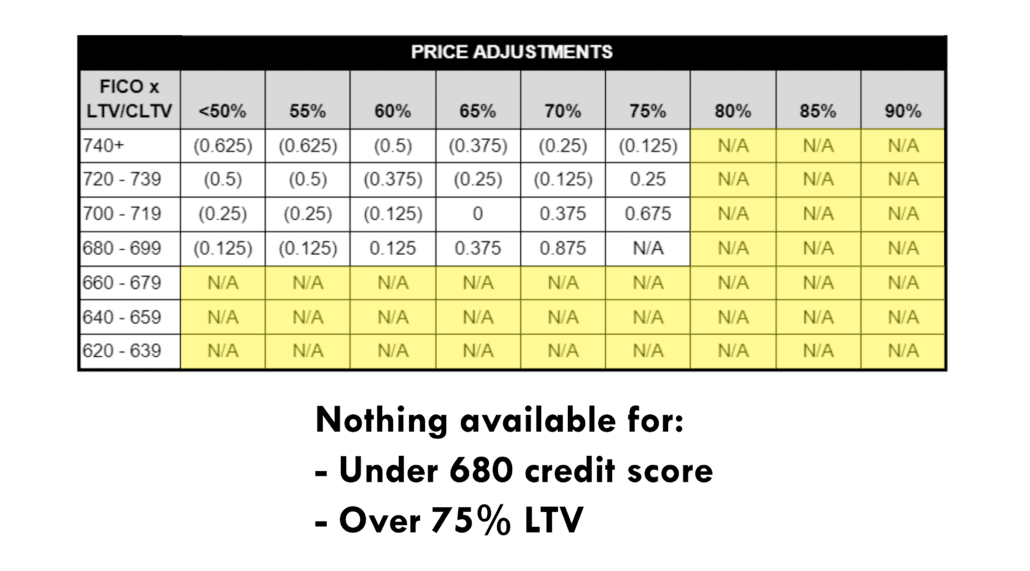

Traditional Bank Lenders Recession Credit Scale Example

Now let’s take a look at the traditional side, with longer-term loans:

This chart uses basis points. It equals to about .25%-.5% higher rate for the lower credit ranges/higher LTVs.

You can see that this traditional lender has also eliminated all options for anyone under a 680 credit score. In the recent past, a score of 640 to 679 could get you something, you’d just have to pay more. Now, you don’t even have options in that range.

Credit score matters if you want the best rate – or any leverage at all!

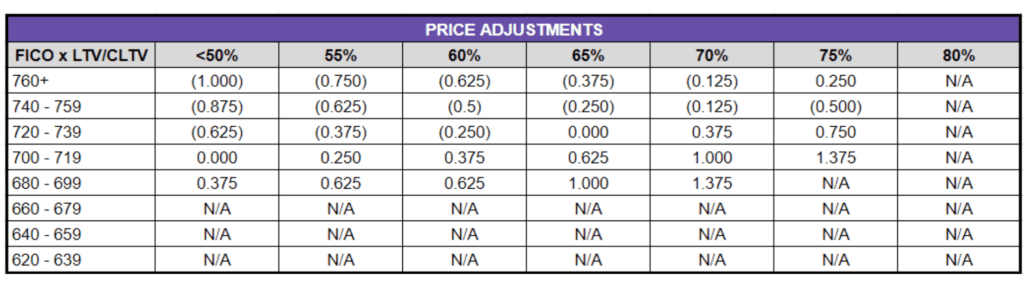

DSCR Loan Credit Requirements in a Recession

Lastly, let’s take a look at an example from a DSCR lender:

Again, over the last 2-3 months, this lender has eliminated anything below a 680 score for a DSCR loan.

For this DSCR, between a 680 and a 760, there’s a 1.125 point higher difference in rate for origination.

To get cheaper money during a recession takes a great credit score. To get any money at all takes a good one.

How Does Your Credit Impact Your Cash Flow and Deal Flow?

