Tag Archive for: Hard Money

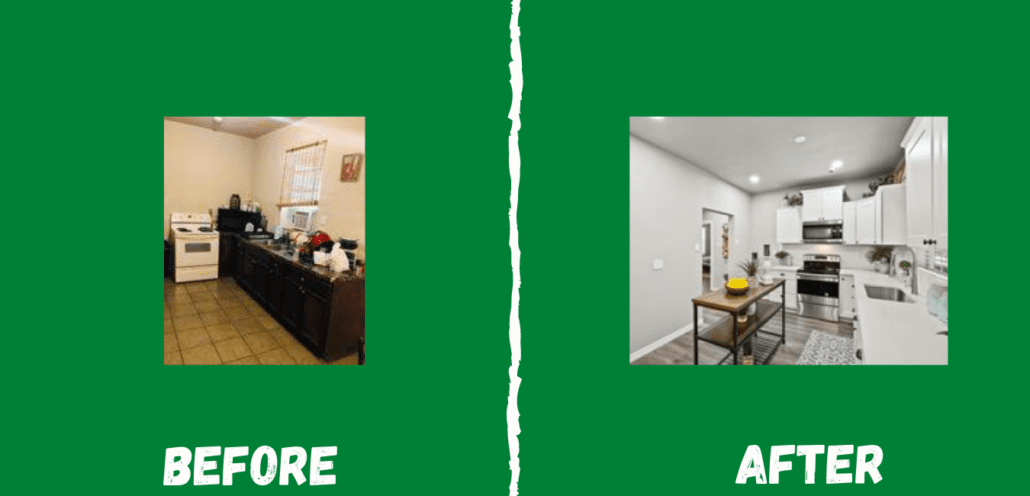

BEFORE AND AFTER PHOTOS FIX/FLIP TEXAS

/in UncategorizedWow! Look at these great before and after photos from one of our repeat clients in Texas!

This property is a shining example of what the real estate investing community is all about.

Let’s all keep making these communities better and enjoying a profitable rehab.

Money Mike is a lender based in Colorado, lending money on all types of commercial based properties: fix and flip, land, whole tailing, and builder bridge loans.

Call Mike Bonn at: 303-539-3000 or email Mike@HardMoneyMike.com

How Much Does Hard Money Cost?

/in Resources

How much does hard money cost? Are these loans expensive?

Is hard money expensive? The quick answer is no, when used correctly.

Hard money loans are actually cheap when used in transactions that fit what they’re intended for.

Pros of Hard Money

Hard money loans are helpful in a few ways:

- Using hard money is cheaper than taking on a partner.

- Hard money lenders focus on real estate investors, unlike most banks.

- It’s easy to qualify for.

Getting a hard money loan is much quicker than the process for a bank loan. In the real estate investment community, closing quick will: 1) get you the deal first, and 2) often get it at a better price.

When investors add up the savings they can get by closing fast with hard money loans, it’s clear this form of financing is a bargain. Missing out on deals and discounts can be the end of your lucrative real estate investing business.

When NOT to Use Hard Money

That being said, hard money does not belong everywhere. Used wrong, it can cost you big time. Here are some things to keep in mind:

- It does NOT replace a bank loan.

- If you have 30 to 60+ days to close and have a bank that works well with investors, you should be using a bank over hard money.

- If you don’t expect to sell or refinance ASAP, a hard money loan probably isn’t right for you.

When hard money loans are used on the right deals for the right borrower, they put more money in your pocket. To increase your speed of investing and increase your cash flow hard money is one of the best tools.

At the end of the day, is it not your goal as a real estate investor to put more money in your pocket?

How Much Does Hard Money Cost?

How much do hard money rates cost? Typical hard money across the country runs from between 8% to 14%. Your actual rate will depend on your loan-to-value and your specific lender’s points and policies.

People see that these rates are higher than bank loans, and they assume it’s a scam. You have to remember that the flexibility, speed, and ease of hard money loans used right helps them pay for themselves.

How to Get a Hard Money Loan

Hard Money Mike has been assisting real estate investors for over 20 years. What form of financing are you looking for?

Contact us for hard money, traditional lending, and setting up bank lines of credit. Email us any questions at Info@HardMoneyMike.com.

Lastly, for more real estate investing resources:

- Check out the videos on our Youtube channel.

- Follow us on Twitter for real estate investing breakdowns.

- Join us on Facebook for daily content to help you grow your business.

Get connected and accelerate your cash flow. Happy Investing.

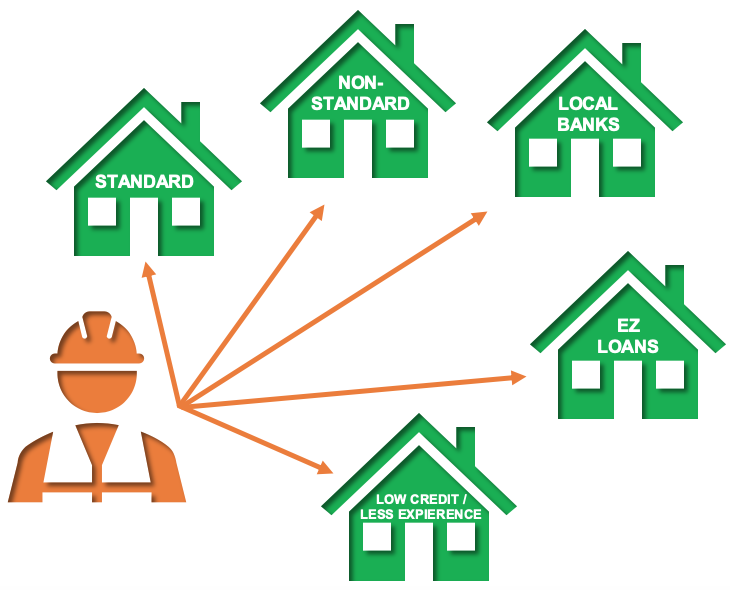

5 Paths to Financing Your Loan

/in ResourcesDid you know you have more than one option when it comes to financing your property investments?

As you can see, there are 5 paths to take with financing your properties:

- Standard/Traditional

- Non-Standard

- Local Banks

- EZ Loan

- Limited Credit or Experience Loans (also known as Non-QM)

So, which loan type is best for your project so you can boost your cash flow and reach your goals faster? Find out here on our sister site, Investor Real Estate Loans.

What’s Your 2-Year Plan?

/in Motivation, ResourcesClose your eyes. Clear your mind. Take a deep breath.

Now, let’s pretend we’re talking to each other two years from now. What happened during that time period that made you proud and put a smile on your face? How does your cash flow look? What kind of work schedule do you have? How does life look for you and your family?

When it comes to investing, we have discovered that thinking ahead two years leads to the most success. Why two years? Well, it’s short enough to imagine without being overwhelming, and it’s long enough to create tangible, positive change in your life.

Coming up with a plan is as easy as one, two, three:

Step 1: Imagine where you want to be in two years.

Step 2: Evaluate where you’re starting at today.

Step 3: Create a plan that connects your current reality to your future dreams.

How do you formulate an actual plan? Well, that’s what our team is here to help you do. It’s just a matter of picking up the phone and giving us a call to chat.

One conversation can change your future…and your life!