How to Start Investing in Real Estate at 40

Set yourself up for retirement – start investing in real estate at age 40+!

We have a lot of people in their 40s and 50s come to us wanting to get into real estate investing. They always say the same thing:

“I wish I would have started 20 years ago.”

But it’s never too late to start real estate investing. The best time is now.

It’s possible for people 40+ years of age to start real estate investing now and retire at 65.

Here’s our plan for how to kickstart your real estate portfolio quickly. In 10-15 years, you’ll have wealth built and cash flowing for retirement.

How to Create Wealth Investing in Real Estate Past 40 – The Plan

Here’s the plan we give to people wanting to start investing in real estate at 40:

Buy ten properties in three years.

For a beginner, that sounds like a lot. But we break it up, you take your time, and ten properties in three years becomes doable.

The Breakdown

Year One: You buy two properties. You’re learning the ropes this year, so you take it slow. Take this year to learn how to do everything right, build relationships in the industry, and prep for the coming years.

Year Two: You get three more properties. After the initial experience of your first year, it’s a reasonable stretch to do one more property. By the end of year two, you’re halfway to your goal of ten properties.

Year Three: You do the remaining five properties. By this time, you’re in the swing of things, you know the right people, and buying five properties in one year is very manageable.

Now Is the Best Time

This is a great time to be in real estate investing. Rent is high, supply is low. Plus, we’re about to hit a recession.

Property prices will come down soon. Low prices are the best time to buy, and the best opportunity to create the most wealth.

Maybe after hearing all this, you’re concerned about how you’d pay off ten properties in 10-15 years. How are you really building wealth when you’re spending hundreds of thousands on real estate?

You don’t have to wait 30 years to pay off the mortgages of these homes. Next, we’ll talk about the numbers behind this plan and how these ten properties will change your retirement.

Example of Building Wealth in Real Estate Over 40

So the plan is to buy ten properties, fast. You’ll learn the logistics of that process quickly enough with the three-year breakdown… But how on earth are you expected to pay for ten pieces of real estate in such a short amount of time?

Here’s an example of how the money breaks down for these retirement properties.

What Type of Properties to Buy Over 40 (And How to Pay for Them)

These ten properties should be BRRRRs or subject tos. Both of these real estate investment methods are ways to:

1) Gain properties with little to no money down

2) Create rental properties that will generate cash flow.

So when we say “buy 10 properties,” it’s not with money out of your pocket. It’ll be with debt leverage and investment strategies that will help you reach your goals quickly (without dipping into retirement savings or hurting cash flow).

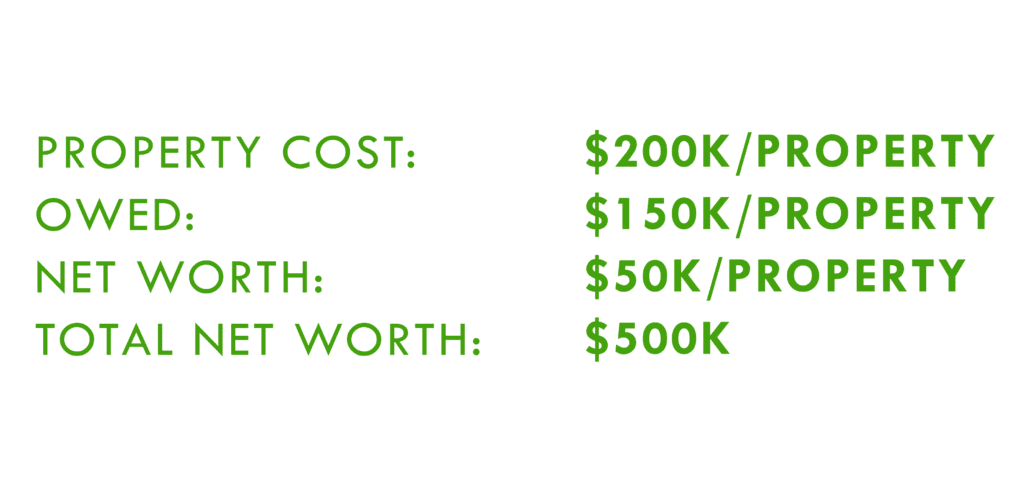

Understanding Your Numbers – Example of Real Estate Retirement

In this example, we’ll look at properties with a value of $200,000. That number is spot on for some regions, and very low for others. Remember, you can use these same equations and concepts no matter what actual price range you’re dealing with.

Let’s say we’re using BRRRR and looking at $200,000 properties. You can get a loan for $150,000 per property (which means you only owe $150,000 on each house).

Each property adds $50,000 in net worth to your portfolio. So ten properties in three years automatically builds you $500,000 in net worth.

Also, these rental properties will add up to $800/month in cash flow (more on cash flow in the next section).

How to Use Cash Flow

If you don’t need the cash flow immediately, you can use it to pay down the loans. This way, you own the houses free and clear. When you do retire, you have all that equity in your portfolio, plus a higher monthly cash flow.

