Wisdom Wednesday: What’s a Good Investment

On this Wisdom Wednesday, we want to focus on what a good investment looks like.

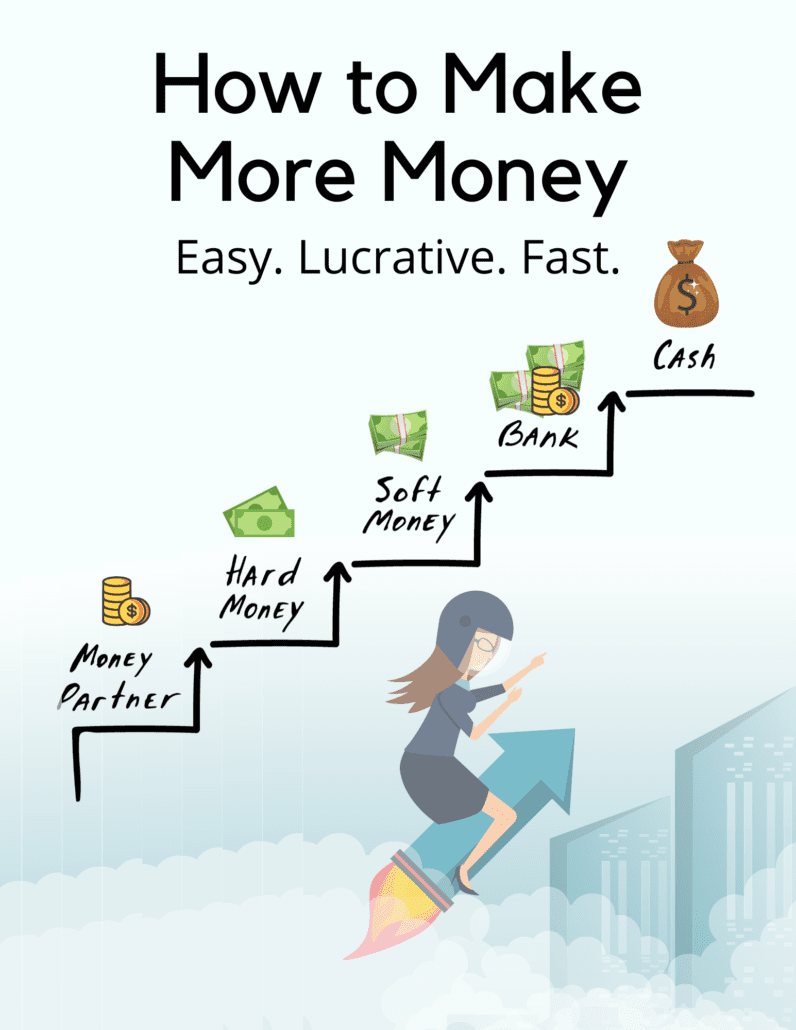

Because, the truth is, good investments are pretty simple. It all boils down to cash flow.

As long as you have more cash flowing in than flowing out, your investment is a good investment. ~Robert Kiyosaki

Yep, it’s really as simple as that. This concept might seem pretty obvious to most investors. Unfortunately, we’ve seen too many clients fail to evaluate their deals in a way to ensure they generate positive cash flow.

What are some of the most common mistakes we see? Here are just a few:

Fail to shop around for the right lender.

Maybe an investor gets comfortable using the same lender over and over again, or they only call one lender and decide to go with their product. Whatever the case, when real estate investors fail to shop around for the best loan with the best rates and terms, then their cash flow can take a major (and unexpected) hit.

Use their heart more than their head.

Too many investors fall in love with a property and refuse to accept it’s not a good investment once they crunch the numbers. Remember, this is a business. You’re not buying a house for you or your family. You’re buying an asset that’s intended to make you money. So try to use logic rather instead of emotion.

Calculate bad numbers.

Real estate investing comes down to numbers. Pure and simple. But when investors use the wrong numbers, then they use the wrong math. And the wrong math means big consequences for their cash flow. Some common missteps with math include inaccurate comps, underestimated renovation budgets, and hidden lender junk fees. (If a lender promises amazing rates and terms, then it’s probably too good to be true. Ask them about additional fees after closing. For example, will they charge you to withdraw money from your escrow account?)

Those are just a few of the common mistakes new and seasoned real estate investors make. And those mistakes can make a dent in their cash flow. So, their good investment is suddenly not-so-good.

Ready to talk about your next deal to ensure it’s a good investment? Great, our team is always here to chat.

Happy investing!