How to Retire Early with Real Estate

Our time-tested, actionable plan to retire early with real estate investing.

Here’s the plan we give to people who want to start investing in real estate at 40:

Buy ten properties in three years.

This simple plan can let you earn over $150,000 per year during retirement. Here’s exactly how.

The Timeline

Year One: Buy two properties. You’re learning the ropes this year, so you take it slow. Take this year to learn how to do everything right, build relationships in the industry, and prep for the coming years.

Year Two: Get three more properties. After the initial experience of your first year, it’s a reasonable stretch to do one more property. By the end of year two, you’re halfway to your goal of ten properties.

Year Three: Do the remaining five properties. By this time, you’re in the swing of things, you know the right people, and buying five properties in one year is very manageable.

What Type of Properties to Buy

These ten properties should be BRRRRs or subject tos. Both of these real estate investment methods are ways to:

1) Gain properties with little to no money down

2) Create rental properties that will generate cash flow.

So when we say “buy 10 properties,” it’s not with money out of your pocket. It’ll be with debt leverage and investment strategies that will help you reach your goals quickly (without dipping into retirement savings or hurting cash flow).

Understanding the Numbers to Retire Early with Real Estate

In this example, we’ll look at properties with a value of $200,000. That number is spot on for some regions, and very low for others. Remember, you can use these same equations and concepts no matter what actual price range you’re dealing with.

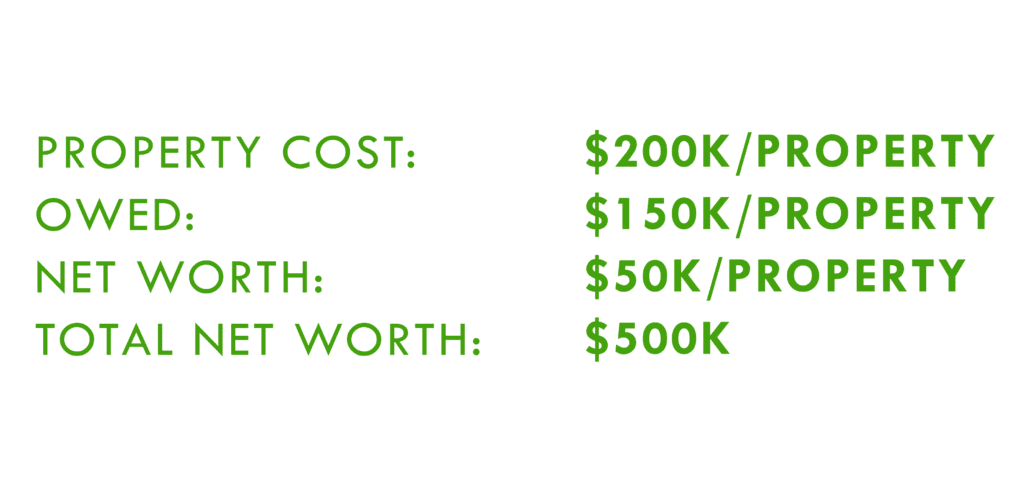

Loans and Net Worth

Let’s say we’re using BRRRR and looking at $200,000 properties. You can get a loan for $150,000 per property (which means you only owe $150,000 on each house).

Each property adds $50,000 in net worth to your portfolio. So ten properties in three years automatically builds you $500,000 in net worth.

Also, these rental properties will add up to $800/month in cash flow (more on cash flow in the next section).

Calculating Cash Flow

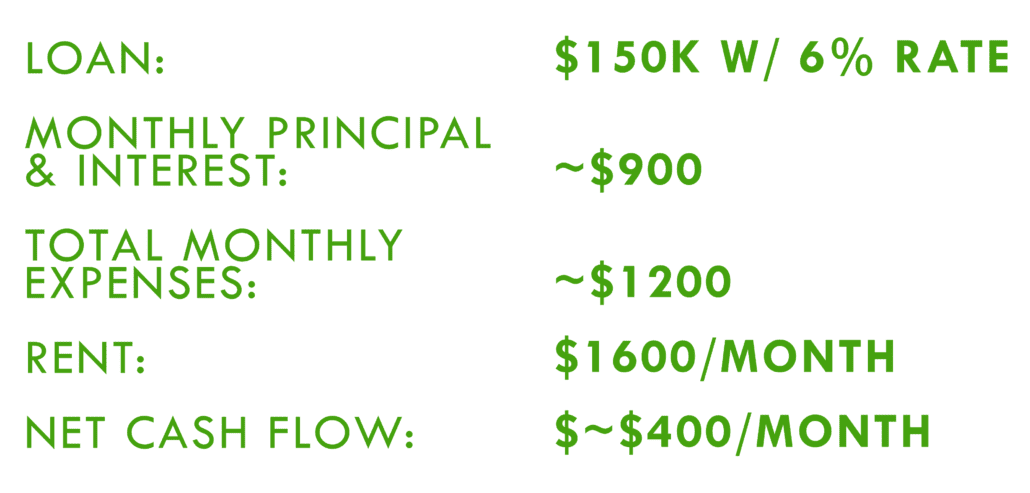

Let’s look at an example property that has a loan for $150,000 and an interest rate of 6%.