Next, we’ll dig into the details of cash flow and how it can help you retire early.

Retire Early with Real Estate – How to Make Cash Flow Work for You

We’re all about the money and leverage side of real estate. We want you to understand the numbers behind the mortgages so you can reach your goals and get out of the loans faster.

To retire early at 40+, it’s important to look at some key numbers.

Evaluating Cash Flow When You Start Investing in Real Estate at 40

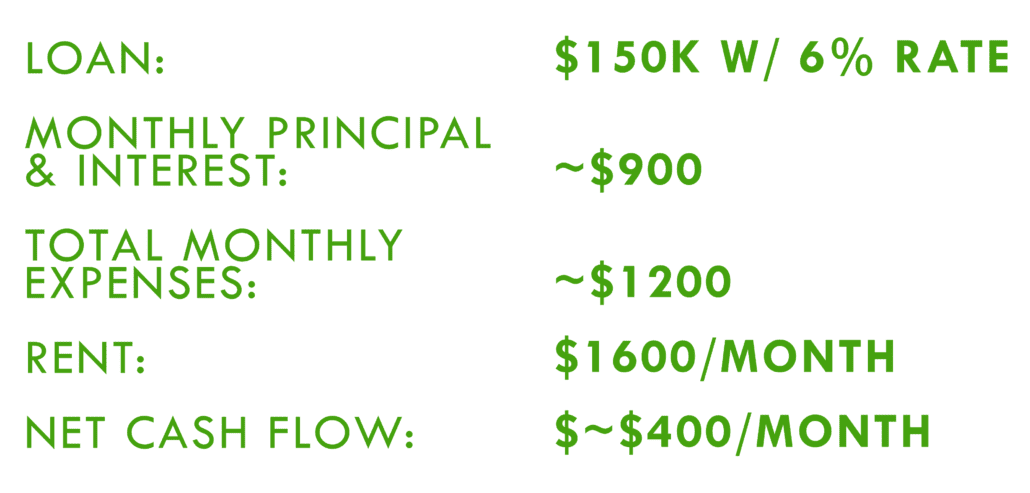

Let’s look at an example property that has a loan for $150,000 and an interest rate of 6%.

In this case, your monthly principal and interest payment will be $899.33.

Once you add taxes, insurance, and other costs, you’ll be at $1,184.33 in expenses.

If you’re in an area where you’re finding a $200,000, 3-bedroom 2-bath property, you should be able to reasonably rent for $1,600.

With that rent, we’d have a net total of $415.67/month coming into the property.

How Should You Use the Cash Flow?

If you’re nearing retirement age and don’t need to pocket the cash flow on your new properties, there are some options to make that money work for you.

By using the income from your rentals, you can get the properties completely paid off. So once you finally retire, you’ll have several options:

- Sell off the houses

- Take out equity loans to buy more real estate or supplement retirement income

- Get higher cash flow on each property with no loan payments

Increasing Cash Flow to Retire Early with Real Estate

If you use the cash flow on properties pre-retirement to pay down the mortgages, you can retire early (and with more money!).

Let’s round our $415.67/month net income down to $400. So instead of taking that $400 and putting it in your pocket, let’s see what it looks like to pay down an extra $400 on your mortgage every month.

Instead of paying around $1,200 toward your loan plus insurance and taxes, you’ll be doing around $1,600/month total.

