Hard Money Loan Basics: Numbers to Know

The ultimate beginner’s guide to basic hard money loan numbers to know (AKA, your guide to wealth in real estate investing).

There’s money in the money when it comes to real estate investing. But the numbers surrounding hard money loans can be confusing, especially for beginners.

Many investors don’t want to learn these numbers. Just by reading this guide, you’ll be way ahead of the game.

Let’s go over these basic numbers to get you one step closer to being a real estate expert:

Hard Money Loans – Knowing the Basics

As a beginner investor, you need to know the basics about hard money loans.

The two most basic hard money questions you need to know the answers to are:

- What’s the difference between loan-to-value and ARV?

- How do you calculate them?

Know the Basics: Loan-to-Value

Loan-to-Value, LTV, involves the:

- appraised value of a property

- as it sits right now

- with nothing changed about it.

As a real estate investor, if a property costs $100,000 as it sits, you know you’re going to put work into it and make it worth more. But that as-is value, the $100,000, is what lenders base their loan amount on.

Know the Basics: After Repair Value

After Repair Value (ARV) is used more by hard money lenders and the real estate investment world. Banks and traditional lenders more often use LTV.

Because in real estate investing, we’re basing our numbers on what you can do to the property. What can the value be once you fix it up? That’s the number that determines profit, so that number is more important for hard money lenders.

ARV is the target value of what the house will be worth after all your renovations. This ARV should always be higher than the current price of the house when you buy it.

Calculating ARV and LTV

Let’s say you found an undermarket property that’s selling for $100,000. If a lender says, “We’ll loan you 75%,” that could mean two things, and you’ll want to know the difference.

First, if they’re a bank, they’re likely talking about 75% of the value. In this example, that would be:

$100,000 × 75% = $75,000 loan

Hard money lenders will care more about the value of the home after repairs, so they go off ARV. If they loan you 75%, that would be:

$150,000 × 75% = $112,500 loan

If a loan is based on ARV, lenders might want to know – what are you doing to the property? Different renovations will affect the value of the property in different ways. What you will do and the quality of the work will affect the ARV.

Know the basics about LTV and ARV, and your hard money experience will be much smoother.

Hard Money Loan Requirements

What are the requirements for a hard money loan?

What will hard money lenders lend you, and what does it take to get it? Knowing these numbers in advance will help you stay on track to getting profitable deals.

The majority of hard money lenders will lend up to 75% of the ARV.

So, let’s say a property will be worth $100,000 after all repairs, and a lender offers you 75% of that ARV. You’ll receive a loan for $75,000.

Is that enough? Now it’s up to you to crunch the numbers and see if you meet these hard money loan requirements. Will that $75,000 cover everything – the purchase, the rehab, etc.? And if it doesn’t – how much do you need to bring in? Can you make that work?

What Expenses Does a Hard Money Loan Cover?

A hard money loan covers:

- The purchase of a property.

- The rehab of that property.

100% financing is possible with a hard money loan, but it’s dependent on a lot of things – your credit score, investing experience, relationship with the lender, and more.

Let’s see an example of how the numbers on that $75,000 loan could work out to cover the flip 100%:

Loan: $75,000

Purchase Price: $50,000

Rehab: $25,000

If it’s possible to keep rehab costs at $25,000, you could get this $50,000 property 100% financed by a hard money loan, if the ARV is $100,000.

But let’s say rehab ends up costing $35,000. The total cost of the project would be $85,000, but your loan only covers $75,000. You’d have to come up with that extra $10,000 somewhere else – either from an alternative lender or from your own pocket.

Know the numbers to help you plan ahead with your hard money loan. If you know up-front that rehab will cost $35,000 on this property, you’ll know to only go through with the deal if you’re able to bring in that additional $10,000.

The 75% Rule Hard Money Loan Requirement

You can learn ahead of time whether your project can be 100% covered by a hard money loan. Just follow the 75% rule: make sure the costs of your project are under 75% of the property’s ARV.

Hard Money Loans Calculations

We’ve gone over some of the basics, but there are a few more hard money loans calculations to know.

Hard money lenders – especially national lenders – have two important numbers they go by.

First, 75% of the ARV is the maximum they’ll lend you.

Second is a more specific breakdown of how that money will be used, usually referred to as 90/100 or 80/100.

Know the Numbers: What Is the 90/100 Number in a Hard Money Loan?

This number is usually around 90/100, but lenders can tighten down to 80/100 or lower. But what does this number mean?

The first number is the percentage of the loan that goes toward the purchase. The second number is the percentage that goes toward rehab. The higher the numbers, the less of your own money you have to put down.

In the case of 90/100, that means your loan will cover 90% of the purchase and 100% of the rehab.

