Investor Mortgage Report 6.4.2020

Thankfully, it’s looking like another great week for standard conventional mortgage rates.

So far this week, all evidence is pointing towards increasing stability and improvements on the conventional mortgage front.

- Depending on whether you pay your mortgage person points or you have them wrapped into your loan, rates fluctuate between low 3’s and low 4’s.

- We’re seeing great rates on the conforming side.

- Every week, the non-traditional loans are reappearing with increased frequency.

- Some lenders have decreased credit score requirements to 680.

- Rates are still on average above 7%, but signs are showing that they will drop soon.

- LTVs are inching higher, but not to the degree we have seen them in the past.

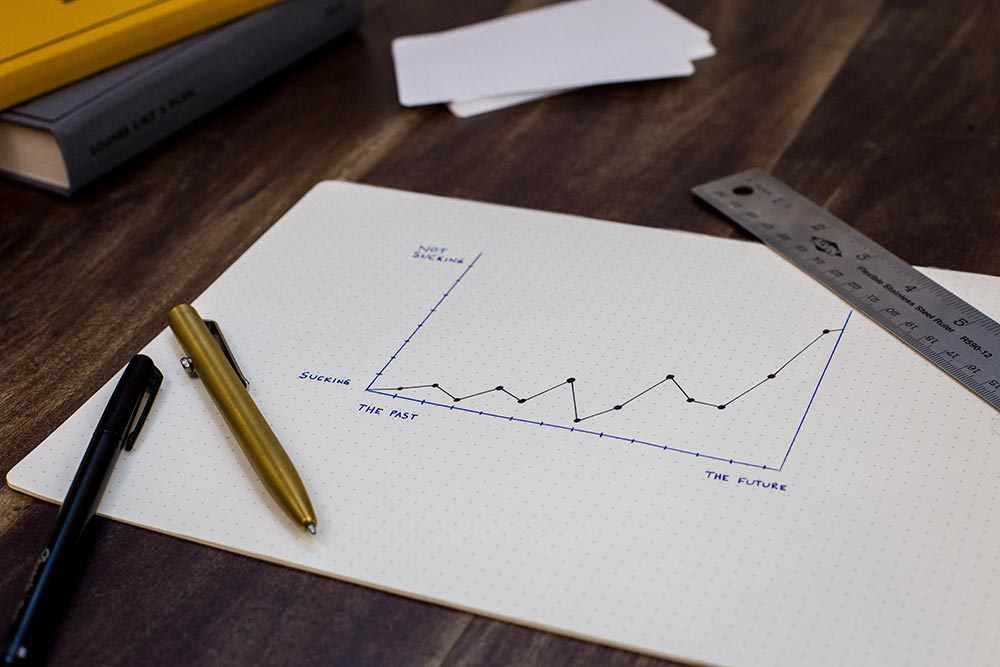

In short: conventional mortgage interest rates are really good. But what does that mean for you?

How do you know when it’s smart to refinance your rental (or any) property?

Let’s face it: as rates drop, the question of whether or not to refinance runs through all our minds.

Would you like to find out (without the sales pitch from your mortgage person?)

Anyone can crunch the numbers in just a few minutes with just a few items.

Yes. It involves math. But we swear it’s EASY.

For now, all you need is a piece a paper, a pen, a calculator, and your mortgage information. (You can pull this info directly from your mortgage company’s website). Then, follow these three steps:

Step 1: Locate the amount you pay monthly for principal and interest. (Ignore everything but your principal and interest (i.e. taxes and insurance).

Step 2: Locate the number of months remaining on your loan.

Step 3: Multiply your monthly payment by the number of months you have left on your loan.

That’s it!

Let’s look at an example:

A: Your monthly principal and interest payment is $1,200.

B: You have 288 payments left on your loan.

C: $1,200.00 X 288 = $345,600

(Scary sometimes to see how much you really owe, isn’t it? Don’t panic.)

Now, let’s say that you have an opportunity to refinance and lower your interest rate with a new payment of $1,100. Should you do it?

Let’s take a look:

On your new loan, you’d pay $1,100.00 for 30 years (or 360 months). That’s $1,100.00 x 360 = $396,000.00

If you refinance, you’d increase your monthly cash flow $100.00. However, as a result, you’d pay an extra $50,400.00 over the life of your loan!

So, is the extra $100/month worth an extra 72 months (6 years) of mortgage payments? Does refinancing make sense for you financially? Well, that’s up to you.

Perhaps cash flow is more important at this time in your business life and paying the extra years is ok with you. That’s a decision only you can make. At least when you know all the numbers, you can make your call an educated one.

Try it on all your loans and find out what makes sense for you!

Your payments __________________ Months remaining _______________

Total remaining to be paid ___________________

Okay, we’re sure a few questions are swimming around in your head, so we’ll see if we can answer some of the most common ones upfront:

Q: “What if I’m not going to keep the property for 24 or 30 years? At what point does it make sense to refinance?”

A: That’s coming up in the next article.

Q: “What if I want to use those savings and pay down my mortgage?”

A: We’ll be addressing that in a future article as well.

Q: “What is my breakeven interest rate?”

A: There are so many paths you can go down and we’ll cover as many as we can. We’ll also provide a tool for you to run all these scenarios.

Today, it’s all about knowing your raw numbers.

Want an investor tool that can run these numbers (plus your breakeven rate and many more) in seconds? We have one in the works. Just get on our contact list, and we’ll let you know when it’s ready!

By knowing these numbers, you can save tens of thousands on each refinance.

Don’t worry if math isn’t your “thing.” If you don’t feel like doing this or worry the math might overwhelm you, we’ve got your back. Shoot us an email with your current statement and we can run them for you.

Leave a Reply

Want to join the discussion?Feel free to contribute!