Money Chat Encore: How to Fund a Flip

Money Chat Encore: How to Fund a Flip

Attention real estate investors, both new and seasoned! Did you miss Tuesday’s Money Chat with lending expert, Mike Bonn?

It’s okay, because Mike will be hosting an encore Money Chat tomorrow, Thursday, September 2nd at 11 a.m.

During tomorrow’s chat, Mike will answer all of your questions on How to Fund a Flip.

If you’ve always wanted to get into the fix and flip game, but don’t know where to start when it comes to buying properties, then this Money Chat is perfect for you!

This is your chance to join other like-minded real estate investors and ask all of your questions to a lending professional.

If you’d like to join Mike’s Money Chat tomorrow, then you can register for FREE here.

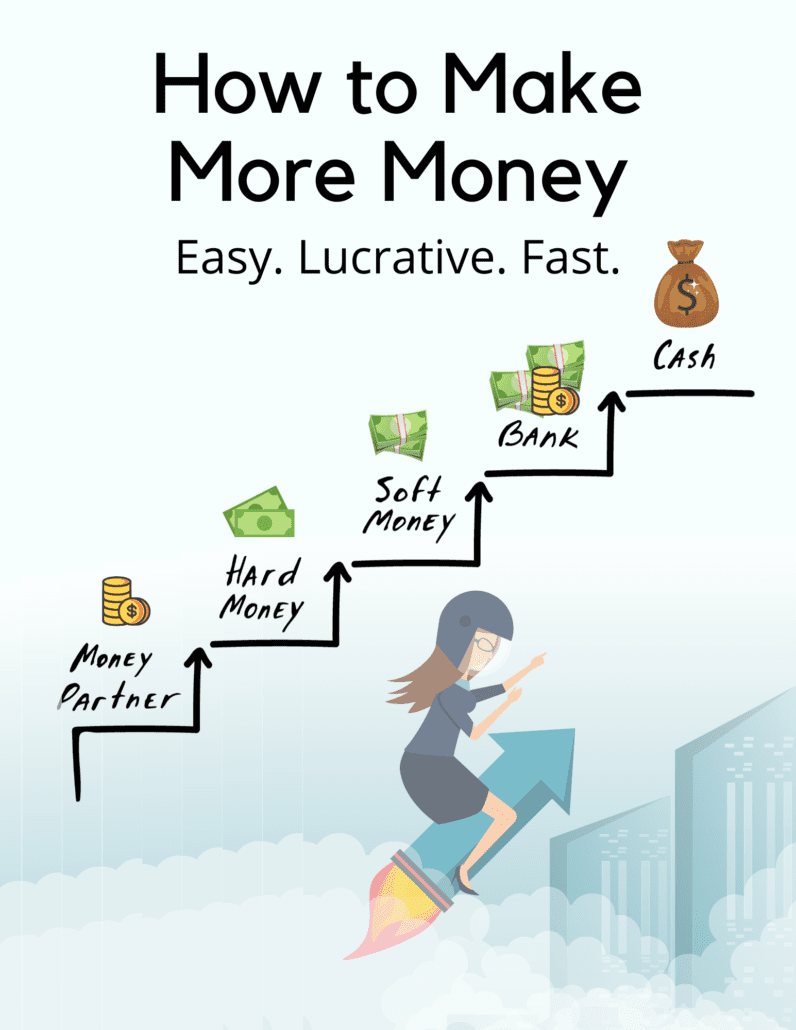

During the virtual call, Mike will answer common questions like:

- What are my funding options?

- What is hard money?

- How do I qualify? What credit score do I need? Income? Experience?

By the end of the Money Chat, you should have a much better grasp of how to get going in real estate investing…and how to pay for your properties.

Can’t make it to tomorrow’s chat? No problem. Let us know and we’ll set up more Money Chats on how to fund a flip. Or you can reach out to our team and schedule a time for one-on-one call. That way you have an opportunity to ask all of your questions on how to fund a flip (and any other value-add property).

But, better to tune in tomorrow to listen in with other like-minded investors.

When?

Tomorrow at 11 AM MST

Where?

Virtual nationwide.

Register for free at my.demio.com/ref/1j9cO1wJ3Co6QkW1

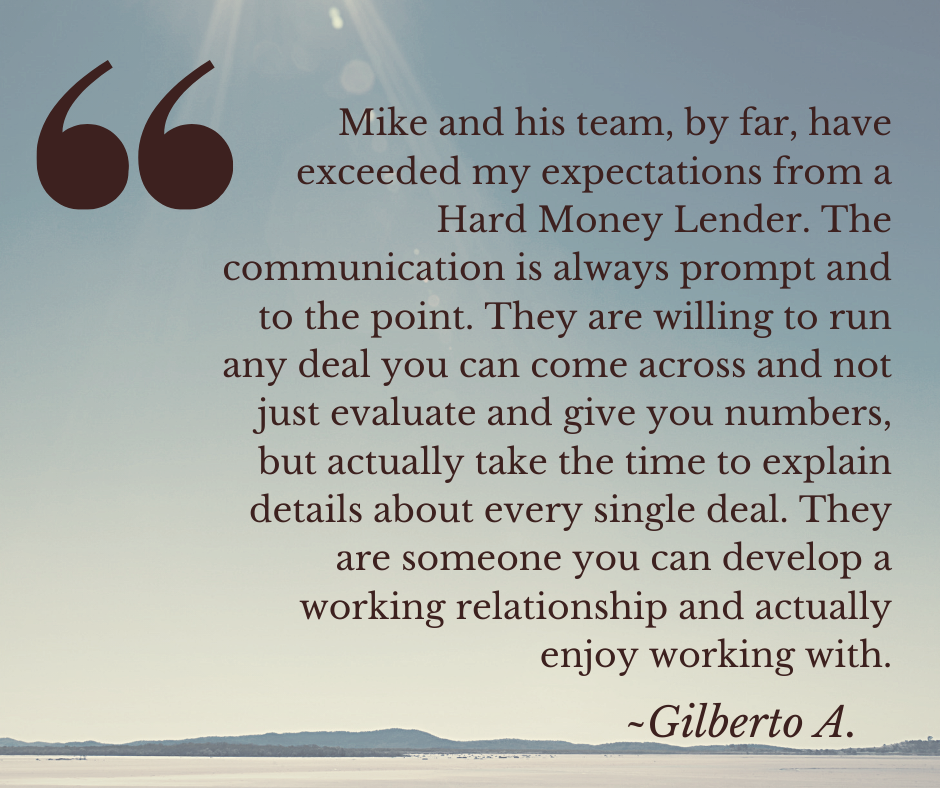

Mike and the rest of the Hard Money Mike/Cash Flow Mortgage Company team looks forward to seeing you tomorrow!

If you have any questions about our weekly Money Chats, then our team is here to answer them any time.

Happy investing!