DSCR Loans: Is Your Credit Score Killing Your Approval Rate?

DSCR Loans: Is Your Credit Score Killing Your Approval Rate?

Many investors wonder whether or not their credit score is killing their approval rate for a DSCR loan. The answer is yes! Here at Hard Money Mike we see a lot of clients who are struggling with their credit scores and need them fixed. It is amazing how many clients are only 1 to 10 points away from either getting a loan or getting better terms. One of the biggest contributing factors is credit score usage. How can you increase your approval rate? Let’s take a closer look.

The importance of reviewing credit score usage.

Here at Hard Money Mike we require that customers use a simulator first. This simulation can be done through MyFico, Experian, Credit Karma, and shows how your credit score will change if credit cards are paid down or paid off. How can you pay off your credit card debt quickly and easily when you are looking at using a DSCR? The answer is a usage loan. Most investors have used their credit cards to make personal purchases, buy information or training materials, or rehab expenses on personal credit cards. In doing so it not only drives up their balance, but it also drives down their score. This usage problem affects 7 out of 10 investors because they are using personal credit instead of business credit.

Get into a better long term loan today!

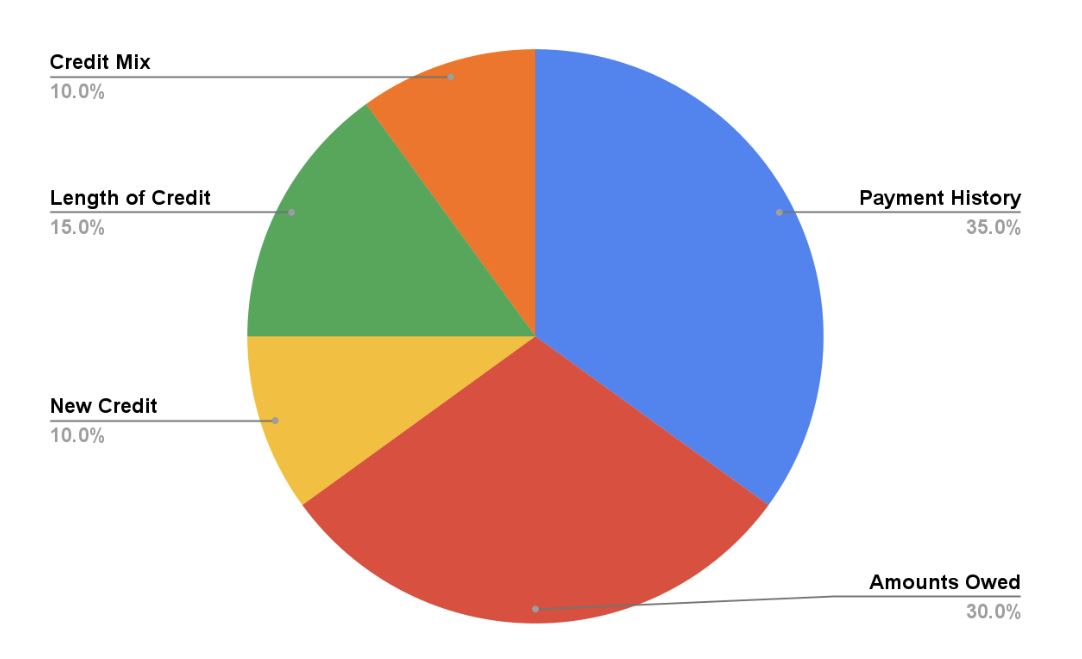

First and foremost investors need to address the areas where their credit score is impacting them the most. They can then pay it down by using another loan in order to boost the credit score quickly and easily. By running a simulation first, investors can see the areas that are impacting their credit score the most. Our main goal is to help investors get into a better long term loan. A DSCR loan is based on your credit score and the income made on the property. If your credit score is low, it will in turn affect your income because you are at a higher rate. As a result of the higher rate, it can often kill your approval rate because the amount could go above the break even point. Don’t let low credit scores ruin your chance to succeed in real estate investing.

What exactly is a usage loan?

A usage loan is a private loan that is secured with a property in order to guarantee repayment. This loan is used to pay off either all or part of your credit debt in order to increase your credit score. Again, this is where the simulator comes into play. It helps us to determine what needs to be removed from your credit in order to increase your overall credit score. Once the credit card statements cycle, the information is reported to the credit bureaus. This is what will impact your score. For example, we had a client in Detroit who was able to drop his DSCR rate by 2 points in a matter of weeks because he was able to increase his credit score.

Make the move to business credit cards today.

If you are one of the many investors who are struggling with credit score usage, have no fear. Once you get your credit score under control with the usage loan, and get the DSCR loan that you need. After that, you can then begin the switch over to business credit cards. Business credit cards are the same as personal credit cards, however, they do not show up on your personal credit. If you are new to real estate investing it is important to make this process easier and more profitable from the very beginning. This can be done by setting up your LLC, getting business credit cards, and making sure that your lenders are in line. Those who take the time to set themselves up correctly will have lower rates, better terms, and the LTV will get better as a result.

We can help you build wealth by accumulating assets.

Here at Hard Money Mike we want to help you succeed in real estate investing. Build the wealth you want by accumulating assets today! Higher credit scores will allow you to qualify for the properties you need for your success. Those who are able to accumulate assets at the best rates possible will create opportunities to build their wealth quickly and easily. Is a usage loan right for you? Contact us today to find out more!

Watch our most recent video to find out more about DSCR Loans: Is Your Credit Score Killing Your Approval Rate?