But whatever that calculation is, it still has to be less than 75% of the ARV. Here’s an example

90/100 Calculation Example

Let’s use the numbers from our last example to look at a 90/100 loan. We’ll take 90% of the purchase price.

Purchase Price: $50,000

50,000 × 90% = $45,000

So, $45,000 of your loan must go toward the purchase of the property. But since it costs $50,000 total, you’d have to bring in the additional $5,000.

Rehab: $25,000

25,000 × 100% = $25,000

So, $25,000 of the loan will go toward rehab. That covers all of it, so you wouldn’t need to put any of your own cash into repairs.

So what would this 90/100 loan cover total?

$45,000 + $25,000 = $70,000

90/100 vs 75% Rule

But wait, that 90/100 loan example only gave you $70,000. The 75% rule on the same property said you could get a $75,000 loan. So which is it?

The 75% rule (hard money lenders loaning 75% of the ARV of a property) isn’t a guaranteed loan amount. It’s the maximum loan amount.

This maximum rule becomes more relevant as the deals get riskier.

Lenders don’t like risky deals because there’s a good chance you’ll lose money or only breakeven.

Here’s how our previous example could become much riskier and the 75% rule would become more important:

Let’s say we have that same property with an ARV of $100,000. But this time, the purchase price is bigger.

Purchase Price: $60,000

Rehab: $25,000

Now, let’s apply the 90/100 principle:

60,000 × 90% = $54,000 loan for purchase

25,000 × 100% = $25,000 loan for rehab

Total loan amount = $79,000

So if a loan covered 90% of this purchase price plus all of the repair costs, the total loan would need to be $79,000.

But the 75% rule says your max loan for this property with a $100,000 ARV can only be $75,000. So, in this case, you’d get the loan for $75,000, and be stuck bringing in that extra $4,000 the loan didn’t cover.

Why the 75% Rule?

The 75% rule protects you from the other costs from your project. You’ll still have to pay for selling costs, overhead, and loan fees. Yet you’ll still want at least 10% – 15% profit.

If your loan by itself is any more than 75% of your ARV, you’d be set up to make little to no money.

Lenders want to stop you before you get started if they can see there’s a good chance you won’t make a profit. They want to encourage good deals, and discourage deals people won’t be able to follow through on.

The bottom line: remember there are two numbers. The 75% rule is the maximum amount they’ll lend you overall. The 90/100 (or 80/100, etc) tells you the amount of the loan they’ll allocate to purchase and rehab.

What If I’m Still Confused?

These hard money calculations, numbers, and requirements can be overwhelming if you’re not used to them. Luckily, you don’t have to memorize all this stuff right off the bat.

Download our deal analyzer here. With this spreadsheet, all you have to do is enter the numbers. It does the math for you to help you decide whether to pursue your deal, and how much money you’ll have to bring in if you do.

A tool like this can help you know the numbers before you go to your hard money lender. Life is easier for everyone, and more profitable for you, when you know the numbers of a hard money loan.

Calculating Hard Money Loans for BRRRR

If you’re looking at the rental side of real estate investing with BRRRR, what are the numbers you need for a hard money loan? What do you look for in a profitable flip?

BRRRR was designed to let investors get into rental flips with almost no money down. How do you do it? The 75% rule.

What does that mean, and how do we calculate it?

With BRRRR, there’s two loans involved. The first (hard money) loan is to purchase and fix up the property. And the second (bank) loan is to refinance for the long term.

To make the BRRRR process happen with no money down, you have to know ahead of time that you can keep costs under 75% of the ARV.

The Math on a BRRRR Hard Money Loan Using the 75% Rule

75% of what your property will be worth (ARV) is your cap for costs.

Let’s say you’re buying a property, and based on the neighborhood, comps, and all other appraisal considerations, the ARV is $200,000.

Using the 75% rule would give us:

200,000 × 75% = $150,000

Your hard money loan could be up to $150,000. This means if all your costs for the project stay under $150,000, you don’t have to bring any money in.

With this example, it would be doable:

Purchase Price: $125,000

Rehab: $25,000

Total cost: $150,000

If you could keep rehab costs at $25,000 for the project, all costs would be equal to the 75% ($150,000) loan we’d receive.

If we take the same example, but the purchase price was $140,000 with $25,000 of rehab costs, you’d end up putting in $15,000 of your own money. Still doable, but more expensive.

100% BRRRR Financing in the Future

As the economy turns and we begin to see more foreclosures, BRRRRs will be a great opportunity to build up a bigger real estate portfolio with no money down.

The opportunities are out there, but to do it, your costs have to be at 75% or lower. This number might tighten in the near future to 70%, but all the same rules still apply.

If you know your numbers before you buy, you can use a BRRRR hard money loan to your full advantage with zero money down.

