How to Make More Money in Real Estate: Funding Tips

How to Make More Money in Real Estate: Funding Tips

Do you often wonder how you can make more money with your real estate investments?

Well, when it comes to investing in value-add properties (aka, rentals, fix and flips, etc.) the best way to generate positive cash flow is to focus on the numbers.

What does that really mean?

It means taking the time to understand your funding options. Because all investors are different. They have different goals, different qualifications, and different strengths and weaknesses.

But all real estate investors also share a few similarities:

- They’re in the business to make money.

- They’re constantly searching for a GREAT deal.

- And they have access to multiple lenders.

Let’s take a closer look at that last similarity, because it’s where the numbers make ALL the difference.

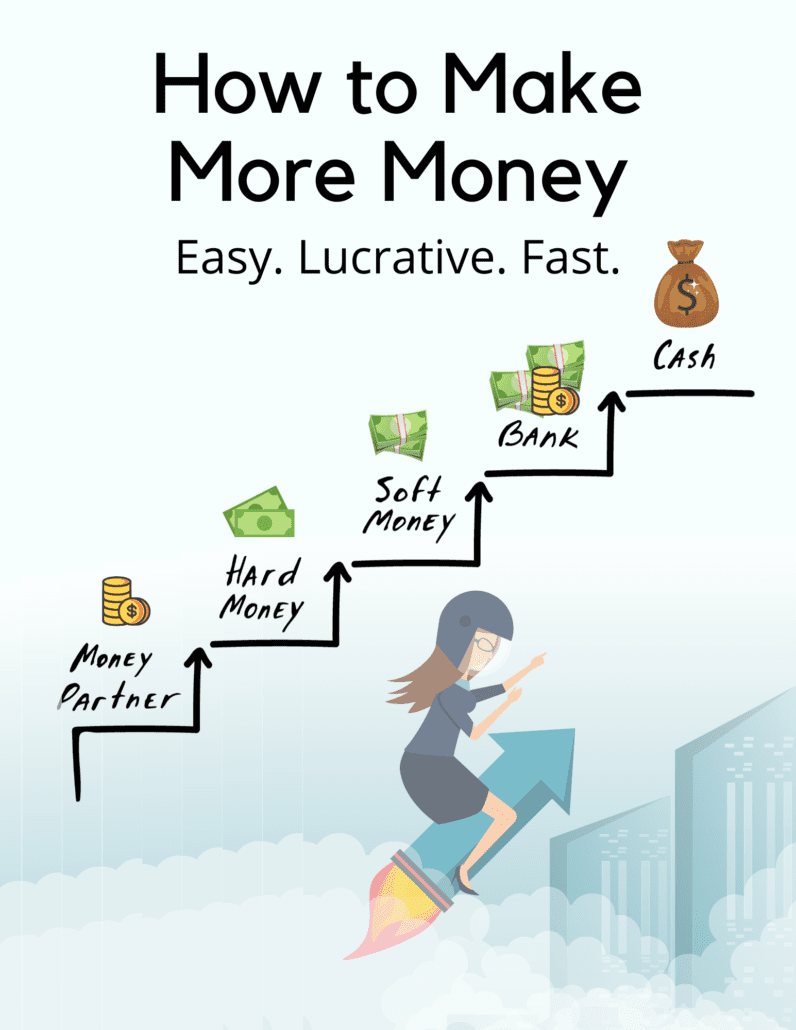

Real estate investors can get funding from a variety of sources. Just look at this “lending staircase”…

Did you know you have 5 different ways to get funding for your value-add deals?

You don’t have to break your back to qualify for a bank loan (the strictest lender you’ll likely come across). And you definitely don’t have to push pause on your investment dreams. You can always get started with a money partner (aka, a family member, friend, or business partner).

Money partners might be unpredictable and dip deeper into your profits than other lenders, but at least they can help you get moving. And if you get moving, you can also start building your real estate portfolio. And that’s key. Because experience will launch you up the lending staircase to other loan options.

Like hard money.

Hard money is great for closing deals FAST. We’re talking lightning speed compared to other lenders. But, it is on the pricier side. That’s why most investors should only plan on getting a hard money loan for 3-6 months. Any longer and it’ll eat away at your profits.

But the further you move up the lending staircase, the less that will happen. Hence, you’ll be able to make more money on your real estate deals, because you’ll be able to obtain cheaper loan products.

So, what’s the bottom line? Well, once again, it comes down to numbers. And those numbers come from the type of loan you use to fund your real estate properties.

Are you ready to start making more money by looking into YOUR funding options? Great! Our team is here to help.

Happy investing!

Leave a Reply

Want to join the discussion?Feel free to contribute!