The Truth About Hard Money: 3 Steps to Make Hard Money Cheaper

The Truth About Hard Money: 3 Steps to Make Hard Money Cheaper

Have you ever wondered you can make hard money cheaper? Or have you always assumed there’s no such thing as “cheap” hard money?

Well, it’s time to explore the truth about this investor-friendly lending option. Because one of the biggest misconceptions about hard money is it’s took expensive.

Spoiler alert…This assumption is false!

Here’s the truth. Getting a hard money loan doesn’t mean automatically paying 12% interest or higher. Actually, if you take these 3 steps, you can pay a lot less for it.

Experience is everything

That’s right. If you can prove you have real estate experience, a lender will feel a lot more confident giving you money. And when a lender feels confident about a client, they will offer lower rates.

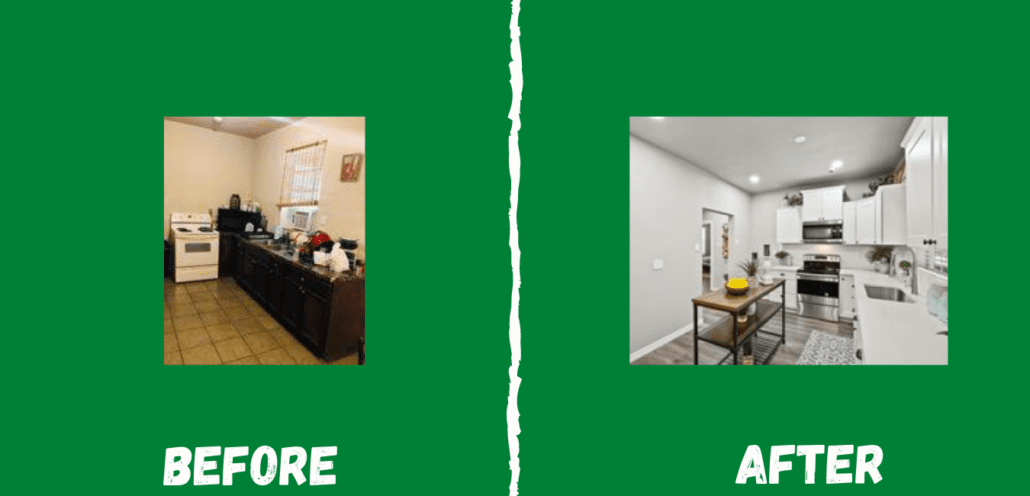

How can you present your experience to a hard money lender? Well, the best method is to create a real estate portfolio. This portfolio should include things like:

- Before and after pictures

- Budgets

- Profits earned

Put SOME money down

If you’re willing to put money down at closing, then a lender will see you’re serious about your deal and lower the cost of your loan. Because it helps lower their risk.

How much of a down payment should you make, you ask? The ideal amount would be 10% or more, but even 5% would ease the cost of your loan.

Manage your credit score

We know you’ve heard it once, but it bears repeating. Your credit score matters, especially when it comes to qualifying for a competitive loan. Because the higher your score, the lower your interest rates.

But, let’s say your credit score is lower than 670. Well, don’t get flustered, because you can quickly raise it if you follow some of our credit boosting tips, including these 3:

- Keep your credit card in your wallet and, instead, focus on paying it down (or off). This method is simple, but effective. Just remember when you whittle your credit card balance down to $0, keep your card. Do NOT close your account. Closing an account that’s in good standing is anti-productive in keeping your score healthy.

- Keep your card balance low. By that we mean only use 30% of your total maximum credit line. So if you have a $1,000 maximum, don’t let your balance rise above $300. Pay it down every week or month to keep it under the 30% range. The credit bureau likes to see that.

- Pay your bills and pay them on time. Again, simple, but effective. If you make your payments on time for the next 12 months, your score WILL go up.

Look, hard money can be pricy, but you can make it cheaper by following these 3 easy steps. In fact, we promise if you adhere to these steps, you will greatly reduce the cost of your next hard money loan.

Want more truths about hard money? Then stay tuned for our next video where we discuss the myth of getting trapped in a hard money loan.

Ready to chat about your hard money and other lending options? Our team is always here to help.

What is hard money? Learn more on our YouTube channel!

Happy investing!