2 Key Pillars of BRRRR

BRRRR is great, but did you know there are 2 key pillars of BRRRR that most investors don’t know about? Whether you’re just starting out with real estate investing, or you’re an ol’ pro, you should consider taking advantage of these crucial steps to ensure you don’t miss out on cash boosting opportunities.

Take a look at this video and learn about the two key pillars of the BRRRR method.

If you invest in rental properties, then you need to:

- Buy under market properties (i.e. wholesale).

- Use the Quick to Buy, Quick to Refi strategy.

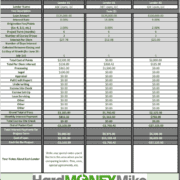

These steps help you maximize your loan amount while limiting the cash you need to put into each deal. They also ensure you’re able to buy more deals and build your portfolio at a faster pace.

Through research and conversations, we discovered many investors are confused about how to get going on a deal with little to no money. So, we’ve taken a step back and tried to figure out why that is.

We found out many investors don’t understand the power of the appraisal/ARV. When you get into a long-term loan, you get to use the appraisal value/ARV. It doesn’t matter what you originally paid for the property or the amount of money you put in to fix it up. As long as you set up the loan properly, then you should be able to use the appraised value/ARV.

If you’re ready to maximize your cash flow, capture lots of free equity, and live the life you want, check out the full video.

Want more videos with more tips to maximize your cash flow? Subscribe to our new YouTube channel!

Leave a Reply

Want to join the discussion?Feel free to contribute!