Hard Money Calculator

A hard money calculator is another important tool to help investors know the numbers of a hard money loan.

Beginner and experienced investors alike need to know the difference between loans offered by different hard money lenders.

How Does a Hard Money Calculator Work?

Some lenders will charge higher interest rates with no points. Some will charge higher points, which are percentage points taken out for fees, but have a lower interest rate.

The numbers get complicated fast. How can you compare all this for your specific deal?

The best way to figure out these numbers is to use our loan optimizer, with a free download here.

With this loan optimizer, you insert all the numbers – the loan amount, required down payment, interest rates, points, fees, etc – from up to three different lenders. Then the calculator does all the math to show how much each loan would actually cost.

It’s a simple way to compare lenders in your area and find the best price.

Example of a Hard Money Loan Calculator

Finding the cheapest loan for your deal can save you thousands of dollars on your project.

(Note: It’s good to shop around to find the best numbers, but don’t shop around forever! Or else you’ll never get to know a lender well enough to get preferential treatment.)

Here’s a walkthrough of how a loan optimizer might compare two lenders:

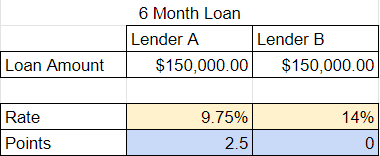

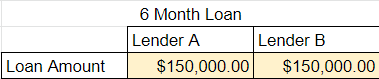

Loan Amount

Let’s say for a potential deal, you need a loan for $150,000. Both lenders we’re comparing are going to give you that full amount:

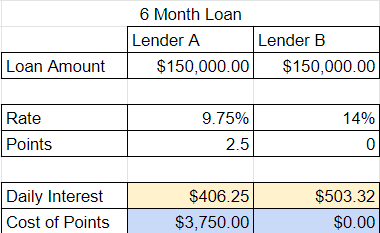

Interest Rates, Points, and Their Costs

But let’s say Lender A and Lender B have different rates (interest rate) and points (percentage taken out for fees).

Many beginner investors look at this and think, “Well, I don’t want a lender with so many points. I don’t want to just be paying fees.” But they fail to actually do the calculations. You’ll be surprised which loan will save you the most money.

A loan optimizer will calculate the cost based on these rates and points:

As we can see, the daily interest combined with the cost of the points makes Lender B look like the cheaper option so far.

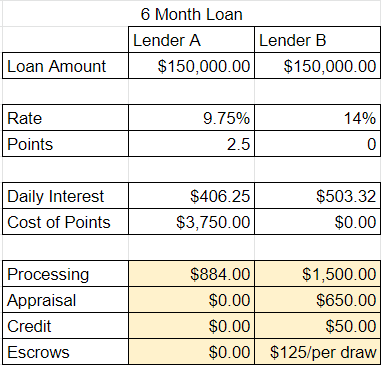

Other Fees

But there’s one more crucial cost we still need to take into consideration.

Often, lenders who charge zero points up-front end up charging a lot of “junk fees” later. Here’s the example of Lender A and Lender B with all the extra fees highlighted:

The various fees charged by Lender B add up quickly, making Lender A suddenly look a lot better.

Final Costs

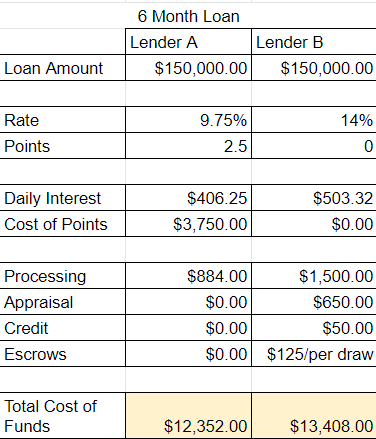

But let’s check with a final calculation which lender would be the cheaper choice:

Here’s our final calculation by our loan optimizer. By the end of the six months, we’d be paying $12,352 to Lender A, or $13,408 to Lender B.

So, Lender A, who had more points up-front, is the cheaper option – by over a thousand dollars!

Yet, if we’d judged these lenders based on our first impression of interest rate and points, we might not have gone with Lender A.

This is why it’s always important to use a loan calculating tool when shopping for hard money lenders. Know the hard money loan numbers – it can be simple! Click this link for the free download of our loan optimizer.

Know the Numbers of a Hard Money Loan

When you know the numbers, you’ll pick more profitable deals and cheaper loans.

There’s money in the money. There’s money in the numbers.

But you probably won’t become an expert in the numbers overnight.

Reach out to us at HardMoneyMike.com with questions about your deals, or with general questions about hard money numbers.

Happy Investing.

Leave a Reply

Want to join the discussion?Feel free to contribute!