How to Raise Credit Scores in 30 Days or Less

Everyone in real estate investing knows the power of credit scores. But how can you raise credit scores quickly so you don’t miss out on deals?

The best part of real estate investing is that anyone from anywhere can begin building wealth if they know how to use leverage.

One of the biggest pieces of leverage in an investor’s toolbox is their credit score.

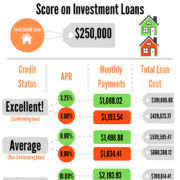

Your credit score can be the difference between a deal that makes you rich and a deal that puts you in debt. With a good score, you’ll likely find better terms, rates, and points.

However, if you’re struggling with a low credit score, what can you do to fix it? And how long is that going to take?

Identifying the Problem

If you’re using your personal credit card to cover the expenses of real estate investing, chances are you have a usage issue.

Your credit score is calculated based on the balance between two items: 1) available funds, and 2) how much of those funds you’re using (usage). If you’re constantly using all—or nearly all—of the available funds, credit companies see you as a risky investor. This lowers your score.

If this sounds like you, that’s great news! There are fairly painless ways to fix usage issues.

Unfortunately, if your score is low because you’ve struggled with late payments, there is no quick fix for that. Only time can remedy the damage caused by bad payment history.

A Quick Fix to Raise Credit Scores: Usage Loans

A usage loan pays off your credit card, transferring the balance to a private loan that doesn’t report to your credit score.

Many companies and individuals, including us, offer usage loans, and we’re happy to talk about your options at Hard Money Mike.

Usage loans have a near-instant affect on your credit score. You’ll see the change as soon as the next report processes. If you want to see how much your credit score could change if you pursued a usage loan, you can use tools on sites like Experian or Credit Karma.

If your score is low, and you’re convinced that the next deal will fix everything, here’s our advice:

Don’t play credit roulette.

Don’t put your credit score at risk while you wait for the next deal to go through. Get ahead by protecting your credit score with a usage loan.

A Long Term Fix: Business Credit Cards

Once you revive your credit score with a usage loan, what can you do to protect your score long term?

It’s pretty simple: Transfer your real estate investing to business credit cards.

Business credit cards (if you find a good one) won’t report on your credit score. Additionally, because their purpose is different, credit card companies sometimes reward high usage on business accounts even though they penalize private accounts for the same activity.

You still need to pay off these cards on time. But as long as you’re doing that, you protect your personal credit score from jeopardizing your deals.

To learn more about business credit cards or how to find the right one for you, check out our sister company, The Cash Flow Company.

We Can Help

If you want to explore a usage loan or have questions about how to raise credit scores, feel free to reach out to us at Info@HardMoneyMike.com.

We’re always happy to walk you through your options. Our goal is to help you find the right loans and solutions that fit your needs.

Happy investing!

Leave a Reply

Want to join the discussion?Feel free to contribute!