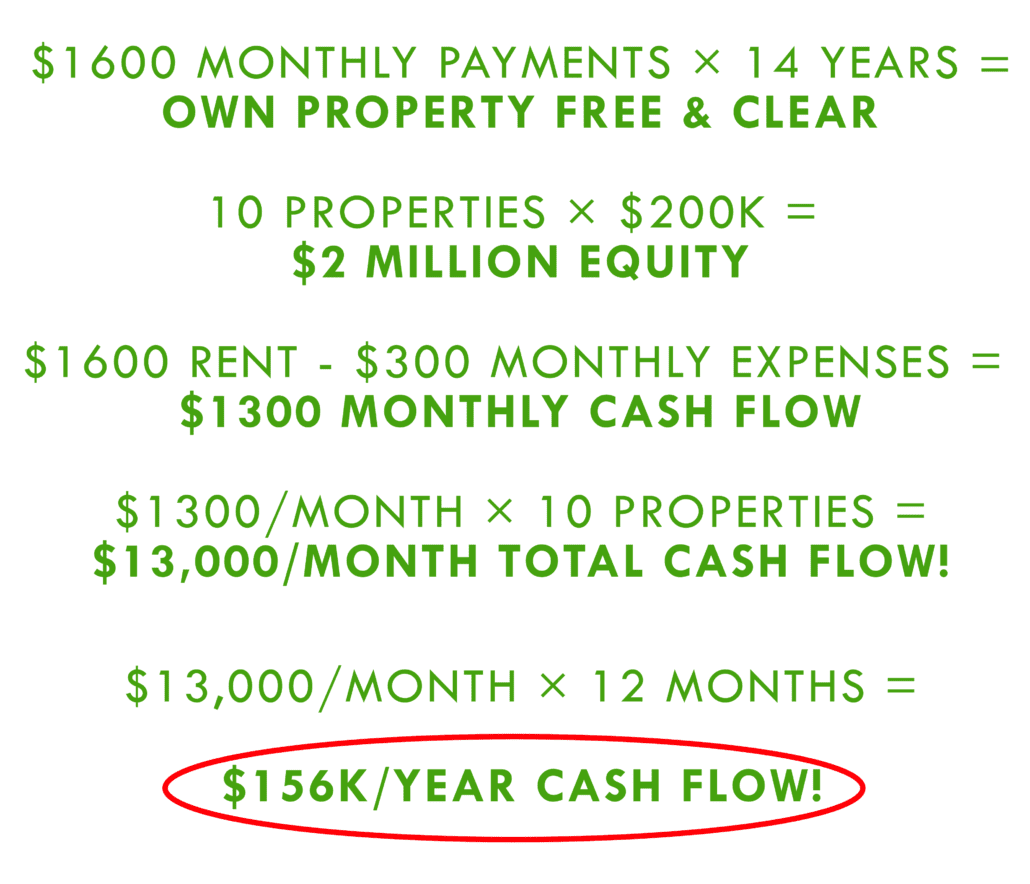

This will cut your mortgage down to 14 years. So even if you’re 50, you can own these properties free and clear by the time you’re 65.

And once all the houses are paid off, you’ll automatically have:

- $2 million in equity.

- $1,300/month income per property. (You no longer have to pay principal or interest, just taxes and insurance.)

$1,300/month per property equals $13,000/month total across 10 properties. That’s an annual income of $156,000/year. While being retired!

Long-Term Wealth in Real Estate Over 40

Once the houses are paid off, the only work left to do is upkeep on the properties. A small price to pay to make over 150k every year you’re retired!

These calculations, of course, are in “today’s” money. Inflation will continue at a steady rate, so rents will go up and home values will go up. But all costs will rise over time, so these amounts will “feel” about the same.

It’s never too late to start investing in real estate.

Real Estate Investing for 40+ Beginners with No Money

Ten properties in three years. Paying down the loans so you own them free and clear by retirement. It really is great, but…

How can you start with no money?

BRRRR

BRRRR stands for Buy, Rehab, Rent, Refinance, Repeat.

You buy the same type of properties as fix-and-flippers, but instead of selling them, you rent. They’re properties from wholesalers that are listed undermarket.

These properties require quite a bit of work to fix up, but they have the opportunity for the highest cash flow.

Subject To

A subject to is when you take ownership of someone’s property without taking out a loan. You make all payments, but the previous owner keeps their mortgage on it.

Subject tos are a great way to get into a property for little money – this is especially important since money is tightening in the real estate lending world. This investment technique has been less popular in recent years, but with the market turning, they’ll be coming back strong in the next year or two.

The Value of No Money Down Investing for Soon-To-Be Retirees

You don’t want to tap into your retirement or savings with your real estate investments – you want to add to them.

Look into BRRRR, Subject Tos, and other no money down investment techniques. This is the path to adding $2 million to your net worth without spending any money.

Real Estate Investing for Beginners in a Recession

A recession can cause unease for people nearing retirement – and people who are considering any major investments.

So why is this the best time to get into real estate investing? Even for older people?

Looking Back at the Great Recession

If you had bought the homes real estate investors did in 2010, you’d be retired by now.

Our current market is beginning to look a bit like 2008-2009 – a recession coming on, inflation hitting, the money supply tightening. Which means there will be more homes available at a discount.

Consumer debt is increasing. Especially after the housing blitz we’re just getting out of, it will be harder for homeowners to keep up on payments. When people need to move, it will be harder for them to sell. People get stuck with houses they can’t afford.

For real estate investors, that means there’s more inventory, at lower prices.

Using The Recession to Increase Net Worth

Buy soon, when prices are down and inventory is high. In the future, rates will come down and prices will go back up. So that plan that offers $2 million of net worth could potentially double or triple.

In 2010, we helped people use the same retirement real estate investment plan outlined in this article.

One client bought ten properties that year. Since then, his real estate has quadrupled in value, and ten years later, he owns eight of the properties free and clear.

This is the time. You don’t want to buy when prices are high and sellers have control. Jump in and buy now to get the deals that will truly create wealth and help you achieve the retirement you want.

Start Real Estate Investing at 40 – Where to Go From Here?

Whether you’re ready to kickstart your investment career now or not, the best place to start is to get educated.

It doesn’t matter if you’re 30, 40, or 50 years old. Reach out to us with specific questions, or any help starting your plan for retirement at info@hardmoneymike.com or HardMoneyMike.com.

Visit these links for a BRRRR investment guide and more information on no money down investing.

Leave a Reply

Want to join the discussion?Feel free to contribute!