We’ve gone over a behind-the-scenes look at the grid of requirements from underwriters and lenders…

But how does it all affect you in practice? How does it impact your money coming in and money going out?

Lower Score, Higher Down Payments, Higher Interest

For credit scores below 680, if you can even get a loan, you can expect to put in 5-15%+ more than usual.

Hard money loans that used to require 10% down at 680, now need up to 25%. So on a $200,000 deal, you’d now have to come up with $50,000.

More money into each deal means fewer deals (deal flow) and more money out-of-pocket (cash flow). To combat this, you may need to look into something like gap funding.

Additionally, you’ll be paying more in interest on your BRRRR rentals and flips. When a fix-and-flip has higher interest, your margins come down. When a BRRRR has higher interest, your cash flow comes down.

Focus on your credit. Your credit score has a direct relationship with your profits. A low score means more money is going out and less is coming in on your investments. A high score means less money is going out and more is coming in.

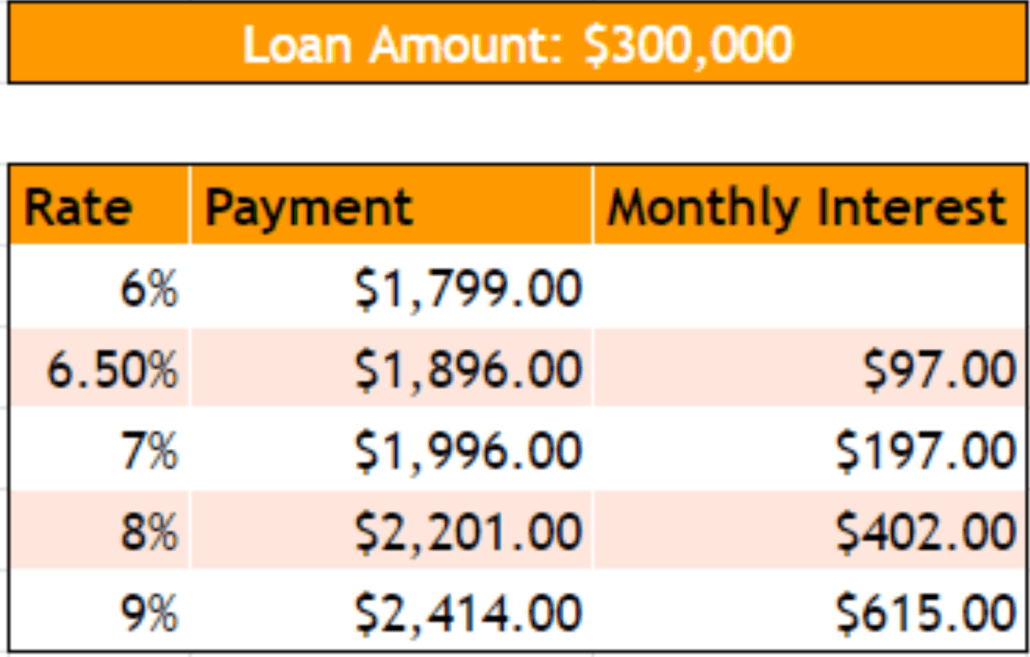

Example of Credit Score’s Impact on Rates and Cash Flow in a Recession

Let’s look at an example with real numbers to get a picture of just how seriously your credit score impacts cash flow on your real estate investments.

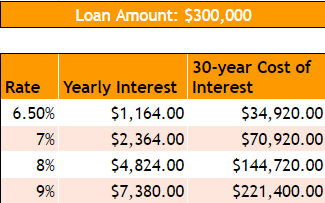

Comparing Interest Rates

Pretend you have a $300,000 loan. And say you were able to get a 6% interest rate – a normal rate for today. Your monthly payment is around $1,800.

Now, for every 10 to 20 points your credit score lowers, your rate increases. This increases your monthly payments by $100 to $200.

So with a low score, you’d only be able to get a 9% rate on that $300,000 loan. You’d be giving $615 every month straight to the bank. That’s money other investors will be able to use to re-invest.

