Tag Archive for: investor tool

2 Key Pillars of BRRRR

/in Finance Tools, ResourcesBRRRR is great, but did you know there are 2 key pillars of BRRRR that most investors don’t know about? Whether you’re just starting out with real estate investing, or you’re an ol’ pro, you should consider taking advantage of these crucial steps to ensure you don’t miss out on cash boosting opportunities.

Take a look at this video and learn about the two key pillars of the BRRRR method.

If you invest in rental properties, then you need to:

- Buy under market properties (i.e. wholesale).

- Use the Quick to Buy, Quick to Refi strategy.

These steps help you maximize your loan amount while limiting the cash you need to put into each deal. They also ensure you’re able to buy more deals and build your portfolio at a faster pace.

Through research and conversations, we discovered many investors are confused about how to get going on a deal with little to no money. So, we’ve taken a step back and tried to figure out why that is.

We found out many investors don’t understand the power of the appraisal/ARV. When you get into a long-term loan, you get to use the appraisal value/ARV. It doesn’t matter what you originally paid for the property or the amount of money you put in to fix it up. As long as you set up the loan properly, then you should be able to use the appraised value/ARV.

If you’re ready to maximize your cash flow, capture lots of free equity, and live the life you want, check out the full video.

Want more videos with more tips to maximize your cash flow? Subscribe to our new YouTube channel!

BRRRR Is Out, BARRRR Is In

/in ResourcesCheck out this article from Bigger Pockets! There’s a brand new, enhanced way to look at the BRRRR strategy that could save you a lot of money.

It’s called BARRR: Buy, ADVERTISE, rehab, rent, refinance, repeat.

“Consider it a much-needed addition that has the potential to save you tax dollars, perhaps allowing you to take your spouse out to that super high-end restaurant downtown…”

Read all about the BARRRR strategy here!

Investor Mortgage Report 6.4.2020

/in Finance Tools, Resources, Tips

Thankfully, it’s looking like another great week for standard conventional mortgage rates.

So far this week, all evidence is pointing towards increasing stability and improvements on the conventional mortgage front.

- Depending on whether you pay your mortgage person points or you have them wrapped into your loan, rates fluctuate between low 3’s and low 4’s.

- We’re seeing great rates on the conforming side.

- Every week, the non-traditional loans are reappearing with increased frequency.

- Some lenders have decreased credit score requirements to 680.

- Rates are still on average above 7%, but signs are showing that they will drop soon.

- LTVs are inching higher, but not to the degree we have seen them in the past.

In short: conventional mortgage interest rates are really good. But what does that mean for you?

How do you know when it’s smart to refinance your rental (or any) property?

Let’s face it: as rates drop, the question of whether or not to refinance runs through all our minds.

Would you like to find out (without the sales pitch from your mortgage person?)

Anyone can crunch the numbers in just a few minutes with just a few items.

Yes. It involves math. But we swear it’s EASY.

For now, all you need is a piece a paper, a pen, a calculator, and your mortgage information. (You can pull this info directly from your mortgage company’s website). Then, follow these three steps:

Step 1: Locate the amount you pay monthly for principal and interest. (Ignore everything but your principal and interest (i.e. taxes and insurance).

Step 2: Locate the number of months remaining on your loan.

Step 3: Multiply your monthly payment by the number of months you have left on your loan.

That’s it!

Let’s look at an example:

A: Your monthly principal and interest payment is $1,200.

B: You have 288 payments left on your loan.

C: $1,200.00 X 288 = $345,600

(Scary sometimes to see how much you really owe, isn’t it? Don’t panic.)

Now, let’s say that you have an opportunity to refinance and lower your interest rate with a new payment of $1,100. Should you do it?

Let’s take a look:

On your new loan, you’d pay $1,100.00 for 30 years (or 360 months). That’s $1,100.00 x 360 = $396,000.00

If you refinance, you’d increase your monthly cash flow $100.00. However, as a result, you’d pay an extra $50,400.00 over the life of your loan!

So, is the extra $100/month worth an extra 72 months (6 years) of mortgage payments? Does refinancing make sense for you financially? Well, that’s up to you.

Perhaps cash flow is more important at this time in your business life and paying the extra years is ok with you. That’s a decision only you can make. At least when you know all the numbers, you can make your call an educated one.

Try it on all your loans and find out what makes sense for you!

Your payments __________________ Months remaining _______________

Total remaining to be paid ___________________

Okay, we’re sure a few questions are swimming around in your head, so we’ll see if we can answer some of the most common ones upfront:

Q: “What if I’m not going to keep the property for 24 or 30 years? At what point does it make sense to refinance?”

A: That’s coming up in the next article.

Q: “What if I want to use those savings and pay down my mortgage?”