In this case, your monthly principal and interest payment will be $899.33.

Once you add taxes, insurance, and other costs, you’ll be at $1,184.33 in expenses.

If you’re in an area where you’re finding a $200,000, 3-bedroom 2-bath property, you should be able to reasonably rent for $1,600.

With that rent, we’d have a net total of $415.67/month coming into the property.

How Should You Use Cash Flow?

If you’re nearing retirement age and don’t need to pocket the cash flow on your new properties, there are some options to make that money work for you.

By using the income from your rentals, you can get the properties completely paid off. So once you finally retire, you’ll have several options:

- Sell off the houses

- Take out equity loans to buy more real estate or supplement retirement income

- Get higher cash flow on each property with no loan payments

How to Increasing Cash Flow to Retire Early with Real Estate

If you use the cash flow on properties pre-retirement to pay down the mortgages, you can retire early (and with more money!).

Let’s round our $415.67/month net income down to $400. So instead of taking that $400 and putting it in your pocket, let’s see what it looks like to pay down an extra $400 on your mortgage every month.

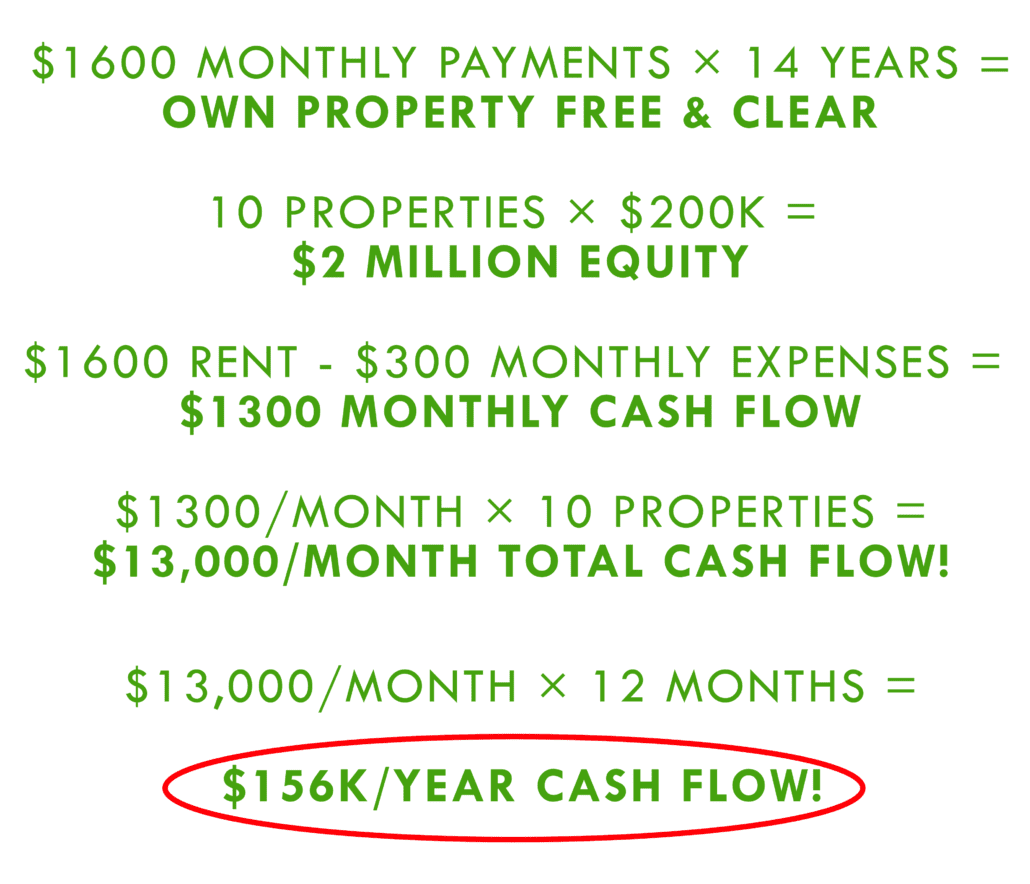

Instead of paying around $1,200 toward your loan plus insurance and taxes, you’ll be doing around $1,600/month total.

This will cut your mortgage down to 14 years. So even if you’re 50, you can own these properties free and clear by the time you’re 65.

And once all the houses are paid off, you’ll automatically have:

- $2 million in equity.

- $1,300/month income per property. (You no longer have to pay principal or interest, just taxes and insurance.)

$1,300/month per property equals $13,000/month total across 10 properties. That’s an annual income of $156,000/year. While being retired!

Read the full article here.

Watch the video here:

https://youtu.be/k3FDgD-gwPU