Interest Rates Over the Life of the Loan

This interest story gets worse when we consider the full life of the loan.

The person with a 6.5% interest rate pays a little under $1,200 per year in interest, or around $35,000 for the full 30-year loan.

The person with 9% pays over $7,300 yearly, and over $221,000 over the course of the loan!

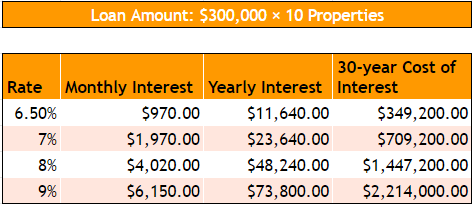

We can take this example out further.

Let’s say we have a portfolio of 10 properties, not just one. Ten properties, each with $300,000 loans.

At 6.5%, you’ll spend almost $350,000 over 30 years between the interest of all the loans. At 9%, you shell out over $2.2 million in interest in 30 years.

Cash Flow Conclusion

A low credit score is a major disadvantage. Properties that would cash flow for someone else, won’t for you. Your debt-to-income could disqualify you for DSCR loans. Your score itself can disqualify you for many other loans.

Look at the impact of your credit score. Keep more money to do what you love and give less to the banks in the form of interest.

If you need to work with a credit specialist to get everything in line, it’ll be worth your time. Do it ASAP – now is the time to get prepared as a real estate investor. Because in 2023, prices will come down, and you don’t want to miss those opportunities.

Loan Options for Real Estate Investors with Bad Credit in a Recession

If you have bad credit, what are your options during a recession?

Understand Your Limitations

The products available to you with a bad score are 10% of what’s available to someone with a 700+ score. Understand the following limitations:

- You’ll have to shop around more

- You’ll pay more in down payments with LTVs 10-15% lower than other investors

- You’ll pay 1-3% higher interest rates.

- The question is no longer, “Do I want to do this deal?” but “Can I do a deal?”

Look at Unique Financing Opportunities

You may be able to look at unique ways to finance properties.

Subject tos or owner carries don’t look at your credit score. These deals don’t directly involve a lender or have an underwriting process – an owner just needs you to come in and take over payments.

A unique opportunity like this can keep the ball rolling for your investment career while you raise your credit score.

No Substitute for a Good Score

As you saw before, some people would have to pay $2 million+ dollars extra on their portfolio, just because they didn’t take care of their credit.

You can look into other options, like subject tos, owner carries, and OPM, but first and foremost, focus on getting your credit score in the 700s.

How to Improve Your Score Quickly

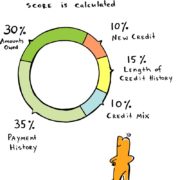

There are a couple quick ways to improve your credit, depending on why your score is low.

- If high balances are your problem:

Many real estate flippers use their credit cards a lot, so they over-leverage everything. High balances impact 30% of your credit score.

Try using private money to fix this problem. If you can borrow money from family or friends, use it to pay off your cards. Even just for 60 days, it can bump your score up because your usage and balance will go down.

While your balances are temporarily lowered with private money, you can apply for your loans. Let your lenders know you have that debt, but it won’t impact your credit score for the time being.

- If length of credit is your problem:

Get authorized by a family or friend with good credit who will authorize you. You get to use their credit history on yours, which quickly bumps your credit.

Also, if you have a lot of credit cards and want to close one – don’t! Pay it off, then let it sit on your account unused. That history will keep accruing on your credit report, and it increases your available credit balance while lowering your usage.

- If your problem comes down to bad habits:

To be a real estate investor, you have to build good financial habits to build a solid foundation for your credit score. No way around it.

- If you’ve never been educated on credit:

More Tips to Raise Your Credit During a Recession

Download our free credit score checklist to start getting on top of your credit.

If you want more information about your credit score, you can watch these credit videos, or find other credit blogs on our website.

And if you have any lingering questions about credit and how it could impact your real estate leverage, reach out to us at HardMoneyMike.com.

Happy Investing.

Leave a Reply

Want to join the discussion?Feel free to contribute!