How Your Credit Score Impacts Your Real Estate Investments

If you want to maximize leverage in your investments, you need to know this key information about your credit score.

There’s nothing more disappointing than this…

You’ve searched everywhere, but can’t seem to find a decent loan.

Money keeps getting sucked away with high interest rates and down payments.

Even when you find good properties, you never seem to come out on top.

…But your real estate investment was supposed to help you start living your dreams.

What’s going wrong on the money side of your investments?

Your Credit Score Matters

Your credit score could be the number one thing holding you back.

A credit score impacts cash flow from real estate investments. It determines interest rates, out-of-pocket costs, and what kinds of loans you can get.

With a low credit score, you’ll have:

- Higher interest rates

- Higher down payments

- Fewer loan options available

What Is a Credit Score?

A credit score is a number between 0 and 850 that tells financial institutions whether or not it’s wise to lend to you.

Your score is determined by several pieces of information about your finances.

But the two most important are payment history and accounts owed.

It comes down to:

- Do you pay your credit cards and loans back on time?

- And do you use less credit than is available to you?

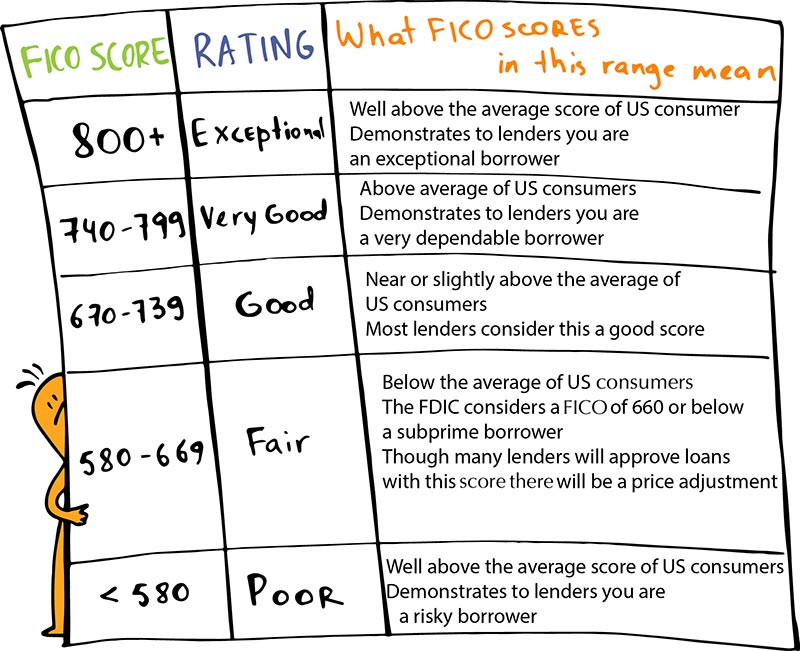

What Should My Credit Score Be?

With a score of 800, you’re almost guaranteed to hear “yes” from any lender.

At 740 and higher, you’ll still have access to the best loans with the best rates.

Between 670-739 is still a good position, and you can get decent rates.

And a score below 670 will be detrimental to your real estate investing experience.

Lending credit scores

But if you’ve just realized you have a low credit score, don’t lose hope.

How Can My Credit Score Maximize My Leverage?

The higher your credit score, the higher your leverage. Lenders look for people with high credit scores. Having a better score will open up doors for you to find:

- Better loans

- More quickly than you would with a lower score

- From a wider variety of financial institutions

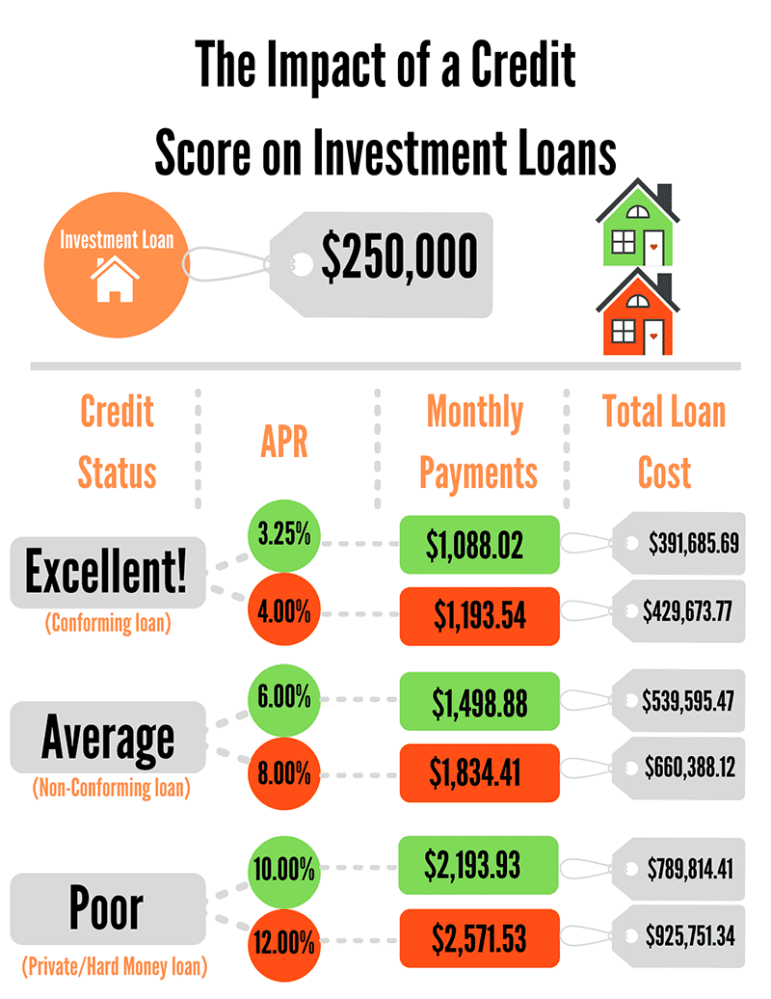

Interest Rates

A good credit score will get you loans with better interest rates.

A significant amount of money can leak out of your deal from bad interest rates brought on by your credit score.

To put it in perspective: If you end up paying $500 per month on interest, that becomes $18,000 after three years. That’s $18,000 that could have been your profit that goes directly to the lender instead. With a better credit score, you can find a loan that keeps more of your money in your pocket.

Down Payment

Let’s say you found a great property for sale for $300,000. With good credit, you may only be asked to put 10% down – or potentially even 0%! With a lower credit score, though, you’ll likely be asked for a 20-25% down payment.

For the same $300,000 deal, good credit can mean the difference between paying $30,000 out-of-pocket or $70,000!

What To Do Next

Your credit score determines whether you take the easy road or the hard road with your real estate investing experience.

If you don’t already have a credit score of 800, focus on raising your credit score before anything else. Doing this will earn you:

- Lower interest rates

- Lower down payments

- More loan options

- A more successful investment!

It’s hard enough to find properties, find contractors, find tenants, find sellers… make it easier on yourself to find lenders.

We want to help you succeed in your investments.

For more help with understanding and improving your credit score as a real estate investor, check out these helpful videos on our YouTube Channel.

You can also download our Credit Score Checklist at this link.

Happy investing.

Leave a Reply

Want to join the discussion?Feel free to contribute!