A: We’ll be addressing that in a future article as well.

Q: “What is my breakeven interest rate?”

A: There are so many paths you can go down and we’ll cover as many as we can. We’ll also provide a tool for you to run all these scenarios.

Today, it’s all about knowing your raw numbers.

Want an investor tool that can run these numbers (plus your breakeven rate and many more) in seconds? We have one in the works. Just get on our contact list, and we’ll let you know when it’s ready!

By knowing these numbers, you can save tens of thousands on each refinance.

Don’t worry if math isn’t your “thing.” If you don’t feel like doing this or worry the math might overwhelm you, we’ve got your back. Shoot us an email with your current statement and we can run them for you.

5 Things Fix-and-Flip Shows Don’t Tell You

/in Resources5 Things Fix-and-Flip Shows Don’t Tell You

Fix and flip shows present a skewed reality. There is a defined formula that’s followed throughout each episode. Every moment of the show presents the best experience of working on a fix and flip without including much of the hard work that happens behind the scenes.

Read the whole article here.

Do you want help with your fix and flips? Then check out our investor tools!

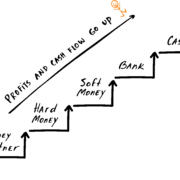

Take Advantage of the Fix and Flip Escalator

/in Finance Tools, ResourcesNow that you’ve seen the benefits of the Fix and Flip Escalator, let’s talk about what you can do to take advantage of it!

- Start with what you have and see how you can enhance it. For example, what are your assets and experience level, and how can you use them to accelerate yourself up the escalator?

- Show off your work! Create a portfolio. The more you analyze your project history the more likely bankers and lenders will fight for your business.

- Fix your credit. Your credit should range between 670-800+. If it’s below that, you should focus on fixing it.

- Keep up to speed on the finance world. Be aware of what products are available to support your current and future plans.

- Find people who can help you with the finance stuff. Because, again, math. Ugh!

- Create a roadmap to financial success!

By moving away from an expensive partner and heading toward profit boosting cash, you’re sure to make A LOT more money A LOT faster.

Which means you can start fulfilling all of your lifelong dreams sooner.

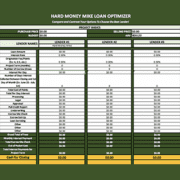

Loan Optimizer Explainer

/in Finance Tools, ResourcesLooking for a powerful tool to analyze the financing of your next project? Then check out our new explainer about the Loan Optimizer!

If you’re ready to download this beneficial tool, click here.

