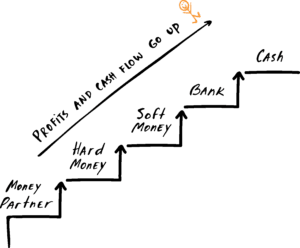

Okay, now that you get the basic gist of who’s who on the escalator, let’s run through some examples. That way you can see for yourself how moving down the escalator means higher profits and lower costs.

Ready to roll?

Let’s go:

So, you need a loan for $250,000. That covers purchase price and repairs.

After 6 months of hard work, you fix the property and sell it for $335,000 (nice job!).

Once you take into account all of your holding, closing, and realtor costs, you should walk away with $50,000.

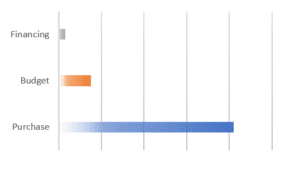

Now, let’s run these numbers down the Fix and Flip Escalator so you can see how your profits drastically vary depending on which step you’re standing on.

Partner/Mentor

Although your partner will take care of the cashflow, they’ll claim at least 50% of the profits. They might even claim the deal as a training fee.

So, instead of walking away with $50,000, you might walk away with $15,000-$25,000.

Yeah, you could do way better.

Hard Money

On average, a hard money lender will charge 4 points and 12% interest (1% a month). They might even deny you the full loan amount you requested—ugh!

Now, instead of $50,000, you’ll be lucky to walk away with $25,000.

That’s better than what you could make with a partner, but still nothing to write home about.

Soft Money

You’ll pay closer to 2 points and 8% interest, but you need to put cash into the deal to get it done—let’s say $40,000. (Just remember, when you put money into the deal, you’ll make more money at the end.)

That means you’ll walk away with $37,000.

Things are starting to look up! Keep going.

Bank Funding

On average, the bank will only charge 1 point and 5.5% interest…and possibly a few other fees.

Like soft money, you need to put money into the deal. In this example, we’ll say $50,000. It’s a large chunk of money, but it’s worth it, because….

You’d walk away from closing with $42,000.

Yippee!

Cash:

You need a lot of cash, and you might have to minimize the number of projects you can take on. But, it pays off because now you’re walking away with $50,000.

Pop that champagne and give yourself a much-deserved toast!

Ready to start making more with your fix and flips? Give us a call and we’ll show you how the escalator works for you.