The Power of Leverage: Are You Losing Money?

These simple examples show you the power of leverage in real estate investing.

Real estate investors know they need loans to buy properties. But few real estate beginners understand exactly how big of a difference leverage makes.

Leverage turns property-buying into a real estate investment career. It builds real money, and a portfolio of net worth that can create generational wealth.

In this article, we’ll use simple examples to break down the power of leverage in real estate – and how maximizing leverage skyrockets your real estate career.

What Is Leverage?

In short, leverage means buying with money that isn’t yours in order to make a profit.

Leverage takes the form of loans from lenders: banks, credit unions, hard money lenders, people you know.

The greatest tool for a real estate investor is leverage.

How to Find the Power of Leverage

Let’s look at some simple numbers to show the power of leverage.

We’ll look for two things:

1) How much income can you get from a rental?

2) How much equity will a property generate over time?

Note: We’re going to use $100,000 as our base number. That might be a lot more money than you have to start with. It’s also likely a lot less money than you’ll spend for your properties.

Regardless, it’s a simple number to show the power of leverage. These same principles will apply despite your starting number or your property costs.

Now, let’s dive in.

Income without Leverage vs with Leverage

Rent is the income you get from tenants. Net rent is that income after you’ve made any loan payments for the month on that property.

Net rent is the number that’s true cash flow for you. We’ll use this number to analyze real estate income with and without the power of leverage.

Income No Leverage

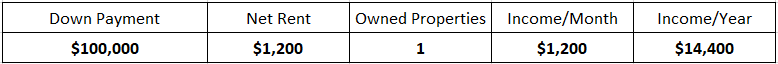

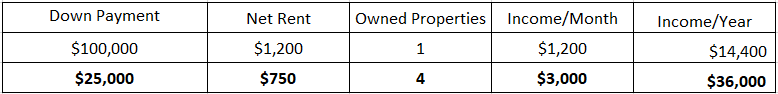

Say you have $100,000 to invest in real estate.

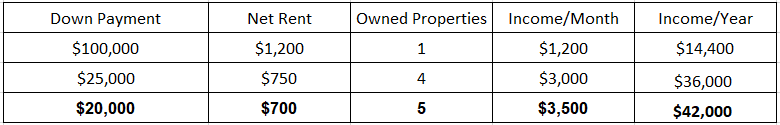

You could take this money and buy one rental property valued at $100,000. You can invest the full $100,000 and receive $1,200 of net rent income per month, or $14,400 per year.

Income With Leverage

Now let’s see how it plays out when you involve a lender rather than buying outright.

You could talk to a lender who might offer to loan you $75,000 if you put in the other $25,000. Now, instead of pouring all of your money into one rental property, you’ll only have to use $25,000. The $75,000 covered by the lender is considered leverage.

Using lenders like this, you could buy four properties, each with a $25,000 down payment. Because you’re paying a mortgage, however, your net rent per month goes down. Your net rent is now $750 per property. This brings in $3,000 per month, or $36,000 per year.

With leverage, you have the potential to make $1,800 per month more, or an additional $21,600 per year – just from using leverage.

Net Worth without Leverage vs with Leverage

Rent income isn’t the only financial outcome of buying and renting real estate. There’s also appreciation.

According to the stats over the last 20 years, real estate goes up an average of 5.3% per year. Using this 5.3% number, one home increases value by an average of $5,000 per year.

This isn’t a straight line (ie, exactly $5,000 per year). Some years may appreciate more, some less. But over the long-term, that’s the average yearly appreciation, so we’ll use this number.

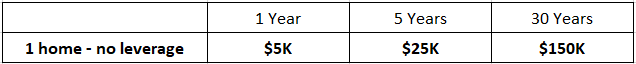

Net Worth No Leverage

Let’s see how appreciation would impact our real estate portfolio had we bought the one home outright, with no leverage.

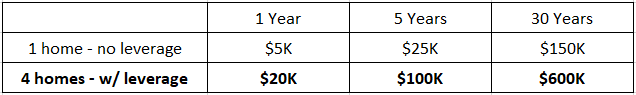

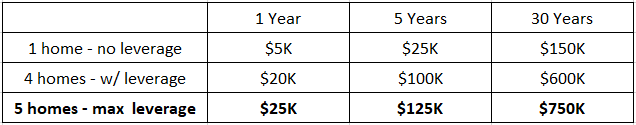

Our single rental would have $5,000 in equity after one year, $25,000 after five years, and $150,000 after 30 years.

Net Worth with Leverage

Now let’s see the equity of the four properties purchased with leverage.

Each of the four homes increases in value by $5,000 every year. Multiply that by four, and your portfolio appreciates $20,000 per year.

Over a 30-year span, your four properties would add $650,000 to your net worth (compared to $150,000 with the single property).

Total Power of Leverage

Let’s put all these numbers together now.

Using leverage brought in an extra $21,600 of income per year, plus a total net worth increase of $600,000 over 30 years.

This is the power of leverage: bringing in extra income and raising your net worth through equity.

By using other people’s money, you can take advantage of the true wealth in real estate.

Maximizing Leverage

Now, we’ll take this example one step further. Simply using leverage unlocks a lot of money. What happens when you maximize leverage?

We looked at an example of a lender giving you 75% ($75,000 on a $100,000 property). “Maximizing” that leverage would look like getting a bigger loan. Instead of 75%, another lender might give you 80-85%.

80% Leverage

Let’s go back to the original example, but say a bank gives you 5% more. Now, you get $80,000 per $100,000 transaction.

Income with Maximized Leverage

Your down payment per property is now only $20,000, so you can buy 5 properties. But since you borrowed more money, the mortgage payment is higher, and the net rent goes down.

At this point, it may seem like you’re set up to make less money since you’re paying more on your loan. But let’s see how it plays out.

Five properties with an income of $700 per month is $3,500 per month. This works out to be $42,000 per year. Annually, that’s $6,000 more than using a 75% loan, and $27,600 more than using no leverage at all.

Equity with Maximized Leverage

For five properties, after 30 years, equity appreciates by $750,000. All that money is added to your net worth.

Maximizing your leverage in this scenario would give you $42,000 in yearly income, plus $750,000 added to the value of your properties over time.

That’s the road to generational wealth.

How to Maximize Leverage

To maximize your leverage, focus on becoming the sort of investor that attracts lenders.

Have a great credit score. Make sure your income is in line. Know the numbers lenders will ask about. Be professional about your investment career.

Having all the right pieces in place will help your leverage take you further. The more leverage you use, the better returns you’ll see – both in the short-term income and long-term equity.

Harnessing the Power of Leverage

Now you can see how leverage impacts your real estate career.

What are your next steps?

If you need an entry point into real estate investment, email Mike@HardMoneyMike.com. Ask about our 30-day fuel up challenge to learn how to maximize your leverage.

You can also join our weekly Leverage Up chat, on Thursdays from 1:15pm – 2:15pm MST at this link.