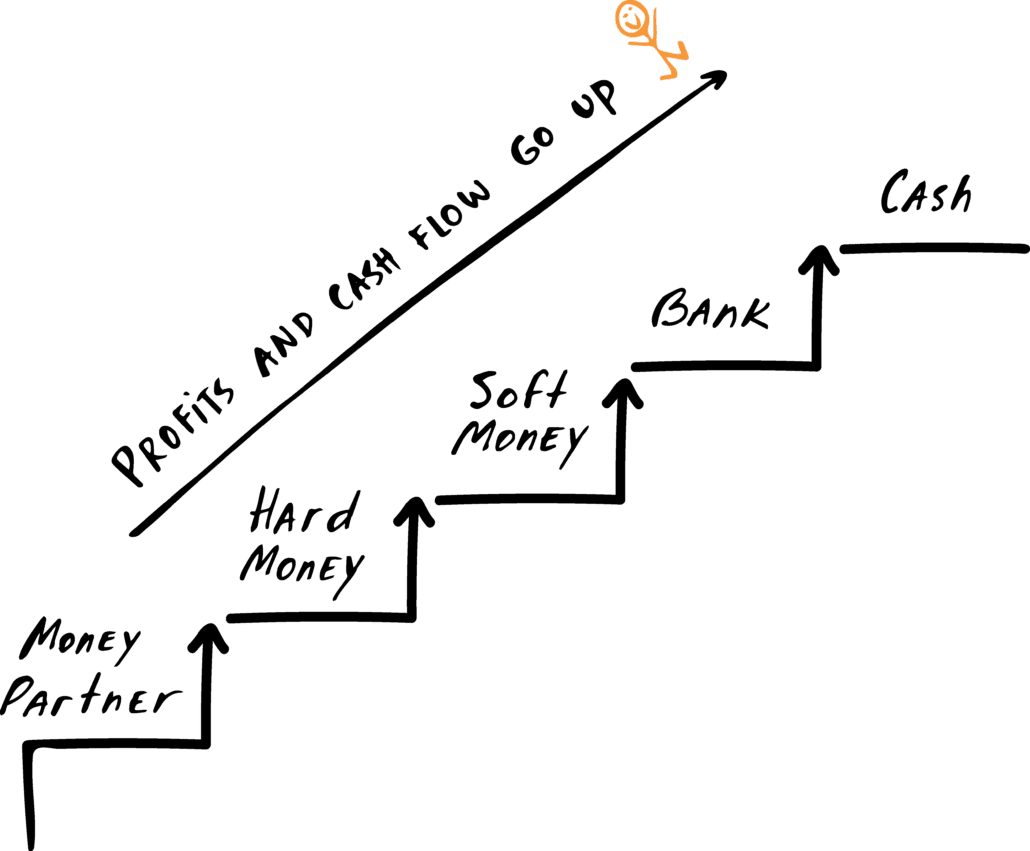

Fix and Flip Escalator: Bigger and Better

/in Finance Tools, ResourcesWhen you use the Fix and Flip Escalator, you’ll quickly realize it’s not magic. It’s SIMPLE math.

This week, let’s use the escalator to see what your money does when you complete four deals per year.

Hard Money > Soft Money

Profits increase by $12,000

$12,000 x 4 deals = $48,000

Hop up another step to bank financing, and this happens:

Hard Money > Banking

Profits increase by $17,000

$17,000 x 4 deals = $68,000

Then look at how your profits skyrocket over the course of two years:

Hard Money > Soft Money

$48,000 x 2 years = $96,000

Hard Money > Banking

$68,000 x 2 years = $136,000

You know what these numbers mean, right? Yes, instead of losing $136,000, you’re making $136,000. That’s money you can reinvest or spend on…anything! Hey, it’s your money. You can do whatever you want with it.

Are you ready to hop on the escalator yet? If so, contact us!

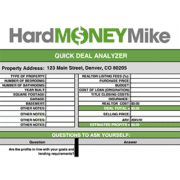

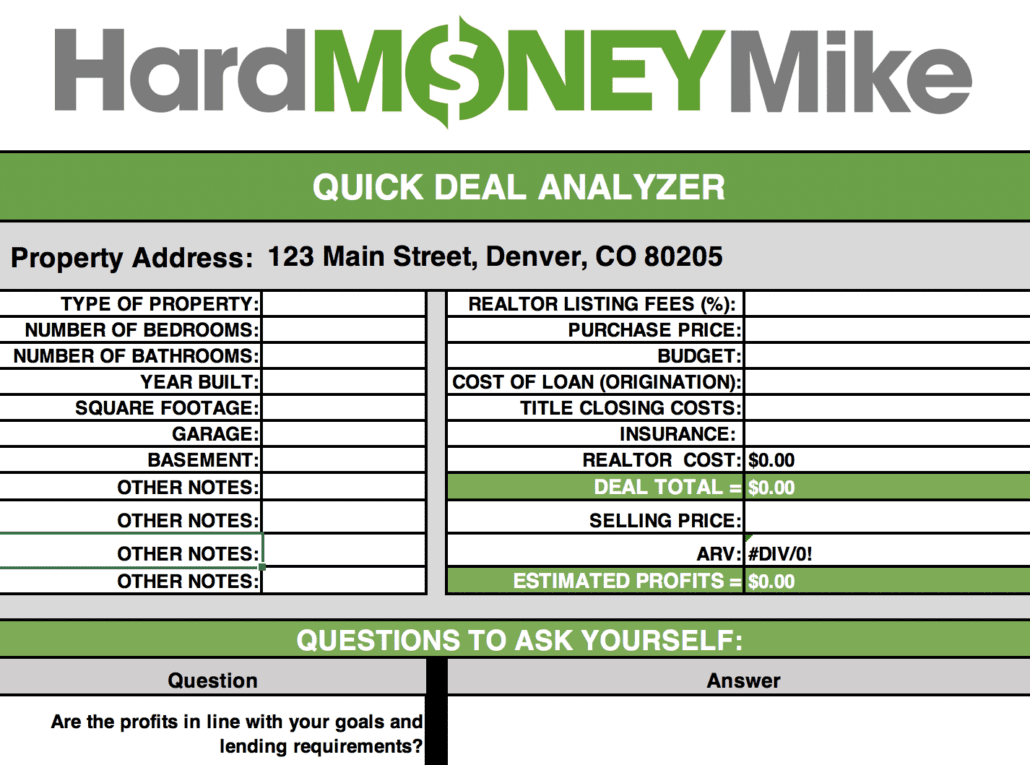

Product Intro: Quick Deal Analyzer

/in Finance Tools, ResourcesIntroducing the new Quick Deal Analyzer from Hard Money Mike!

With the Quick Deal Analyzer, you’ll be able to find out:

- If the estimated profits are in line with your goals.

- If the ARV will work for you and your lender.

- If the project is worth the effort at the end of the day.

If you’re interested in making more money on your next deal, download the Quick Deal Analyzer here.